By Marie Mannes

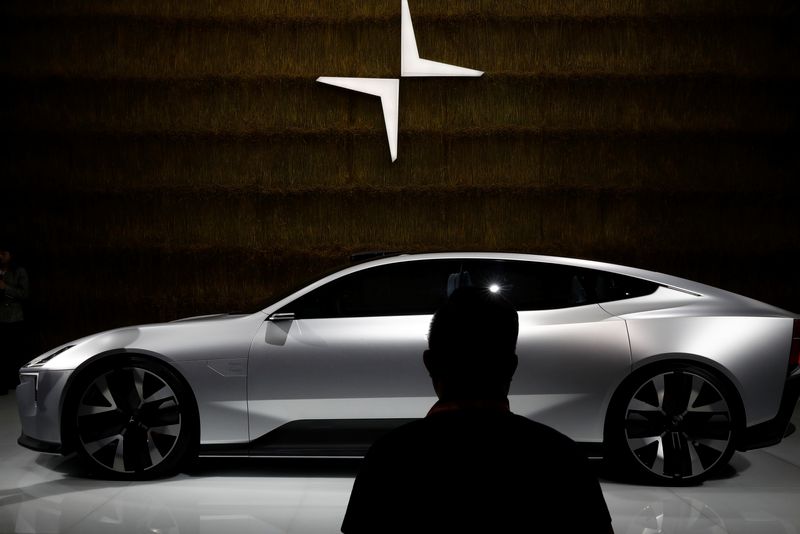

STOCKHOLM (Reuters) -Swedish electric vehicle (EV) maker Polestar's operating loss narrowed in the second quarter as the auto industry slowly recovers from pandemic-related supply chain bottlenecks.

The cash-strapped carmaker, founded by China's Geely and Volvo (OTC:VLVLY) Cars, on Thursday posted an operating loss of $274.4 million, down from $627.3 million a year ago, while revenue rose to $685.2 million from $589.1 million.

Polestar said it delivered 15,765 vehicles during the quarter, and reiterated its forecast to deliver between 60,000 and 70,000 cars in 2023 and achieve a gross margin of 4%.

The company had cut the delivery target from 80,000 in May.

Delayed production starts, job cuts and mounting competition from new Chinese rivals have meant a tough year for the company.

It has also faced increased competition from more established EV makers. While some have cut prices to boost demand from consumers grappling with higher living costs, Polestar has maintained its premium pricing.

Although the firm has inched closer to profitability, Polestar, like its rivals, continues to struggle with previously high raw material prices that - due to a lag - put pressure on the second quarter margin, despite prices on materials such as lithium, cobalt, and nickel falling.

Polestar CEO Thomas Ingenlath told Reuters he expected lower raw material prices to have a positive impact on the second half of 2023, supporting the company's 4% gross margin forecast.

The company posted a net loss per share of $0.14 in the quarter, compared with $0.12 a year ago.

Cash and cash equivalents at the end of the quarter were $1.06 billion, compared with $884.3 million in the preceding three-month period.

Its U.S.-listed shares were down about 12% at $3.41.