Exxon Mobil Corporation (NYSE:XOM) has completed a $4.9 billion all-stock transaction with Denbury Inc., marking a significant step forward for its Low Carbon Solutions business, according to CEO Darren Woods. The deal, valued at $89.45 per share, involved an exchange of 0.84 ExxonMobil shares for each Denbury share.

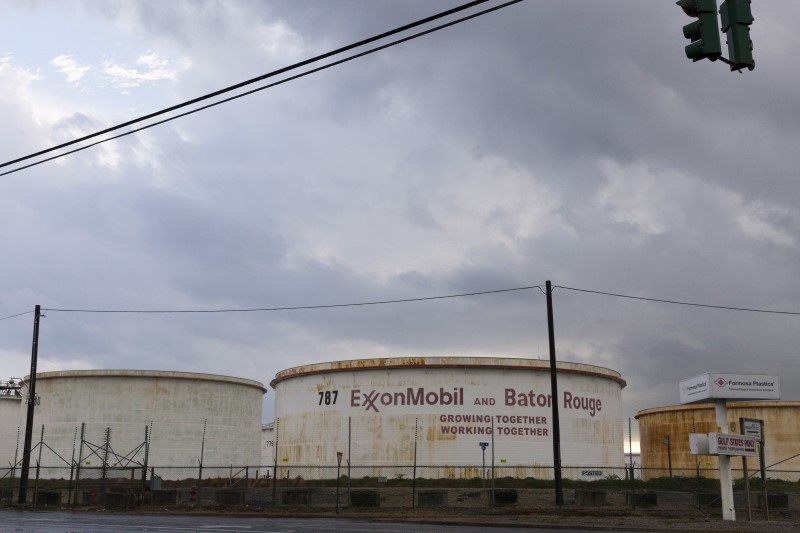

The acquisition integrates ExxonMobil's expertise with Denbury’s extensive CO2 pipeline network and workforce, thereby enhancing their low-carbon leadership and capacity to address industrial decarbonization, as well as reducing their own emissions. ExxonMobil now controls the largest CO2 pipeline network in the U.S., spanning over 1,300 miles, including 925 miles across Louisiana, Texas, and Mississippi - the largest U.S. markets for CO2 emissions.

In addition to the pipeline network, the deal incorporated over 15 onshore CO2 storage sites into ExxonMobil's portfolio. These assets are expected to play a significant role in the company's efforts towards reducing CO2 emissions by over 100 million metric tons annually.

The acquisition also includes Gulf Coast and Rocky Mountain oil and gas operations, which provide immediate operating cash flow and offer additional options for carbon capture operations. As of 2022, these operations held over 200 million barrels of proven oil equivalent reserves and were producing approximately 46,000 oil-equivalent barrels daily.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.