- Stocks often surge in the months after mid-term elections

- Betting markets show high chance GOP snatches control of House and maybe even Senate

- Three investment themes that could catch tailwinds in that scenario

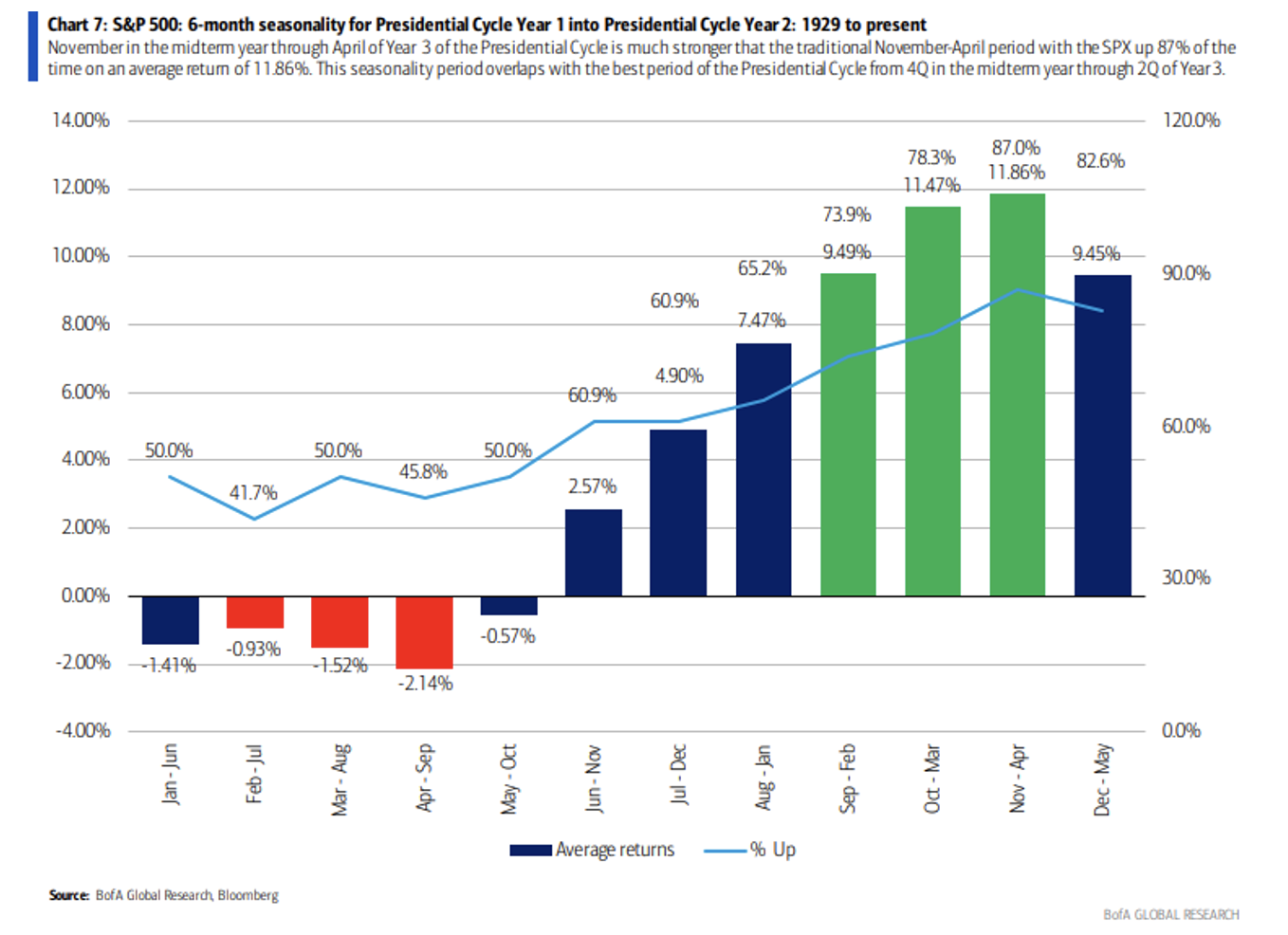

Nervous about the mid-term elections? There’s almost always anxiety in the market regarding how Congress might look after elections. Interestingly, the trend in stocks is often a decline heading into the first Tuesday after the first of November in election years, but then a sharp rally through Q2 the following year.

While it doesn’t work every time, data since 1928 show that the six-month period of May through October in mid-term years features a rare negative return for the S&P 500. Once you get through, say, mid-October, gains really begin to take flight, though. The best six-month run for equities is, on average, the November-through-April period from a mid-term year through the pre-election year, according to Bank of America Global Research.

Mid-Term Year Seasonality: Tailwinds Starting in Q4

Source: Bank of America Global Research

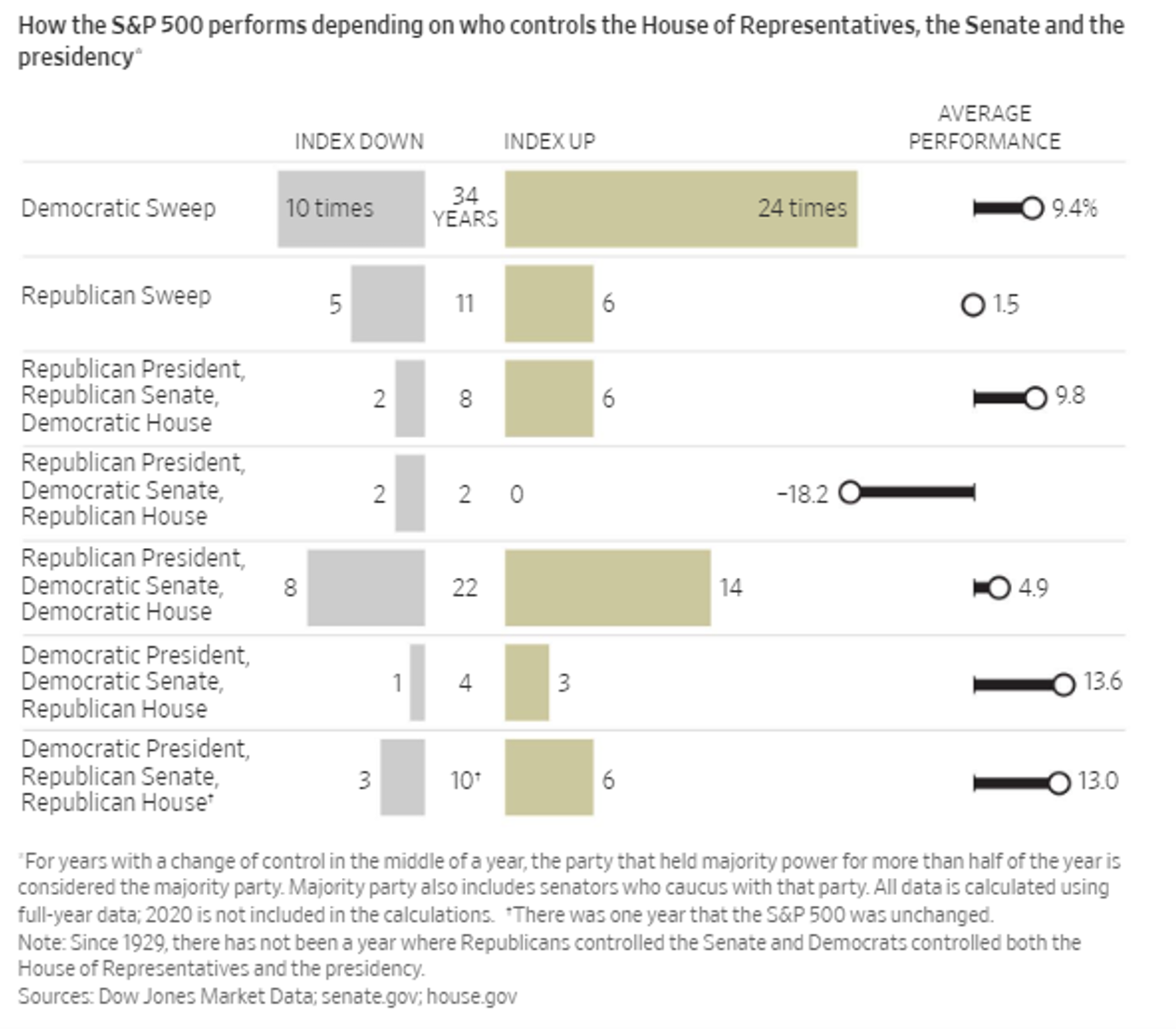

What’s more, this year's mid-term elections might feature a historically bullish setup: a divided government.

Odds are that the Republicans will control at least one house of Congress, while President Joseph Biden, a Democrat, will, of course, hold office at the White House. Data gathered by The Wall Street Journal reveal that the best scenario for the S&P 500 is when there is a Democratic POTUS with either a GOP-controlled Congress or a split in which party has the majority in the House and Senate.

A Divided Government Often Bullish for S&P 500

Source: WSJ

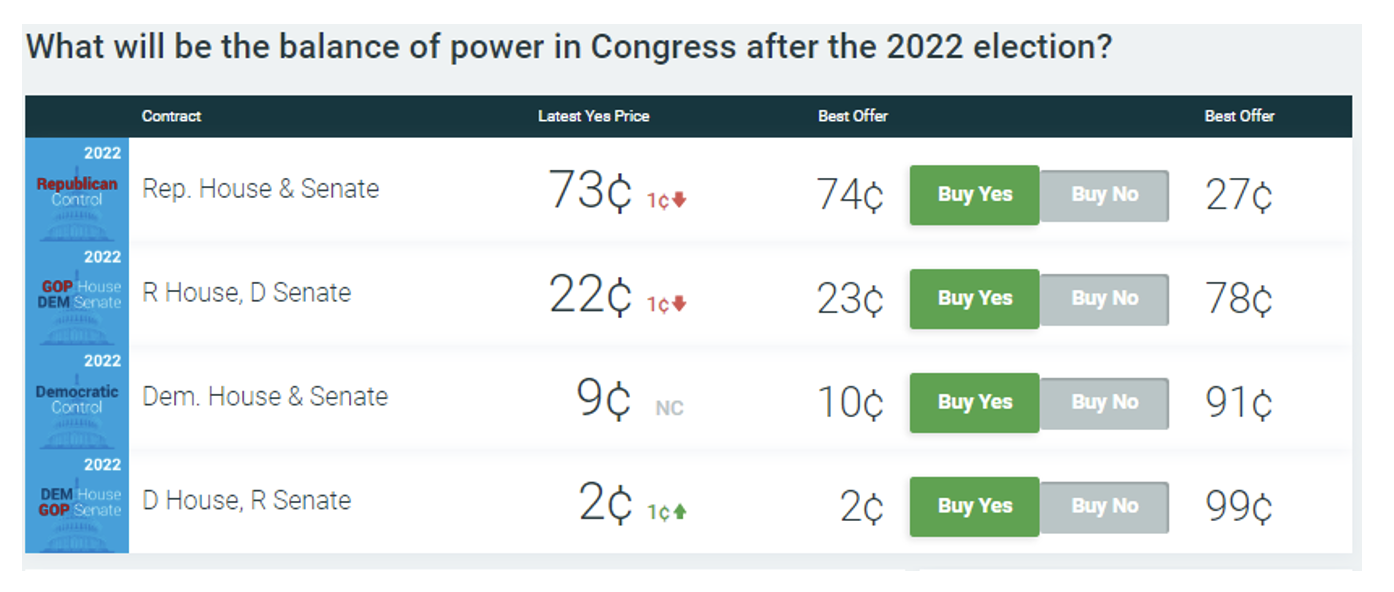

As it stands ahead of Tuesday night, betting markets show a very small chance the Democrats control Capitol Hill come January 2023. PredictIt.com pricing implies an 8% probability of a scenario of Democrats maintaining control of the House and Senate. There’s about a seven-in-10 chance of a “red wave” that puts the GOP in control. That could potentially be great news for the stock market.

Follow the Money: Traders Suggest a Split Congress Likely

Let’s dig deeper, though. What might be some good sectors and industries to play a divided government?

First, you might consider that gridlock in D.C. is the overarching theme. It will be very difficult for vast spending measures or tax-code overhauls to get through. That reality actually brings about some certainty for the market, though expect heated battles on issues like the debt ceiling to rear their head again.

With a Republican-led Congress, we could see increased spending on defense. This could even be a bi-partisan issue as geopolitical risks surrounding Russia and China continue to send jitters across both Wall Street and within the Beltway. The iShares U.S. Aerospace & Defense ETF (NYSE:ITA) is an easy way to get exposure to that space.

Another risk that will still be apparent, and perhaps on the rise, is a tech threat. Cybersecurity investment should be robust and less cyclical than other spending areas among corporations. According to ETF.com, the First Trust NASDAQ Cybersecurity ETF (NASDAQ:CIBR) is the biggest such fund and is the top-performing in the group over the last three months.

You can even look to the company level to find stocks that would benefit from the “re-shoring” or “friend-shoring” trend. Domestic stocks like Rockwell Automation (NYSE:ROK) or others with operations in, say, Mexico, Canada, and Japan are candidates. While Europe is a friend, its dependence on Russia for energy is probably too much of a risk for the government and large companies to take on.

The Bottom Line

Stocks tend to sell off in advance of elections, but then rally once some certainty comes about. As for 2022 and beyond, a few big themes might emerge should the GOP indeed capture at least one house of Congress.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.