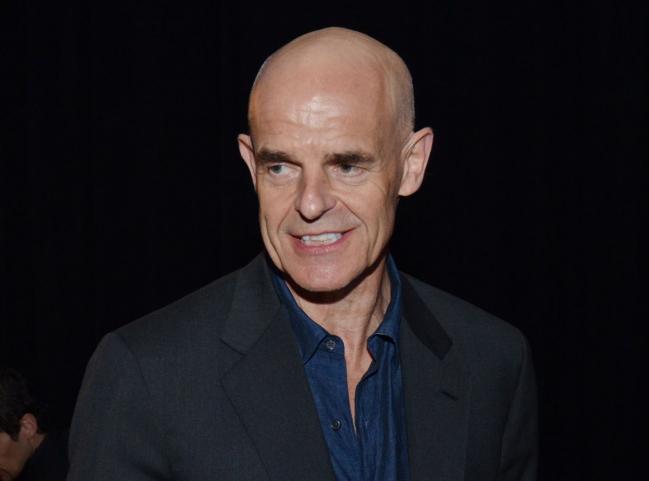

(Bloomberg) -- Andy Hall, one of the most successful oil traders of his generation, is now predicting the biggest shift yet in the global market: the end of demand growth.

While the view may not be original, it underscores the gloomy forecast earlier this week from the Paris-based International Energy Agency saying that global oil consumption will plateau in about a decade. The prospect of “peak demand” would end an expansion that dominated the past century and comes as investors and governments face pressure to move away from fossil-fuel-based economies.

“There’s a non-zero chance that by 2030, we will see a plateauing or decline in global oil consumption,” the former hedge fund manager said at an industry event in New York. “It’ll happen because of technology, electric cars, renewable energy.”

Even as new oil supplies from places including the U.S., Brazil, Norway and Guyana soar, there’s growing concern from the oil and gas industry that it’s running up against a shift in energy consumption. That transition will increasingly limit its ability to make ends meet, with some shale firms and oil-service providers already struggling or going under.

“Oil demand has grown exponentially since the end of World War II,” Hall said at the event, which was organized by Orbital Insight and RBC Capital Markets. “It was just a given that oil consumption would grow from here to eternity. Except we knew logically that couldn’t happen.”

Hall, speaking later in an interview, also said that solar and wind energy are already cheaper than coal.

“If the world fully transitions to renewable energy, what is the role of a fossil fuel company?” he said. “I think renewables is the new oil.”

Hall’s career stretches back to the 1970s and includes stints at oil major BP (LON:BP) Plc and famed trading house Phibro Energy Inc. But he shot to fame during the global financial crisis when Citigroup Inc (NYSE:C). revealed that, in a single year, he had a $100 million payout trading oil for the bank. In 2017, Hall closed down his Astenbeck Masters Commodities Fund II, a capitulation of one of the best-known figures in the commodities world.

He quoted Sheikh Ahmad Zaki Yamani, the former Saudi Arabian oil minister who famously said that the Stone Age didn’t come to an end for lack of stones, and the Oil Age will end long before the world runs out of oil.

Global benchmark Brent crude traded little changed at $62.33 a barrel at 8:58 a.m. New York time Friday. While prices are up about 16% this year, they are still well below lofty highs above $100 from earlier this decade.

“Could we see $100 oil again? Absolutely,” Hall told Bloomberg News. “That would only be temporary and hasten the ultimate demise.”