The Q1 earnings season has portrayed a quite positive and reassuring picture so far. As we near the end of the season, only 18% of the S&P 500 is yet to report their quarterly results. The quarter has not only displayed high growth, but also greater proportion of companies came out with positive surprises.

As per the latest Earnings Preview report of May 5, out of the 412 S&P 500 companies that have come up with their quarterly numbers, approximately 73.3% reported positive earnings surprise, while 67.7% beat top-line estimates. Notably, the earnings of the companies that have reported so far are up by 14.2% from the year-ago period while revenues increased 7.3%. The report further suggests that earnings of the S&P 500 companies are expected to improve 12.7% with revenues increasing 6.2%, from the year-ago period.

The performance of the index is not restricted to a single sector and out of the 16 Zacks sectors, three are expected to witness a decline in earnings this season with Transportation and Autos likely to be the major drags.Consumer Staples sector, which is placed at the bottom 19% of the Zacks Classified sectors (13 out of 16), is displaying strength with total earnings expected to advance 4.4% and revenue growth of 4%.

As of May 5, 75% of the S&P 500 companies in the Consumer Staples sector have reported their results. Out of these, 66.7% companies have posted an earnings beat, while 29.2% surpassed revenue estimates. Food stocks form part of the Consumer Staples sector.

With these factors in mind, let’s see what awaits the following food stocks that are scheduled to release earnings results on May 9.

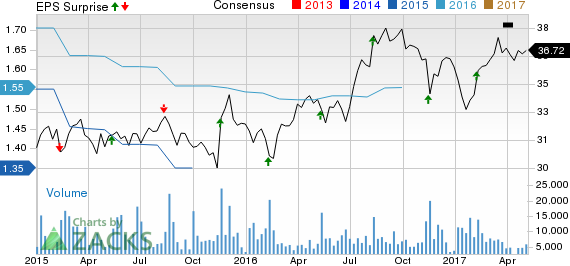

Aramark (NYSE:ARMK) offers customer services acrossfood, uniforms and facilities related platforms. It is slated to release second-quarter fiscal 2017 results before the market opens. The company’s earnings have outpaced the Zacks Consensus Estimate in three out of the preceding four quarters, with a trailing four-quarter average of 3.2%.

Our proven model does not conclusively show earnings beat for Aramark this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Aramark has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 37 cents. Though the company’s Zacks Rank #2 increases the predictive power of ESP, but we need to have a positive ESP in order to be confident about earnings surprise.

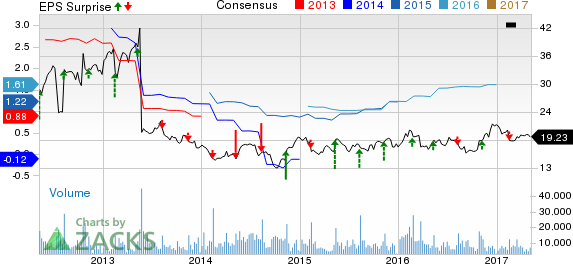

Another food stock, Dean Foods Company (NYSE:DF) is slated to release first-quarter 2017 earnings before the opening bell. The company has Earnings ESP of +5.88%. This is because the Most Accurate estimate of 18 cents is pegged higher than the Zacks Consensus Estimate of 17 cents. The company carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The combination of the company’s Zacks Rank #3 and an Earnings ESP of +5.88% makes us optimistic about earnings beat. The robust brand portfolio of Dean Foods aids it to retain a leading position in the food and beverage industry. While the company mainly focuses upon augmenting the core dairy-related business, efforts are also taken to grab opportunities in juices, teas and other beverage areas. Additionally, management is committed toward optimizing capital allocation and concentrate on core business activities. (Read more: Dean Foods Q1 Earnings: Is the Stock Poised for a Beat?)

Now, let’s take a sneak peek at US Foods Holding (NYSE:USFD) , a leading foodservice distributor, which is scheduled to report first-quarter 2017 earnings before the opening bell. The company, which carries a Zacks Rank #3, posted a positive earnings surprise of 6.3% in the preceding quarter. US Food Holdings has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 20 cents.

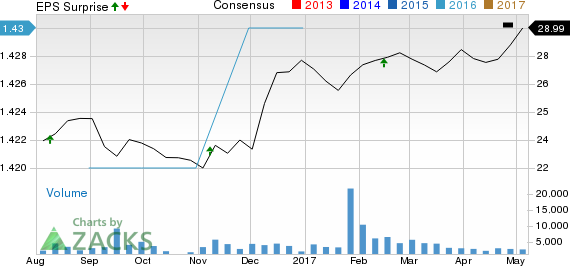

Finally, let’s see what is in store for Hostess Brands, Inc. (NASDAQ:TWNK) a food packaging company, which is set to report first-quarter 2017 earnings after the market close. Hostess Brands has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 16 cents. Further, the company carries a Zacks Rank #3.

Zacks' 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks' radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>.

HOSTESS BRANDS (TWNK): Free Stock Analysis Report

Dean Foods Company (DF): Free Stock Analysis Report

Aramark (ARMK): Free Stock Analysis Report

US Foods Holding Corp. (USFD): Free Stock Analysis Report

Original post

Zacks Investment Research