By Stanley White and Kaori Kaneko

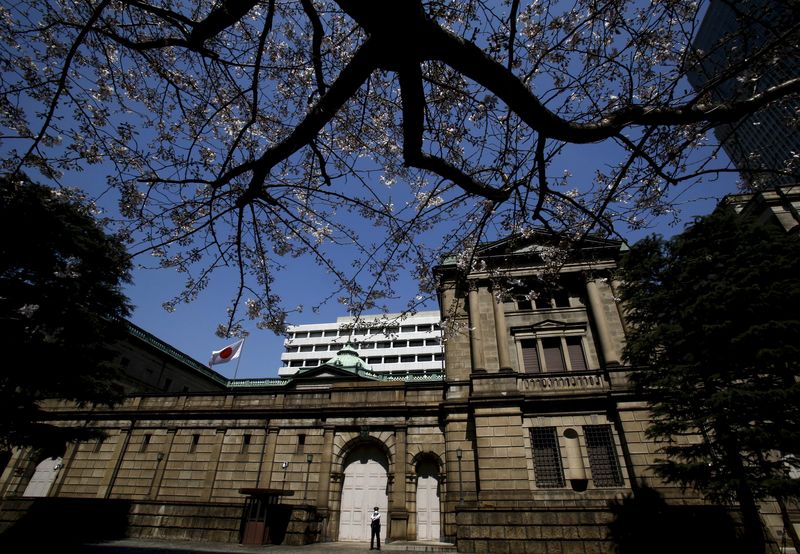

TOKYO (Reuters) - The Bank of Japan is considering applying negative rates to its lending program for financial institutions, Bloomberg reported on its website Friday.

The BOJ may consider the new step if policymakers decide to lower further the negative 0.1 percent interest rate applied to some bank reserves parked with the central bank, Bloomberg said, citing several sources that it did not identify.

The central bank's next two-day policy review ends on April 28.

The BOJ has two lending facilities, one that offers banks zero-interest funding for loans to companies in high-growth industries and one that provides zero-interest long-term funds to banks that increase lending more generally.

The BOJ would consider applying negative rates on both facilities, Bloomberg reported, which would mean the central bank is paying commercial banks to accept funding.

The BOJ would adopt negative rates on its lending facility to further lower yields and support economic activity, Bloomberg said.

Japan's benchmark Nikkei share index climbed to an 11-1/2 week high after the Bloomberg report, which helped push the yen to its lowest point since April 6.

Under the BOJ's current quantitative and qualitative easing program introduced in April 2013, the BOJ buys 80 trillion yen per year in government bonds and 3.3 trillion yen of exchange-traded funds.

This program has so far failed to generate inflationary pressures needed to meet the central bank's 2 percent inflation target by the first half of fiscal 2017.

The central bank added negative interest rates to the stimulus program in February, charging commercial banks 0.1 percent interest on a small portion of their reserves, but some commercial banks have criticized the policy for placing too much of a burden on savers and the financial sector.