- The US faces the highest probability of a recession in 40 years, with the 10-year to 3-month yield spread at its deepest inversion since the 1980s.

- The Federal Reserve predicts a 'mild' recession, but the market expects a pivot this year, suggesting a deeper and earlier recession.

- Investors are advised to allocate a portion of their portfolio to recession-proof stocks to mitigate risks.

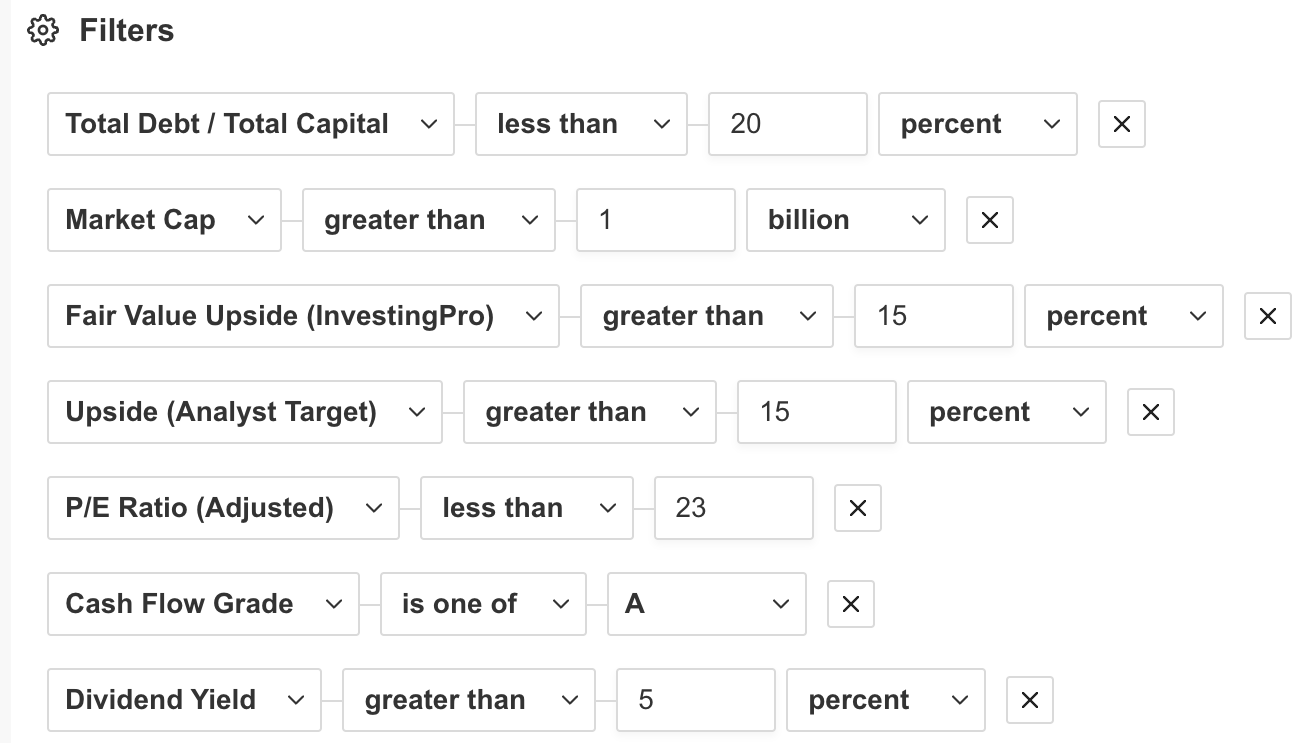

- Total Debt/Total Capital less than 20%.

- Cash Flow Grade with an ‘A’ score

- P/E Ratio (Adjusted) less than 23

- Fair Value Estimate greater than 15%

- Analyst Consensus Upside Target greater than 15%

- Market Cap greater than $1 billion

- Dividend Yield higher than 5%

- Financial Health Score: 5

- Upside Potential: 34.7%

- Dividend Yield: 18.2%

- Financial Health Score: 5

- Upside Potential: 54.6%

- Dividend Yield: 9.1%

- Financial Health Score: 5

- Upside Potential: 30.9%

- Dividend Yield: 5.6%

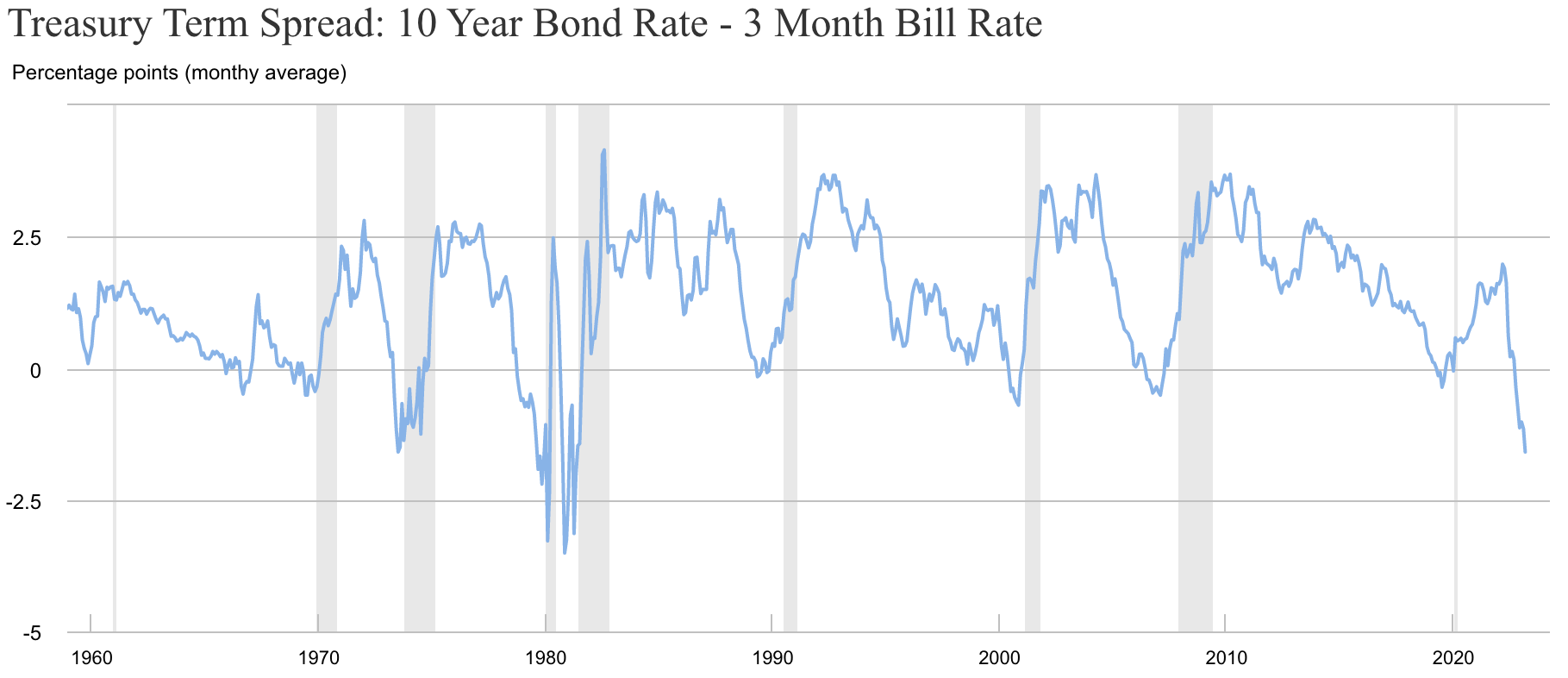

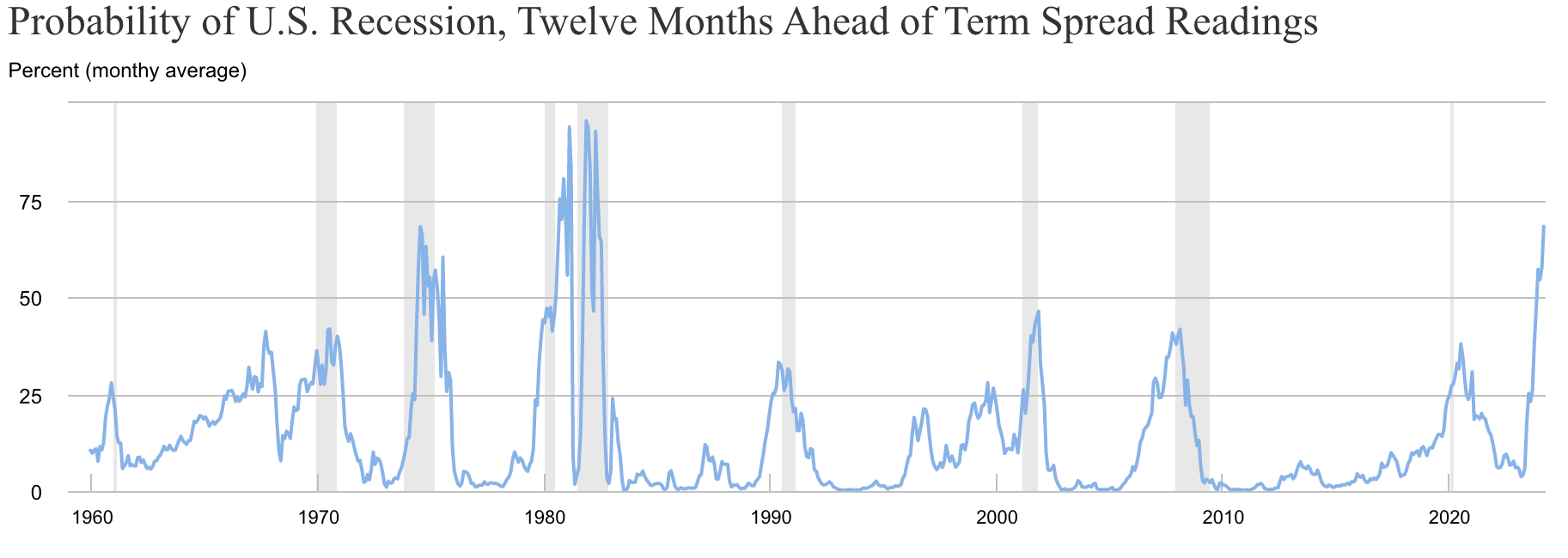

Despite the probable upward revision in Q1 GDP activity in this week’s reading and the likelihood of a minor rebound in economic activity in Q2 (read more about it here), the odds that the US will sink into a recession next year are still the highest in 40 years.

The 10-year to 3-month spread has sunk to -1.59%, the deepest inversion since the 1980s, pushing the recession odds to a hefty 68%, according to the New York Fed. This current risk surpasses that of November 2007, just before the subprime crisis unfolded, when it was positioned at a mere 40%.

Source: NYFed

This week we will likely get an update from the Fed on the topic when it releases the minutes from its last meeting. However, saved an actual pivot from the Fed this year still, the Central Bank’s prediction remains of a ‘mild’ recession starting at the end of this year and dragging well into 2024.

“Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years,” states the last meeting summary.

Regarding the deepness of the probable recession, the term JPow chose for this matter has been ‘mild’ (a new ‘transitory inflation?’). However, it appears that the market is seeing this situation a bit differently.

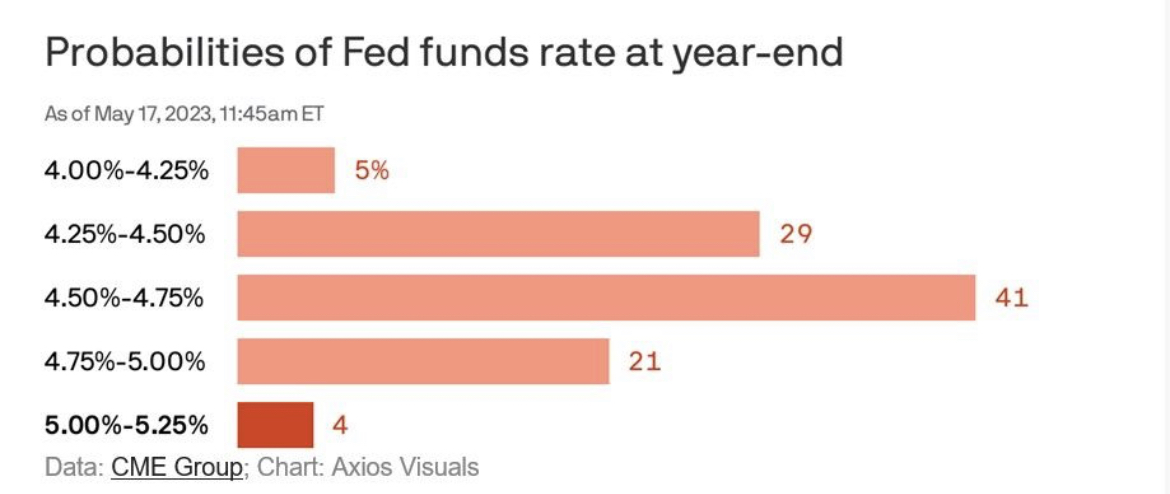

If we look at the Fed Funds futures, it’s clear that the market does not believe the Fed at this point. In fact, it is pricing in a pivot this year already, indicating that the recession might arrive sooner than expected.

Source: Axios, CME Group

How to Deal With This Situation?

The recession debate has been polarized between those who believe a recession will undoubtedly happen against those who are willing to bet against it.

While I lean more toward the latter, I want to propose a pragmatic approach to the problem: Instead of trying to predict what will happen, investors are much better off positioning their portfolios according to the risks presented, regardless of their personal opinion on the matter.

In this sense, every investor should have at least 20% of their stock portfolio in stocks that usually do well in a recession by Q3 this year. Recession believers can go as high as 50% percent while taking advantage of the yearly highs to reduce general stock exposure.

We must also keep in mind that a recession will likely be followed by a pivot by the Fed, making high-quality growth stocks attractive again.

Against the current background, we will use our InvestingPro tool to screen the market for the best recession-proof stocks to buy now. Readers can do the same research for every hot market topic by clicking on the following link: Try it out for a week for free!

Stock Screener

To discover such stocks, I used the InvestingPro advanced stock screener. I focused on finding companies within the sectors that generally do well in a recession (i.e., consumer staples, utilities, materials, and communication services) that are safe regarding their financials and offer good upside potential in the next 12 months. I also looked for companies that pay hefty dividend yields and have sufficient cash flows to keep doing that in spite of a larger economic downturn.

Source: InvestingPro

For the metrics, I used the following:

After rigorously applying these criteria, my search yielded 3 companies. Each stock received a ‘Strong Buy’ recommendation based on their Investing Pro Fair Value price targets and offers substantial upside potential.

Here are my top 3 recession-proof stocks with low P/E, big upside potential, and chunky dividends.

1. Cal-Maine Foods (NASDAQ:CALM)

2. Ternium (NYSE:TX)

3. Warrior Met Coal (NYSE:HCC)

Let’s take a deeper dive with InvestingPro into the top stock within that list.

Cal-Maine Foods

The Mississippi-based CALM, known for its exceptional quality and variety of shell eggs, has been an influential player in the industry since its inception. With a strong presence throughout various regions in the United States, this company has built a solid reputation by providing nutritious and delicious products to consumers nationwide.

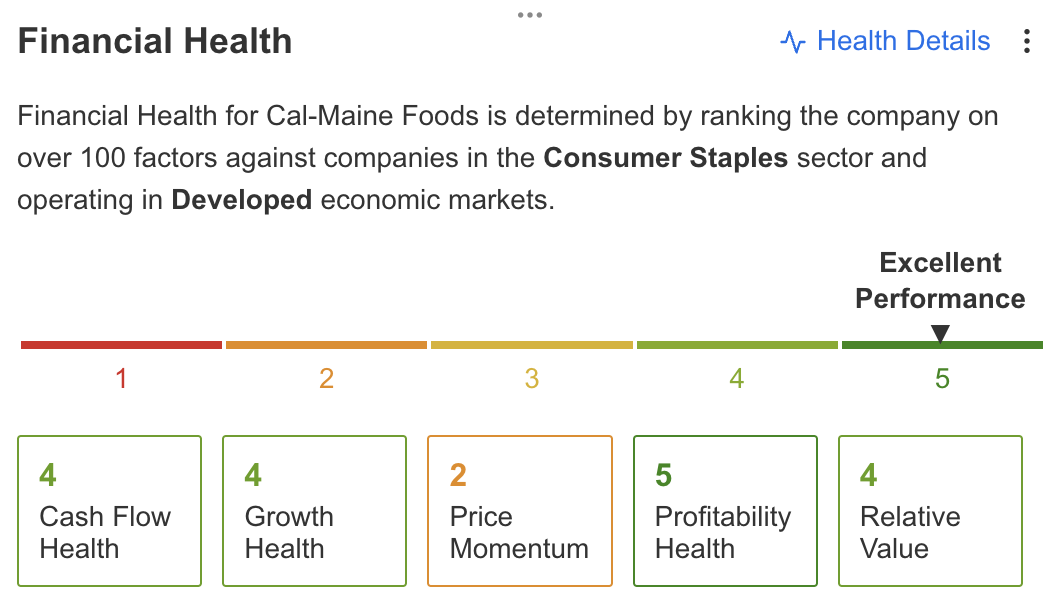

On top of the aforementioned metrics, the company has a perfect five score in InvestingPro’s Financial Health metric.

Source: InvestingPro

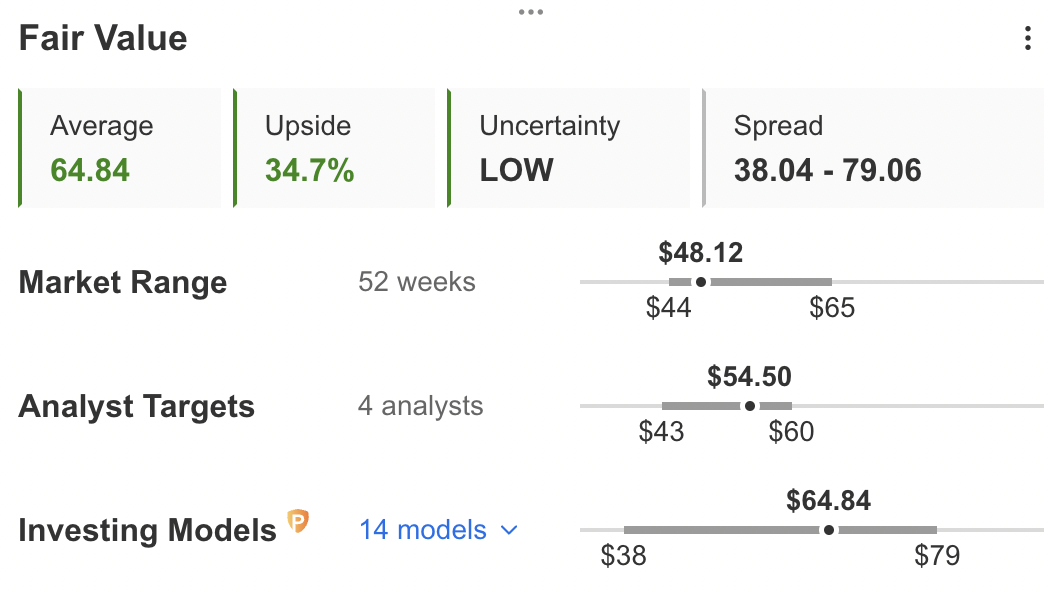

The company also has a 34.7% upside potential at current prices.

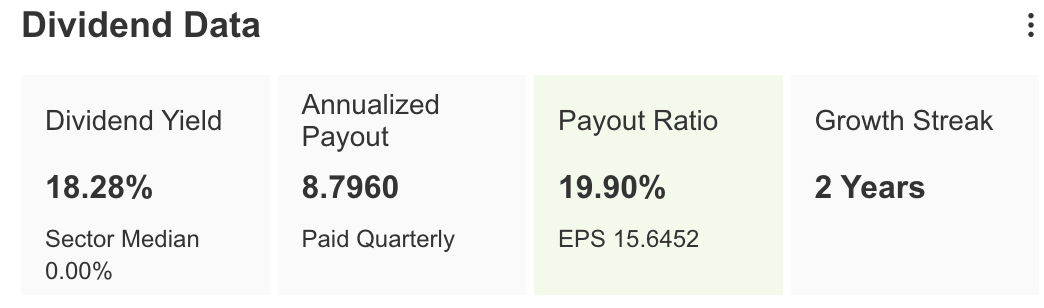

Finally, the food conglomerate also has an impressive 18.2% forward dividend yield, which places it in the top 15% of the S&P 500 in terms of cash payments to its investors.

Source: InvestingPro

Conclusion

Whether a full-blown recession will hit the US economy or not, investors are highly advised to protect from such risks by positioning their portfolios wisely. Instead of trying to predict the future, the correct risk assessment can help you achieve very positive results in the long run.

The InvestingPro stock screener is a great tool to assist in navigating this process. By combining Wall Street analyst insights with comprehensive valuation models, investors can make informed decisions while maximizing their returns.

***

Disclosure: The author of this report currently does not hold any positions in the stocks mentioned. However, he may initiate a position in CALM in the near future.