By David Henry and Anna Irrera

NEW YORK (Reuters) - The U.S. banking industry is about to launch its answer to the popular mobile payments app Venmo, in what is likely to be the biggest change in years in how individuals exchange funds digitally.

Over the next week, five of the largest U.S. banks will light up their segments of a new payments network called Zelle, executives said in interviews. They plan to announce details of the launch on Monday, and expect another two dozen banks and credit unions to join over the next year.

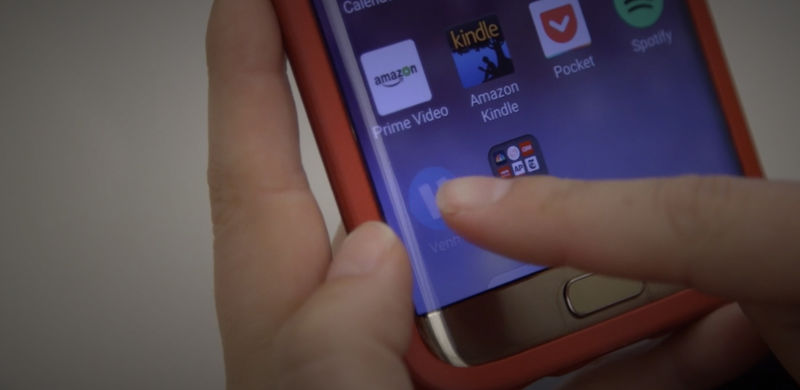

The long-awaited network will allow tens of millions of bank customers to send money to each other instantly - known as person-to-person payments - with a few taps on their smartphones. That is an improvement over Venmo, which immediately alerts users that a money transfer is in progress, but takes time to shift funds between bank accounts.

Customers who use existing bank payment apps may not notice much of a change beyond marketing. Transfers will simply happen faster because the banks are finally linking to each other, executives said.

"By coming together to offer Zelle, we are providing a large majority of Americans with a safe, fast and easy way to move money," said Bill Wallace, head of digital at JPMorgan Chase & Co (N:JPM), the biggest U.S. bank by assets.

JPMorgan, Bank of America Corp (N:BAC), Wells Fargo & Co (N:WFC), U.S. Bancorp (N:USB) and Capital One Financial Corp (N:COF) will be the first to plug into Zelle. The network is the product of an industry consortium called Early Warning Services LLC, whose seven owners have more than 86 million U.S. mobile banking customers.

Zelle took years to establish because fierce rivals had to come together to make it work. In the interim, Silicon Valley has made inroads into digital payments, particularly with the young customers coveted by banks.

In addition to Venmo, which is owned by PayPal Holdings Inc (O:PYPL), Facebook Inc (O:FB), Alphabet Inc's Google (O:GOOGL) and Apple Inc (O:AAPL) all offer payment platforms that allow individuals to send money to each other. The banks want to leap over those sleek but scattered offerings by connecting their critical mass of account holders through a single network.

"Fragmentation has been frustrating for consumers," said Paul Finch, chief executive of Early Warning. "Inconsistent experiences have made it difficult to send and receive money between banks."

Despite losing some ground to technology companies, banks still have a big advantage: No matter what network is used to transfer money, banks hold the vast majority of funds.

And despite the popularity of apps like Venmo, they transfer far less money than banks. The value of digital payments processed through non-financial firms was one-fifth of what banks and credit unions processed last year, research firm Aite Group estimates.

"We are excited to bring the service to everybody and anybody, regardless of which brand of phone you have in your hand or which generation you belong to," said Gareth Gaston, head of omnichannel banking at U.S. Bank.

Along with building customer loyalty, banks hope that Zelle will reduce their costs from handling checks and cash. Eventually, they would like to sell access to businesses that want to eliminate their own paper-related costs.

As more banks connect and more customers use the service, sending cash to another individual will simply involve knowing the person's mobile phone number or email address. Later this year, individuals with accounts at banks not connected with Zelle will be able to use its real-time features by downloading an app and pairing it with a Visa Inc (N:V) or Mastercard Inc (N:MA) debit account.

In launching Zelle, banks are being careful not to confuse customers by offering yet another payments app.

For instance, Chase will initially twin the brand with the QuickPay app its customers already use by showing "QuickPay with Zelle" on its mobile app and website. Eventually, the QuickPay name could fade away.