Soaring real estate, rising volatility, surging commodities and slumping stocks: Does it sound familiar?

This past week marked the 13th anniversary of the bottom of the global financial crisis of 2007-2009. The March 6, 2009, stock market low for the S&P 500 marked a staggering overall value loss of 51.9%.

The financial crisis of 2007-09 resulted from excessive risk-taking by global financial institutions, which resulted in the bursting of the housing market bubble. This, in turn, led to a vast collapse of mortgage-back securities resulting in a dramatic worldwide financial reset.

Is History Repeating Itself?

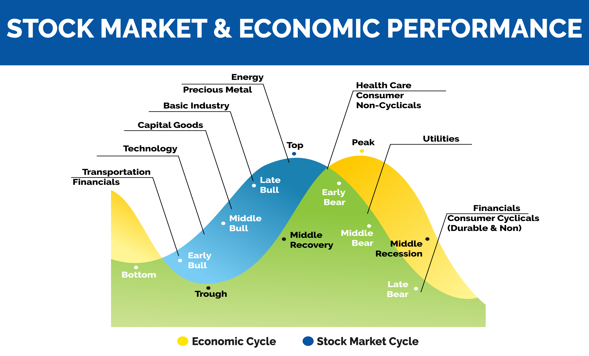

The following graph shows us that precious metals and energy outperform the stock market as the bull cycle reaches its maturity. The stock market is always leads, followed by the economy, and then the commodity markets. But history has shown that commodity markets can move up substantially as the stock market bull runs out of steam.

The current commodities rally in gold began August 2021, crude oil in April 2020, and wheat in January 2022. Interestingly, we started seeing capital outflows in the SPDR® S&P 500 (NYSE:SPY) in early January 2022, and the Direxion Daily Real Estate Bull 3X Shares (NYSE:DRN) starting back in late December 2021.

Let's See What Happened To Stocks And Commodity Markets In 2007-2009

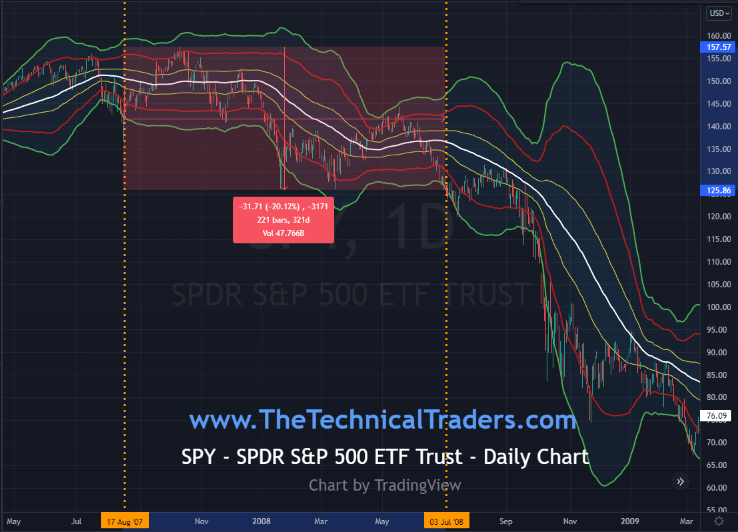

SPY - SPDR S&P 500 TRUST ETF

From Aug. 17, 2007, to July 3, 2008: SPDR S&P 500 ETF Trust depreciated 20.12%

The State Street Corporation (NYSE:STT) designed SPY for investors who want a cost-effective and convenient way to invest in the price and yield performance of the S&P 500 Stock Index. According to State Street’s website www.ssga.com, the Benchmark, the S&P 500 Index, comprises selected stocks from 500 issuers, all of which are listed on national stock exchanges and span over approximately 24 separate industry groups.

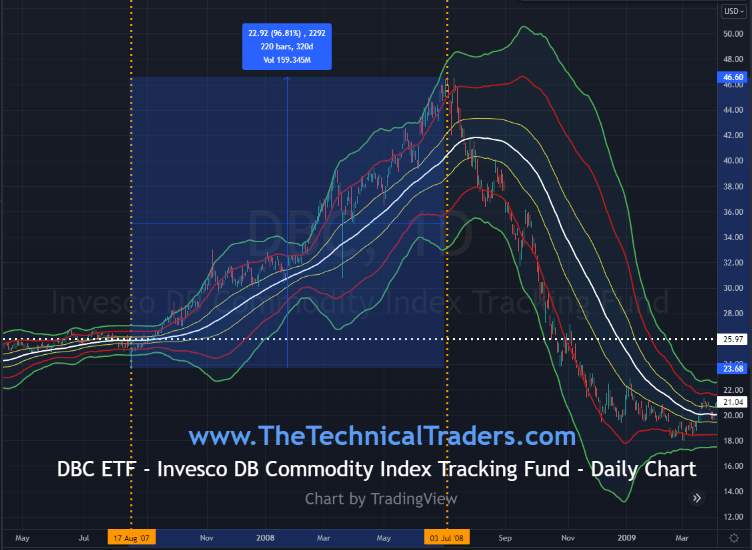

DBC – INVESCO DB COMMODITY INDEX TRACING FUND ETF

From Aug. 17 2007, to July 3, 2008: Invesco DB Commodity Index Tracking Fund appreciated 96.81%

Invesco designed DBC for investors who want a cost-effective and convenient way to invest in commodity futures. According to Invesco’s website www.invesco.com, the index is a rules-based index composed of futures contracts on 14 of the most heavily traded and important physical commodities in the world.

Be Alert: Fed Reserve Policy Meeting Is This Week

In February, the inflation rate rose to 7.9% as food and energy costs pushed prices to their highest level in more than 40 years. If we exclude food and energy, core inflation still rose 6.4%, which was the highest since August 1982. Gasoline, groceries and housing were the most significant contributors to the CPI gain. The consumer price index is the price of a weighted average market basket of consumer goods and services purchased by households.

The Fed was expected to raise interest rates by as much as 50 basis points at its policy meeting this week, March 15-16. However, given the recent Russia–Ukraine war in Europe, the Fed may decide to be more cautious and raise rates by only 25 basis points.

How Will Rising Interest Rates Affect The Stock Market?

As interest rates rise, the cost of borrowing becomes more expensive. Rising interest rates tend to affect the market immediately, while it may take about 9-12 months for the rest of the economy to see any widespread impact. Higher interest rates are generally negative for stocks, with the exception of the financial sector.

Will Rising Interest Rates Burst Housing Bubble?

It is too soon to tell exactly what the impact of rising interest rates will be regarding housing. It is worth noting that in a thriving economy, consumers continue buying. However, in our current economy, where the consumers' monthly payment is not keeping up with the price of gasoline and food, it is more likely to experience a levelling off of residential prices or even the risk of a 2007-2009 repeat of price depreciation.

Potential For Outsized Gains In A Bear Market Are 7 Times Greater Than In A Bull Market

The average bull market lasts 2.7 years. From the March low of 2009, the current bull market has established a new record as the longest-running bull market at 12 years and nine months. The average bear market lasts just under 10 months, while a few have lasted for several years. It is worth noting that bear markets tend to fall 7x faster than bull markets go up. Bear markets also reflect elevated levels of volatility and investor emotions, which contribute significantly to the velocity of the market drop.