By Kate Holton and Gayathree Ganesan

LONDON (Reuters) - U.S. retailer Michael Kors (N:KORS) agreed to buy luxury shoemaker Jimmy Choo (L:CHOO) for $1.2 billion, snapping up a British company whose towering stilettos have been made famous by celebrity customers from Princess Diana to Kendall Jenner.

The move comes two months after rival handbag maker Coach (N:COH) struck a deal to buy quirky fashion brand Kate Spade & Co

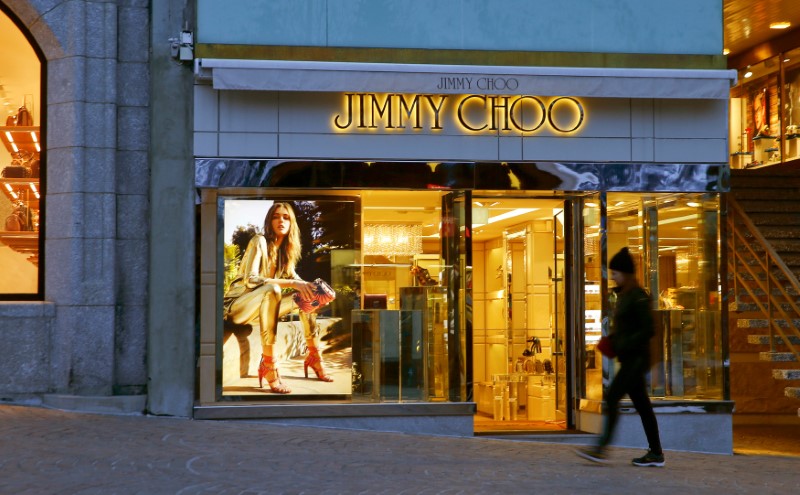

Founded by bespoke shoemaker Jimmy Choo in the 1990s, the company makes three quarters of its revenue from selling shoes and has about 150 company-operated retail stores around the world.

Its strong performance stands in contrast to Kors, which has lost 65 percent of its market value since 2014 due to fierce competition and a drop in customers at department stores.

Michael Kors' shares fell 1.2 percent in morning trading on the New York Stock Exchange. Jimmy Choo shares were up 17 percent at 228.00 pence at 1510 GMT.

Jimmy Choo will help Kors expand its footwear portfolio to 17 percent of total sales from 11 percent, Kors said on a conference call.

The shoemaker has the potential of raking in $1 billion in sales annually as it opens more stores in Asia, especially China, Kors Chief Executive John Idol said.

But the pace of store expansion will be measured, he said.

One of the reasons for falling demand for Kors bags was the fact that the company was expanding too fast, which made the brand too ubiquitous.

Michael Kors, which has tried to stem a decline in sales by expanding into dresses and menswear and its online business, said in May that sales at stores established for more than a year fell 14 percent in its fiscal fourth quarter.

"We like the target given its solid financial footing, premium luxury positioning, and footwear leadership," Jefferies analysts wrote in a broker note.

Kors will pay a premium of 36.5 percent to Jimmy Choo's closing price before it was put up for sale.

MULTI-BRAND STRATEGY

Berenberg analyst Zuzanna Pusz said the Kors and Coach deals showed U.S. accessible luxury companies were pursuing the multi-brand strategy found in Europe, where cash flows from one large brand are reinvested into smaller but faster growing ones.

Pusz said it was probably a sensible move in the long term, with competition unlikely to wane anytime soon.

Companies such as Kering SA (PA:PRTP) have implemented the multi-brand strategy to boost revenue. Kering houses brands including Gucci, Yves Saint Laurent and Alexander McQueen.

Jimmy Choo put itself up for sale in April after its majority-owner JAB, the investment vehicle of Germany's billionaire Reimann family, signaled its intention to focus on consumer goods instead.

Jimmy Choo will continue to be led by the same management team, including Creative Director Sandra Choi who joined the company at its inception.

Goldman Sachs (NYSE:GS) and JP Morgan acted for Michael Kors on the deal, while Merrill Lynch, Citigroup (NYSE:C), Liberum and RBC Europe acted for Jimmy Choo.