(Bloomberg) -- The pay negotiation season is looking increasingly fraught this year as workers fret about 8% inflation — and their job security.

While the labor market remains tight, evidenced by last month’s better-than-expected increases in both jobs and wages, employers are gaining back some leverage just in time for the tough conversations between bosses and employees to begin. This week Goldman Sachs (NYSE:GS) Inc. said smaller bonuses and job cuts are coming while the running tally of tech layoffs hit 52,771 in November, the highest monthly total for the sector since Challenger, Gray & Christmas began keeping detailed industry data in 2000.

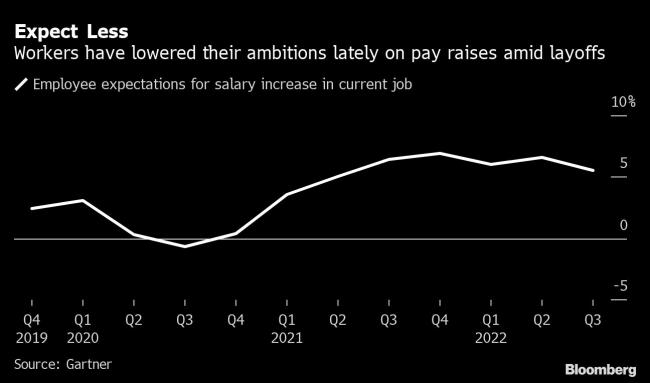

“Over the last year employees knew they could get more money if they left and that remains true, but the ease with which they can get a new job has decreased,” said Tony Guadagni, a senior principal at consultant Gartner (NYSE:IT) Inc. “It’s not the job market it was even three months ago. That shifts the balance of power back to organizations a bit. How they use that to their advantage is a bit unclear, and that’s the big thing to watch as we go into this cycle.”

One thing that’s clear is the gap between the raises that workers expect for next year — 5.5%, according to Gartner — and what companies have budgeted for, typically between 3.5% and 4.5%. One or two percentage points may not seem like much, but it can represent hundreds of millions of dollars.

Some of that disconnect stems from people mistakenly assuming that their employers would deliver raises in line with inflation, but in the current price environment a cost-of-living boost isn’t realistic in most cases. The fault also lies with employers for keeping their compensation practices deliberately opaque for years. While that’s starting to change, sparked by movements to improve transparency, this compensation cycle could be a particularly contentious one, as employees and bosses each have reason to dig in their heels.

“This is a fundamentally different salary negotiating season than we’ve seen in the past,” Guadagni said. “People are going to get smaller raises than they think they deserve and there will be a lot of hard conversations.”

Companies are preparing by harvesting all the compensation information they can from external data providers, economic surveys and industry recruiters, so they can finalize their budgets across teams and departments before the holidays and map out different scenarios depending on business conditions. In January, the pay cycle kicks into high gear, with performance reviews and compensation conversations extending into late February, when bonuses are typically paid out.

Read More: Goldman CEO Sounds Warning on Pay, Job Cuts on Uncertain Outlook

What’s different now, for many white-collar workers at least, is the ability to work from home a few days a week is commonplace, which delivers the same value as a 5% to 10% pay increase, according to research from economists including Stanford University’s Nicholas Bloom. Companies that don’t raise base salaries by as much as workers want can use that increased flexibility as a sweetener. Startups can always dangle equity in lieu of cash, and firms like Lattice (OTC:LTTC), which provides workforce-management software, is doing so for certain employees, according to chief people officer Cara Brennan Allamano.

“We’re starting to focus more on the total reward, which is something we did not pay a ton of attention to in the last few years,” she said. “That means looking at benefits, equity and also what your career experience will be. All of those things are currency. It’s a dramatic shift from last year.”

For example, Lattice is enhancing its fertility benefit for employees next year, while other employers are adding more resources for employee mental health. Companies need to deploy a “full arsenal of rewards to address the unique nature of the 2022 labor market,” said Lori Wisper, a managing director at workplace consultant Willis Towers Watson (NASDAQ:WTW). The problem is that employees often downplay the value of other facets of compensation, according to Brian Dunn, director of professional programs at Cornell University’s Institute for Compensation Studies.

Psychology plays a role as well. Research from behavioral economists shows that expectations often override our senses, blinding us to reality. “If someone got a 5% raise last year, their expectations have been raised and they will be disappointed this year,” Dunn said. “It’s the most prominent thing in their mind, what they got last year.”

Prospects for some types of workers are better than others. Job gains last month were concentrated in a few categories such as leisure and hospitality, healthcare and government. Exxon (NYSE:XOM) Mobil Corp., flush with profits, is awarding US employees with inflation-besting 9% average salary bumps. Meanwhile, employers in retail, transportation and warehousing and temporary help services have cut staff.

Regardless of where they work, though, Americans are growing more pessimistic about the labor market. The share of job seekers who expect there to be fewer jobs available six months from now recently surpassed those who expect there to be more, according to a survey from ZipRecruiter.

Meanwhile, as layoff announcements spread through industries like technology, banking and real estate — even snack maker PepsiCo (NASDAQ:PEP) Inc. is reportedly shedding staff — workers appear more hesitant to leave their current roles: The quits rate, a measure of voluntary job leavers as a share of total employment, dropped to 2.6% in October, the lowest since May 2021.

Nick Bunker, director of North American economic research at job site Indeed, says demand for workers is still very strong, “but the direction things are going will favor employers more. A better time to be a job switcher was three months ago.” Some experts, like Gerald Cohen, chief economist at the University of North Carolina’s Kenan Institute of Private Enterprise, say skilled employees still have the upper hand in salary talks. But he allows that the decline in temp workers, who are the first to go in a downturn, does not bode well for full-timers.

“We were very bullish coming into 2022,” says Lattice’s Allamano. “We are a lot less bullish coming into 2023.”