CyberArk Software Ltd. (NASDAQ:CYBR) recently launched the CyberArk Privileged Access Security Solution v10.8, a platform to protect privileged accounts in cloud.

Among its most notable capabilities are automated threat detection, notification and response for vulnerable accounts of Amazon’s (NASDAQ:AMZN) AWS, and flexible access of users to cloud-based or on-premises Microsoft (NASDAQ:MSFT) Windows systems.

With this new solution, CyberArk focuses on two key challenges — expediting the detection of risky accounts in the cloud, and outpacing cyber attackers in speed to reach and take control of such accounts.

Nir Gertner, chief security strategist, CyberArk, said, “Speed is critical and security leaders who leverage automation and intelligence will have more success protecting their organizations under these conditions. CyberArk delivers the industry’s most complete solution for managing privileged-related risk across hybrid environments while removing operational hurdles.”

Leadership in Enterprise Security Despite Competition

Rising demand for cyber security owing to rising incidents of data breaches is a positive for CyberArk. The advent of cloud computing and the idea of sharing resources to lower cost have further increased demand for adequate security policies, protocols and products.

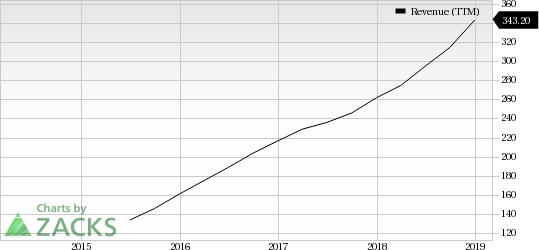

CyberArk is growing rapidly in this space on the back of its privileged access management solutions, which offers customers a set of products that helps them to secure, manage and monitor privileged account access and activities.

Increasing demand for privileged access security on the back of digital transformation and cloud migration strategies is a key growth driver for the company.

During the last reported quarter, CyberArk closed several seven figure add-on deals. The company was the only privileged access security program vendor for a leading bank in EMEA to complement its cloud-first strategy in Microsoft Azure.

Notably, a key customer significantly expanded its CyberArk program in the last reported quarter by adding Endpoint Privilege Manager for credential theft blocking, and Conjur to secure application development in Pivotal Cloud Foundry and AWS.

Moreover, CyberArk was recognized in the Info Security Products Guide Global Excellence Awards as the Best Privileged Access Management Solution. The company was also placed at the top in the Gartner Magic Quadrant for Privileged Access Management.

However, CyberArk faces significant competition from the likes of International Business Machines Corporation (NYSE:IBM) in the access and identity management market.

In November last year, IBM announced new solutions in partnership with VMware to assist enterprises in securely accelerating the adoption of hybrid cloud platforms.

Nonetheless, CyberArk’s security platforms simplify security infrastructure for organizations by protecting against, detecting and responding to cyber-attacks before the security of vital systems is compromised. This reduces the total cost of ownership, thereby giving the organization a competitive edge.

CyberArk currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

International Business Machines Corporation (IBM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research