By Lucia Mutikani

WASHINGTON (Reuters) - New orders for key U.S.-made capital goods rose by the most in six months in January and shipments increased, but the trend in both measures of business spending on equipment remained soft, leaving forecasts for weak first-quarter economic growth intact.

The slowing economy is helping keep inflation tame, with other data on Wednesday showing producer prices barely rising in February, resulting in the smallest annual increase in more than 1-1/2 years. This environment supports the Federal Reserve's wait-and-see approach to further interest rate hikes this year.

"There is still a strong case for the Fed to remain patient," said Michael Pearce, a senior U.S. economist at Capital Economics in New York. "The rebound in underlying capital goods orders is still consistent with a slowdown in business equipment investment growth, and producer price figures show few signs of a pick-up in inflation in the pipeline."

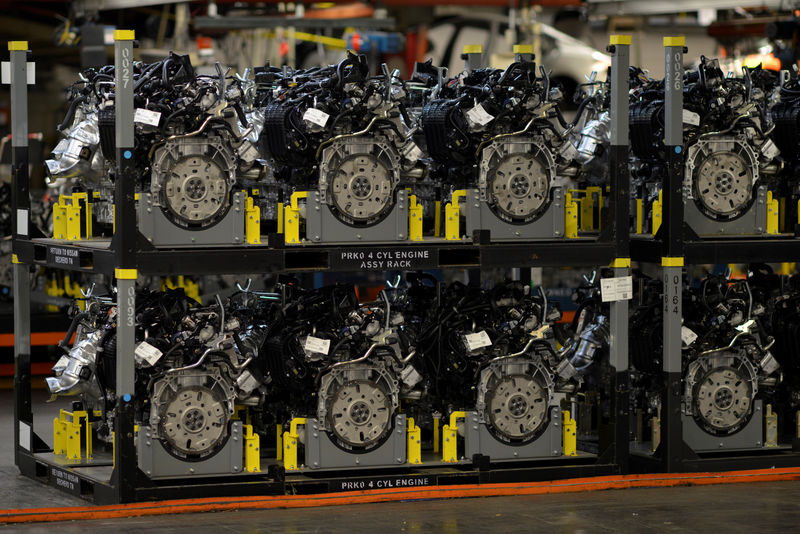

Orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, rebounded 0.8 percent, the biggest gain since July. These so-called core capital goods orders fell 0.9 percent in December.

Economists polled by Reuters had forecast core capital goods orders edging up 0.1 percent in January. Core capital goods orders increased 3.1 percent on a year-on-year basis.

Core capital goods orders in January were boosted by orders for machinery, which rebounded 1.4 percent after dropping 0.6 percent in December. Orders for electrical equipment, appliances and components jumped 1.7 percent after falling 0.2 percent in the prior month.

But orders for computers and electronic products declined 1.3 percent, the biggest drop since March 2017. There were also decreases in orders for primary metals while orders for fabricated metal products were unchanged.

Shipments of core capital goods jumped 0.8 percent in January after edging up 0.1 percent in the prior month. Core capital goods shipments are used to calculate equipment spending in the government's gross domestic product measurement.

The January report was delayed by a 35-day partial shutdown of the federal government that ended on Jan. 25. The February report, which was scheduled for release this month, will now be published on April 2.

LOW GROWTH ESTIMATES

The strong core capital goods shipments in January prompted some economists to raise slightly their estimates for first-quarter business equipment spending. Investment in equipment by businesses accelerated in the fourth quarter of last year after slowing in the July-September period.

The first-quarter GDP growth forecast also got another small lift from a second report from the Commerce Department on Wednesday showing construction outlays jumped 1.3 percent in January as investment in public projects hit a more than eight-year high. Construction spending had dropped for two straight months.

The Atlanta Fed bumped up its growth estimate for the January-March quarter by two-tenths of a percentage point to a 0.4 percent annualized rate. The economy grew at a 2.6 percent pace in the fourth quarter of 2018 after expanding at a brisk 3.4 percent rate in the July-September period.

The dollar was trading lower against a basket of currencies. U.S. Treasury prices fell, and stocks on Wall Street rose.

The economy is losing steam as the stimulus from a $1.5 trillion tax cut fades. A trade war between the United States and China, slowing global economies and uncertainty over Britain's exit from the European Union are other factors hurting activity.

The ebb in activity is helping keep price pressures under wraps. A third report from the Labor Department on Wednesday showed its producer price index for final demand edged up 0.1 percent in February, lifted by a rebound in the cost of gasoline. The PPI had dropped for three straight months.

In the 12 months through February, the PPI rose 1.9 percent. That was the smallest gain since June 2017 and followed a 2.0 percent increase in January. Economists polled by Reuters had forecast the PPI rebounding 0.2 percent in February and advancing 1.9 percent on a year-on-year basis.

A key gauge of underlying producer price pressures that excludes food, energy and trade services rose 0.1 percent last month after climbing 0.2 percent in January.

The so-called core PPI increased 2.3 percent in the 12 months through February, the smallest rise since December 2017, after advancing 2.5 percent in January.

Data on Tuesday showed consumer prices rising moderately in February, with the consumer price index posting its smallest annual gain in nearly 2-1/2 years.

February's tepid producer and consumer inflation readings suggest the Fed's preferred inflation measure, the core personal consumption expenditures (PCE) price index, likely retreated further from the U.S. central bank's 2 percent target.

The core PCE price index increased 1.9 percent on a year-on-year basis in December after a similar gain in November.

"We think that this will moderate to a high-side 1.8 percent reading in January and then a low-side 1.8 percent reading in February, with risks that the February figure rounds to 1.7 percent," said Daniel Silver, an economist at JPMorgan (NYSE:JPM) in New York.

The Commerce Department is scheduled to release January PCE price data on March 29. Publication was delayed by the government shutdown.

(GRAPHIC: U.S. durable goods DataStream Chart - http://tmsnrt.rs/2ew7ABi)