- BRK.B stock is up over 30% in the past year, and saw a record high in May.

- Berkshire Hathaway stock shows the potential of long-term investing and magic of compound interest.

- Despite potential short-term volatility in Q4, buy-and-hold investors could regard any further short-term decline in BRK.B shares as an opportune entry point

- Banks, insurance and finance (as of June 30, aggregate fair value of $86,621 billion);

- Consumer products (aggregate fair value of $150.811 billion);

- Commercial, industrial and other (aggregate fair value of $70,510 billion)

- Financial Select Sector SPDR Fund (NYSE:XLF): This fund is up 29.4% YTD, and BRKb stock’s weighting is 12.14%;

- Absolute Core Strategy ETF (NYSE:ABEQ): The fund is up 6.2% YTD, and BRKb stock’s weighting is 8.56%;

- Davis Select U.S. Equity ETF (NYSE:DUSA): The fund is up 16.5% YTD, and BRKb stock’s weighting is 7.86%;

- iShares MSCI USA Momentum Factor ETF (NYSE:MTUM): The fund is up 9.9% YTD, and BRKb stock’s weighting is 4.25%.

Investors in Berkshire Hathaway B (NYSE:BRKb) shares have enjoyed a robust 2021. BRKb stock is up almost 19% in 2021 and 30.6% in the past 12 months. The shares hit an all-time high (ATH) of $295.08 in May.

But since then, they've lost about 6.5%.

The 52-week price range has been $197.81 - $295.08, while the company’s market capitalization (cap) stands at $416.3 billion.

Warren Buffett, one of the most successful investors of all time, who is sometimes referred to as the 'Oracle of Omaha,' due to his investing skill and prescience, is the Chairman and CEO of Berkshire Hathaway. He purchased the Nebraska-based company in 1965 and over the past almost-six decades, Buffett and his long-time partner Charlie Munger have overseen the spectacular growth of Berkshire Hathaway, turning the former textile manufacturer into the world's largest diversified holding company.

Wall Street pays close attention to Buffett’s views on the economy and broader markets. Thus, his annual shareholder letters receive close attention. Through them, investors can also derive a clear understanding of how Berkshire Hathaway stock has fared over the years.

Between 1965 and 2020, Berkshire Hathaways’ compounded annual gain was 20.0%. For the the S&P 500 index, the return was 10.2% (with dividends included). Put another way, the proverbial $1,000 invested in Berkshire Hathaway in 1965 would now have grown to around $28 million.

If the same amount had been invested in the S&P 500 at that time, it would now be about $235,000. Berkshire Hathaway thus shows the potential of long-term investing coupled with magic of compound interest.

Readers interested in Berkshire Hathaway can buy two types of shares, class A stock (NYSE:BRKa) and the class B shares referred to above. For most retail investors, the main visible difference between the two types of shares is in the price.

On Oct. 1, BRKb stock closed at $275.71. However, BRKa closed at $414,877.97 (no, that is not a misprint). In fact, BRKa currently has the highest share price of any company in history. Its market cap is almost $626.5 billion.

Given the price of BRKa shares, most retail investors as well as exchange-traded funds (ETFs) understandably buy BRKb shares.

What Does Berkshire Hathaway Actually Hold?

In early August, Berkshire Hathaway issued Q2 financials. Total revenue came at $69,114 million. A year ago, that figure was $56,840 million. Net earnings stood at $28,425, compared to $26,407 in Q2 2020.

Berkshire Hathaway owns several businesses, including insurer Geico, the BNSF Railway, and See's Candies. It also invests in publicly-traded companies, operating mainly in three segments:

Berkshire Hathaway's regular 13F filings with the Securities and Exchange Commission (SEC) regularly detail the company’s public investments. Among Berkshire's top holdings are Apple (NASDAQ:AAPL), Bank of America (NYSE:BAC), American Express (NYSE:AXP) and Coca-Cola (NYSE:KO).

What To Expect From BRKb Stock

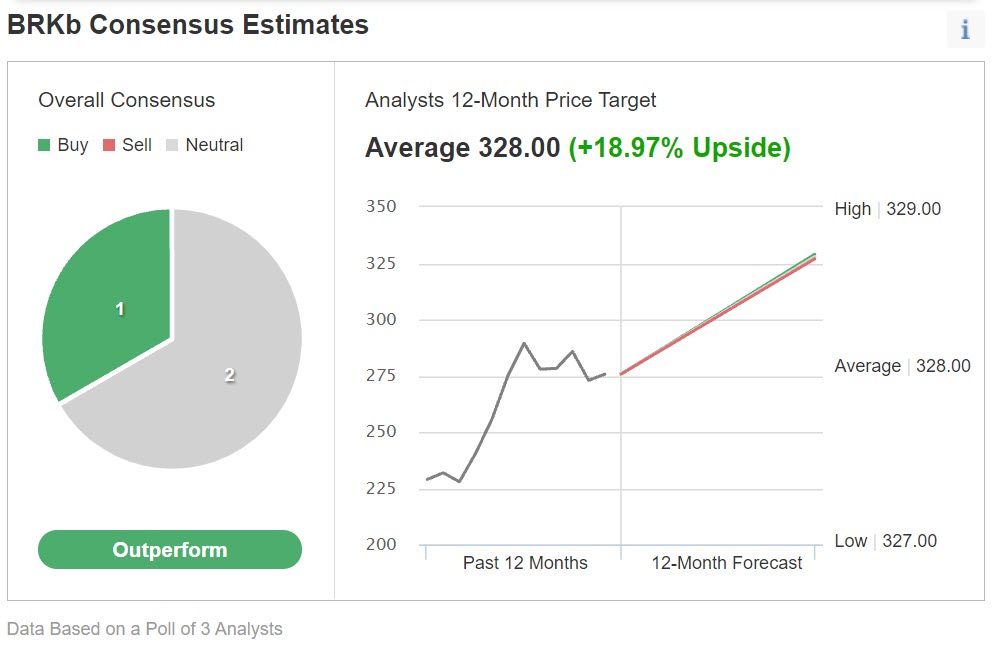

Among 3 analysts polled via Investing.com, BRKb stock has an ‘outperform' rating.

The shares have a 12-month price target of $328, implying an increase of about 19% from current levels.

Trailing P/E, P/S and P/B ratios for BRKb stock stand at 6.09x, 2.39x and 1.34x, respectively. By comparison, the same ratios for Apple, its largest holding, are 27.94x, 6.79x and 36.74x.

Investors who watch technical charts might be interested to know that a number of BRKb short and medium-term indicators are flashing caution signals. However, the stock's long-term uptrend is still intact.

Thus, if broader markets, especially Berkshire Hathaways’ largest holdings, were to come under further pressure during October, we could see BRKb shares decline toward $265, or even $255, after which the stock could trade sideways while it establishes a new base. In the case of such a decline, Berkshire Hathaway is likely to find strong support around the $250 level.

Indeed, given the recent run-up in price, our expectation is for the stock to decline about 5% in the short term. However, such a drop could offer a better entry point for buy-and-hold investors who expect growth to accelerate in the coming years.

3 Possible Trades on BRK.B

1. Buy The Stock At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in BRK.b stock now.

On Oct.1, Berkshire Hathaway closed at $275.71. Buy-and-hold investors should expect to keep this long position for several months while the stock makes another attempt at the record high of $295.08. Then, the next target would be the 12-month price target of $328.

Investors who are concerned about large declines might also consider placing a stop-loss at about 3-5% below their entry point.

2. Buy An ETF With BRKb As A Main Holding

Many readers are familiar with the fact that we regularly cover ETFs that might be suitable for buy-and-hold investors. Thus, readers who do not want to commit capital to Berkshire Hathaway stock but would still like to have substantial exposure to the shares could consider researching a fund that holds the company as a top holding.

Examples of such ETFs include:

3. Bear Put Spread

Readers who believe there could be more profit-taking and a decline in BRKb stock in the short run might consider initiating a bear put spread strategy. As it involves options, this set-up will not be appropriate for all investors.

It might also appeal to long-term Berkshire Hathaway investors to use this strategy in conjunction with their long stock position. The set-up would offer some short-term protection against a decline in price in the coming weeks.

This trade requires a trader to have one long Berkshire Hathaway put with a higher strike price and one short Berkshire Hathaway put with a lower strike price. Both puts will have the same expiration date.

Such a bear put spread would be established for a net debit (or net cost). It will profit if Berkshire Hathaway shares decline in price.

For instance, the trader might buy an out-of-the-money (OTM) put option, like the BRKb 21 January 2022 270-strike put option. This option is currently offered at $9.30. Thus, it would cost the trader $930 to own this put option, which expires in about four months.

At the same time, the trader would sell another put option with a lower strike, such as the BRKb 21 January 2022 250-strike put option. This option is currently offered at $4.68. Thus, the trader would receive $468 to sell this put option, which also expires in about four months.

The maximum risk of this trade would be equal to the cost of the put spread (plus commissions). In our example, the maximum loss would be ($9.30 - $4.68) X 100 = $462.00 (plus commissions).

This maximum loss of $462 could easily be realized if the position is held to expiry and both BRKb puts expire worthless. Both puts will expire worthless if the BRKb share price at expiration is above the strike price of the long put (higher strike), which is $270 at this point.

This trade’s potential profit is limited to the difference between the strike prices (i.e, ($270.00 - $250.00) X 100) minus the net cost of the spread (i.e., $462.00) plus commissions.

In our example, the difference between the strike prices is $20.00. Therefore, the profit potential is $2,000 - $462 = $1,538.

This trade would break even at $265.38 on the day of the expiry (excluding brokerage commissions).