- Some stocks tend to outperform S&P 500 in the last quarter of the year

- The index, on average, has risen +4.8% in the last quarter over the past 5 years, while these companies have surged +10%

- Let's delve deep to find out which stocks can repeat this feat this time

Some stocks have consistently outperformed the S&P 500 index over the past five fiscal years, with a particularly strong showing in the last quarter of the year.

What's truly remarkable is that these stocks have achieved returns of over 10%, surpassing the market's performance by more than double (10% compared to the S&P 500's 4.8%).

In this piece, we'll explore the best-performing stocks in the last quarter of the year, some of which have achieved an impressive +16% return compared to the S&P 500's +4.8% over the past five years.

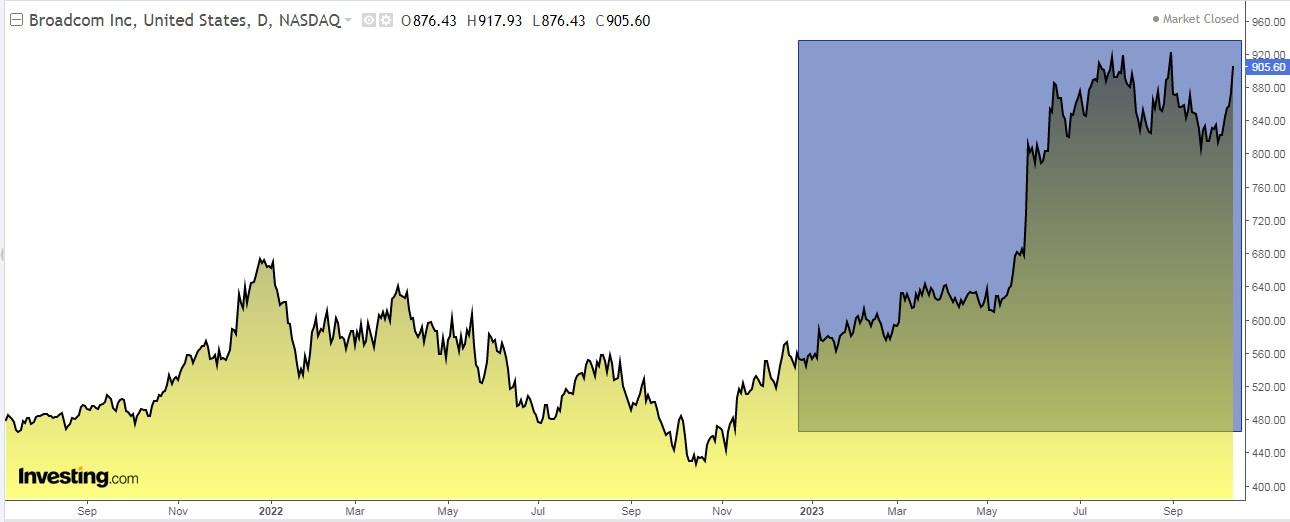

1. Broadcom

Broadcom (NASDAQ:AVGO) designs, develops and supplies various semiconductor-based devices.

Its products are used in various applications such as data centers, set-top boxes, broadband access, telecommunications equipment, and smartphones. It was founded in 2018 and is headquartered in San Jose, California.

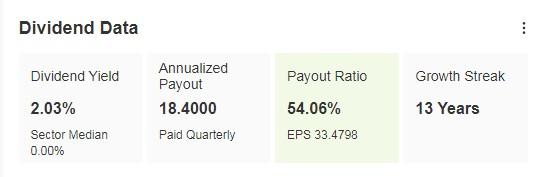

Its annual dividend yield is +2.03%.

On December 7, it will present its results and is expected to increase EPS by +3.46% and for the 2023 computation by +11.9%.

Source: InvestingPro

Oppenheimer estimated its potential at $990, while the market puts it at $967.29.

Source: InvestingPro

Over the past 5 years, its shares are up in the last quarter of the year by an average of +20.2%, with the 26% rally in the last quarter of last year being noteworthy.

At the close of the week, its shares were up +113.31% in the last 12 months and +7.28% in the last 30 days.

2. Lam Research

Lam Research (NASDAQ:LRCX) designs, manufactures, markets, and services semiconductor processing equipment used in the manufacture of integrated circuits.

It sells its products and services to the semiconductor industry in the United States, China, Europe, Japan, Korea, and Southeast Asia. It was founded in 1980 and is headquartered in Fremont, California.

Its dividend yield is +1.22%.

Previous earnings on July 26 were good, with EPS beating market expectations by almost +17%. The next results will be published today.

Source: InvestingPro

Needham & Company updated its price target for Lam Research to $800. The market is more cautious and puts the target at $700.

Source: InvestingPro

Over the last 5 years, its shares are up in the last quarter of the year by an average of +20%.

At the end of the week, its shares were up +94.60% in the last 12 months.

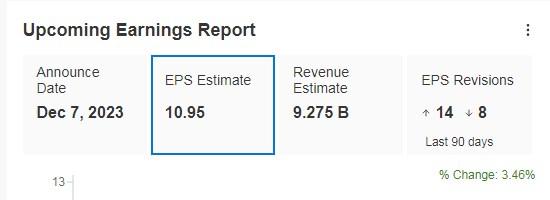

3. KLA Corporation

KLA Corporation (NASDAQ:KLAC) designs, manufactures, and markets process control and yield management solutions for the semiconductor and electronics industries.

It was previously called KLA-Tencor Corporation and changed its name to KLA Corporation in July 2019. It was born in 1975 and is headquartered in Milpitas, California.

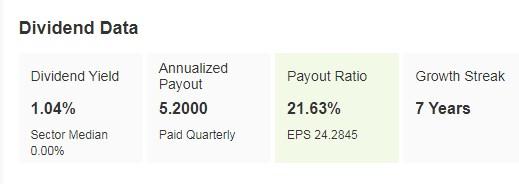

Its dividend yield is +1.04%.

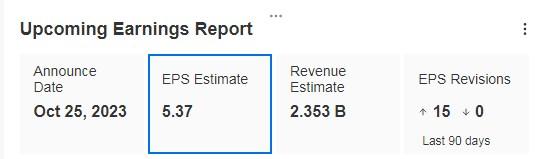

Good results presented on July 27 with EPS beating market forecasts by +11.2%. On October 25 it presents the next accounts and EPS is expected to increase by +2.50%.

Source: InvestingPro

Of note is ROCE (Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets - Current Liabilities). Over the last twelve months to June 2023, it stands at a remarkable 39%.

This figure not only represents an exceptional performance in absolute terms but also exceeds the semiconductor industry average of 12%.

The market has set the potential target at $532.75.

Source: InvestingPro

The stock's performance has been impressive, delivering a +385% return over the past five years.

Over the past 5 years, its shares are up in the last quarter of the year by an average of +17%.

At the close of the week, its shares were up over the last 12 months by +82.97%.

4. Cigna

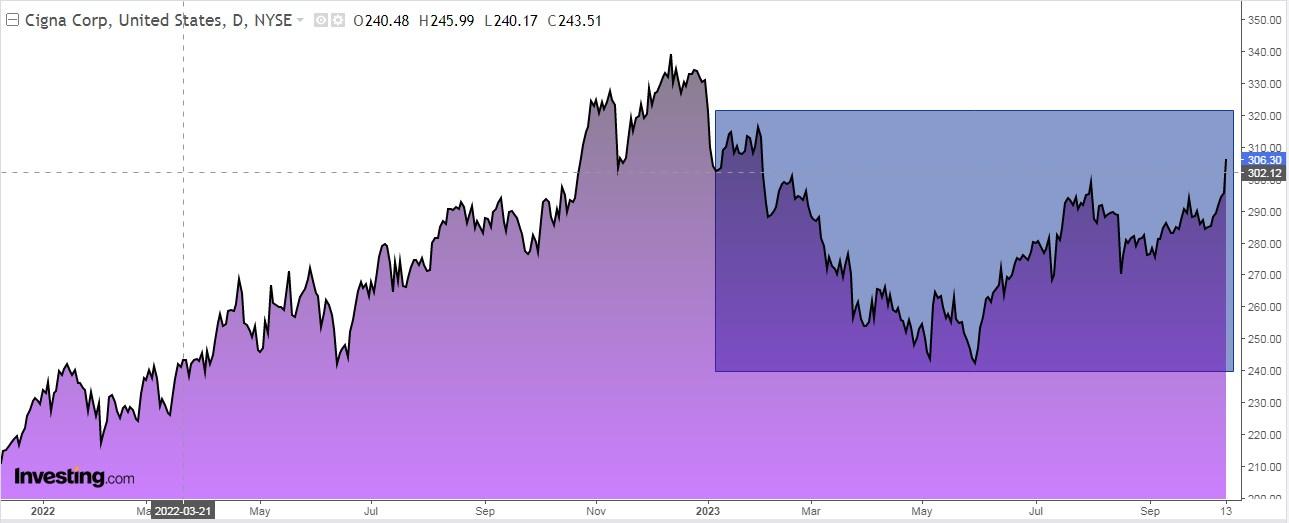

Cigna (NYSE:CI) is an insurance company in the health sector. The company was formerly known as Cigna Corporation and changed its name to The Cigna Group in February 2023. It was born in 1792 and is headquartered in Bloomfield, Connecticut.

Its dividend yield is +1.66%.

August 3 results beat market expectations. The next ones will be presented on November 2 with an increase in real income of +1.78% and for the 2023 computation an increase of +6.2%.

Source: InvestingPro

The company has settled allegations that it overcharged the Medicare Advantage program (a government health insurance program for people over 65) by making it appear that patients were sicker than they actually were.

The settlement includes a payout of about $172 million from Cigna. Meanwhile, InvestingPro models see the potential target at $419.32.

Source: InvestingPro

Over the past 5 years, its shares are up in the last quarter of the year by an average of +16.6%.

At the close of the week, its shares were up in the last 3 months by +12.90% and in the last month by +7.37%.

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered investment advice.