By Trevor Hunnicutt and Michelle Price

NEW YORK/WASHINGTON (Reuters) - The U.S. Securities and Exchange Commission on Thursday stood by a decision blocking an exchange-traded fund that would have tracked bitcoin, citing concerns about market manipulation.

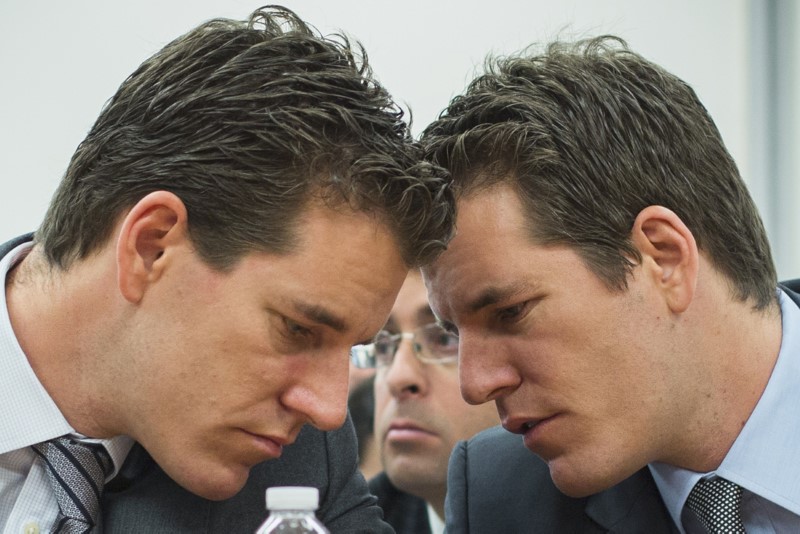

The securities regulator found "unpersuasive" arguments that the bitcoin ETF proposed by Cameron and Tyler Winklevoss, the twin brothers who founded crypto exchange Gemini Trust Co LLC, would be sufficiently protected from manipulation, it said in a 92-page analysis posted on its website https://

"Regulated bitcoin-related markets are in the early stages of their development," the SEC said, saying that it "cannot...conclude that bitcoin markets are uniquely resistant to manipulation."

But the SEC did not completely shut the door to such products coming to market once the bitcoin market has matured, offering some hope for at least five other bitcoin ETF proposals that are still pending before the regulator.

Bitcoin turned negative after the SEC's ruling, and last traded down 2.9 percent.

The virtual currency can be used to move money around the world quickly and with relative anonymity, without the need for a central authority, such as a bank or government. A fund holding the currency could attract more investors and push its price higher.

The SEC said there was not enough evidence that efforts to thwart manipulation of the ETF's price or that of the underlying bitcoin market would be successful.

The SEC had blocked the Winklevoss ETF from coming to market in March 2017, but then faced an appeal from exchange operator CBOE's Bats exchange, which applied to list the ETF.

The CBOE said it was reviewing both the SEC's notice and Commissioner Hester Peirce's dissent.

"Investors are better served by products traded on a regulated securities market and protected by robust securities laws and we will continue to work with the SEC and ETF issuers to construct a fully regulated product," said Chris Concannon, chief operating officer of CBOE Global Markets.

The parties can appeal the SEC's decision in federal court.

Gemini did not immediately respond to requests for comment.

The Winklevoss twins are best known for their feud with Facebook Inc (NASDAQ:FB) founder Mark Zuckerberg over whether he stole the idea for what became the world's most popular social networking website from them. The former Olympic rowers ultimately settled their legal dispute, which was dramatized in the 2010 film "The Social Network."

The SEC's decision to block the ETF was voted for 3-1 by its sitting commissioners, with Peirce voting against. In a statement, Peirce said she believed the product met the legal standard.

"More institutional participation would ameliorate many of the Commission's concerns with the bitcoin market that underlie its disapproval order," she said, adding that the ruling "sends a strong signal that innovation is unwelcome in our markets."