By Dhirendra Tripathi

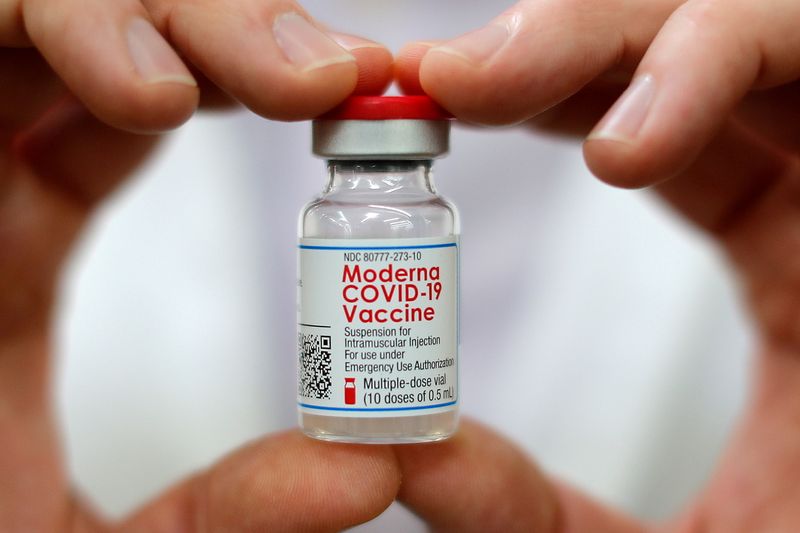

Investing.com – Moderna stock (NASDAQ:MRNA) slumped more than 16% on Thursday after the company made a sizeable cut to its guidance for sales of its two-dose Covid-19 vaccine.

The company said vaccine sales would be between $15 billion and $18 billion in 2021, a large cut just three months after it claimed to have signed agreements for $20 billion in anticipated 2021 vaccine sales.

This compares with rival Pfizer (NYSE:PFE), which raised its full-year forecast for Covid vaccine sales to $36 billion earlier this week.

Moderna also lowered its vaccine production forecast for the year to between 700 million and 800 million doses, at the full 100 microgram dose used for the initial two shots.

Moderna blamed longer delivery lead times for international shipments and exports that may shift deliveries to early 2022. The company said it is seeing a temporary impact from the expansion of bottling capacity, also known as fill/finish.

The cut in the sales forecast is also due to the prioritization of deliveries to low-income countries, many of which still lack access to the life-saving shot.

“We are working hard to ensure our vaccine is available in low-income countries with approximately 10% of our 2021 volume and significantly more of our 2022 volume going to low-income countries. . .,” Chief Executive Officer Stéphane Bancel said in a company statement.

The cut in guidance overshadowed word that the company’s board approved a share buyback of up to $1 billion spread over two years.

Moderna’s September-quarter revenue jumped more than 31 times to $4.97 billion as the company shipped millions of doses and remained at the forefront of action against the pandemic. Profit was $3.33 billion against a loss of $233 million in the same quarter last year. Despite that, both profit and sales were below estimates.