By Patrick Graham

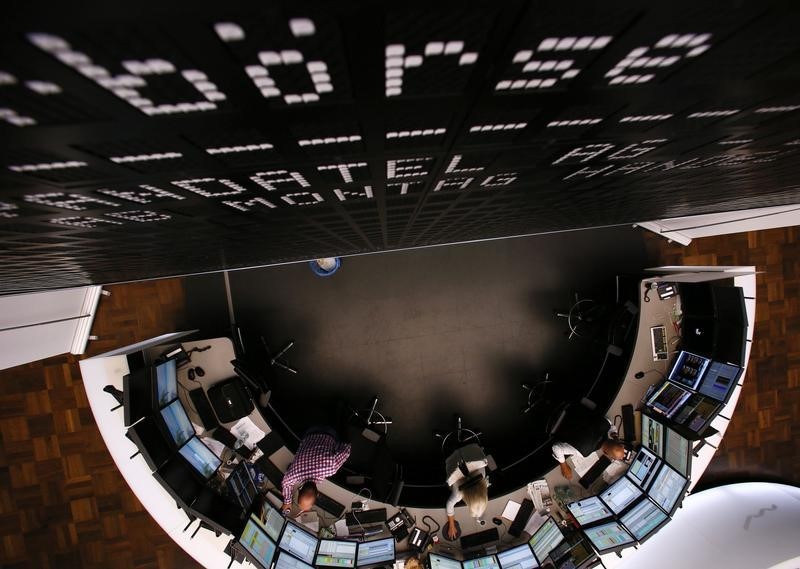

LONDON (Reuters) - Stock markets headed for their biggest weekly gain in two months on Friday after a week of central bank meetings that left investors still unconvinced that U.S. policymakers intend to put an end to an era of ultra-low interest rates.

European stock markets dipped around half a percent in morning trade, but global share indices (MIWD00000PUS) were still near 13-month highs, helped by the assumption after a statement on Wednesday that the Federal Reserve, at worst, would raise interest rates only gradually over the next two years.

Oil prices (LCOc1), down in early trade, surged back into positive territory after sources told Reuters that Saudi Arabia had offered to reduce output if rival Iran also agrees to a cap, a major compromise ahead of OPEC talks in Algeria.

But the mood remained rocky. A batch of poor German and European data helped propel losses for Europe's major exchanges and sterling <GBP=> (EURGBP=) fell 1 percent on nerves about the pace and course of talks on Britain's exit from the European Union. Wall Street was set to open marginally lower. (1YMc1)

"Markets look to have at least one eye on Brexit’s timing after (UK Foreign Minister) Boris Johnson stepped into the fray to suggest the formal withdrawal process could begin early next year," said Chris Saint, Senior Analyst at Hargreaves Lansdown (LON:HRGV) Currency Service.

"Disappointing euro zone PMI data haven’t dented appetite for the euro... (but) the data will add to worries that growth across the region is losing momentum."

The jury is still out on whether the Fed will deliver a long-speculated increase in interest rates in December, pushing Treasury yields to their biggest decline in weeks and the dollar to a half percent loss for the week.

Buying of Italian and Spanish debt - another indicator of markets' appetite for risk - has driven the biggest weekly fall in yields since the start of July.

"The immediate reaction across markets to the Fed’s decision ... has been lower treasury yields, higher stock prices and a weaker dollar," said Jasper Lawler, an analyst at CMC Markets in London. "This reflects an understanding that the Fed isn’t about to raise rates for at least three months."

Asian shares held near 14-month highs, while Japanese bond yields fell as investors continued to debate the Bank of Japan's new policy scheme, which will seek to keep longer-dated yields around zero.

MSCI's broadest index of Asia-Pacific shares outside Japan (MIAPJ0000PUS) ticked up 0.15 percent, driven by gains in Australia, and within sight of their highest levels since July 2015.

But Japan's Nikkei (N225) dipped 0.3 percent, reflecting the yen's gains during a market holiday on Thursday.

"Equity indices are displaying oft-seen Friday weakness, investors digesting strong 3-4 percent rallies of the last week/10-days," said Mike van Dulken, Head of Research at Accendo Markets.

"Banks remain pressured by the prospect of lower rates for longer and global growth uncertainty. Defensives more in favor into week-end."