By Valentina Za

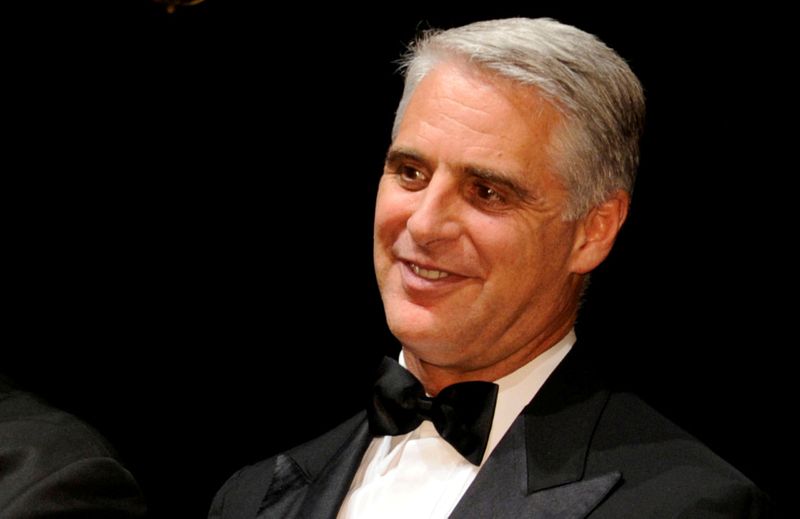

MILAN (Reuters) -Andrea Orcel will fulfil his dream of becoming a bank boss on Thursday when UniCredit investors back the veteran dealmaker as chief executive, but disquiet over his pay, among the highest for a banker in Europe, means his tenure begins on the defensive.

Orcel only narrowly defeated a shareholder revolt over the terms and size of his up to 7.5 million euro ($9 million)remuneration package, Italian daily la Repubblica reported on its website late on Wednesday.

UniCredit declined to comment.

The package, which is double the pay of former CEO Jean Pierre Mustier, had drawn criticism from leading shareholder advisory firms which had recommended a "no" vote. They were particularly unhappy that the share bonus for the first year was not linked to performance and cannot be recouped in case of misconduct.

Results of the shareholder vote are expected later on Thursday after the bank holds its annual general meeting. Votes gathered by a proxy holder, however, showed that the remuneration policy passed with 55% of votes, according to la Repubblica.

That is just above the 50% plus one vote needed for the proposal to go through and compares with a 96% approval rate last year and the 87% investor backing for the remuneration policy Mustier adopted after he arrived in 2016.

The French banker, who steered UniCredit through a tough restructuring, had cut his fixed pay by 40% to 1.2 million euros, waived his yearly bonuses through 2019 and pledged to leave without a severance cheque when the time came.

In 2020 he further cut his pay by 25% due to the pandemic, waiving also a 2.4 million euro bonus.

Investors accounting for 60% of the bank's ordinary share capital are represented at the general meeting, the bank said, so a 55% rate would mean just a third of UniCredit's overall capital supports Orcel's pay package.

Two top 30 UniCredit investors had told Reuters they would vote against.

The slate of directors put forward by the outgoing board, comprising Orcel as CEO and former Economy Minister Pier Carlo Padoan as president, got around 80% of votes, la Repubblica said.

In taking the job at UniCredit, Orcel is relinquishing more than 25 million euros in deferred pay from former employer UBS, whose investment banking arm he led until 2018.

UniCredit has said it will not compensate him in any way for that loss, after a row over pay prompted Spanish bank Santander (MC:SAN) to withdraw its offer to make Orcel its CEO back in 2019, leaving the Italian banker out of a job.

Orcel is suing Santander for 112 million euros. A public hearing in the dispute is scheduled in Madrid on May 19.

($1 = 0.8345 euros)