Investing.com - Gold futures edged higher on Thursday, after the Federal Reserve gave no indications on whether it will begin to taper its stimulus program in the near future.

Moves in the gold price this year have largely tracked shifting expectations as to whether the Fed would end its quantitative easing program sooner-than-expected.

On the Comex division of the New York Mercantile Exchange, gold futures for December delivery traded at USD1,319.55 a troy ounce during European morning hours, up 0.5%.

Gold futures were likely to find support at USD1,306.05 a troy ounce, Tuesday’s low and resistance at USD1,346.15, the high from July 24.

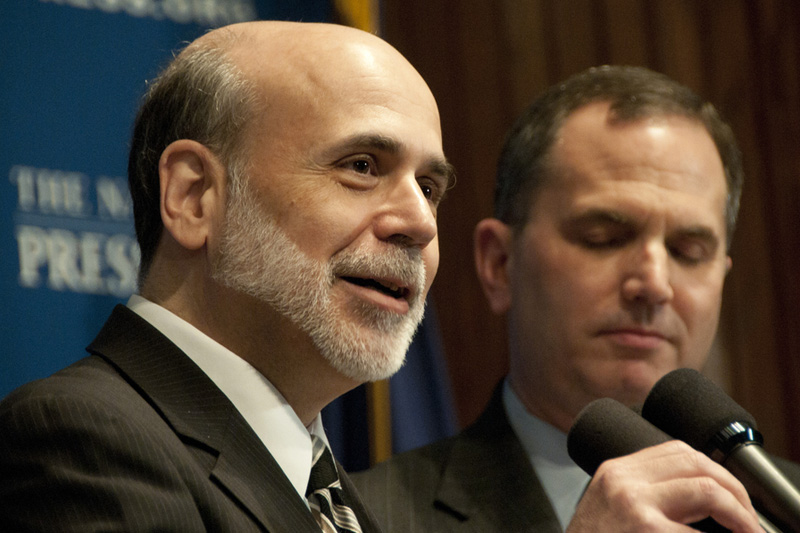

At the end of its two-day policy meeting on Wednesday, the Fed said it would keep buying USD85 billion a month in mortgage and Treasury securities and added that the pace of economic growth is "modest".

Market players now looked ahead to highly-anticipated data on U.S. nonfarm payrolls due on Friday for indications of how the recovery in the U.S. labor market is progressing.

Investors have closely been looking out for data reports recently to gauge if they will strengthen or weaken the case for the Fed to reduce its bond purchases.

Gold traders also looked ahead to the European Central Bank's upcoming policy statement due later in the day, as well as ECB President Mario Draghi's traditional press conference.

The December contract settled down 0.9% at USD1,313.0 a troy ounce on Wednesday after official data showed that the U.S. economy grew more-than-expected in the second quarter of 2012.

The Commerce Department said that gross domestic product grew at a seasonally adjusted annual rate of 1.7% in the three months to June, beating expectations for growth of 1%.

The robust GDP data came after payroll processing firm ADP said non-farm private employment rose by a seasonally adjusted 200,000 in July, above expectations for an increase of 180,000.

Any improvement in the U.S. economy was likely to reinforce the view that the Federal Reserve will begin to taper its bond purchase program in the coming months.

The precious metal is on track to post a loss of 21% on the year amid concerns the Fed will start to unwind its stimulus program by the year's end.

An exit from the stimulus would deal a heavy blow to gold, which has thrived on demand from investors who buy gold to hedge against the inflationary risks of loose monetary policies.

Elsewhere on the Comex, silver for September delivery rose 0.1% to trade at USD19.65 a troy ounce, while copper for September delivery added 0.5% to trade at USD3.135 a pound.

Earlier in the day, a government report showed that China’s manufacturing purchasing managers' index rose unexpectedly to 50.3 in July from 50.1 in June.

Above 50.0 indicates industry expansion, below indicates contraction.

However, the official data differed from the final reading of the HSBC China Purchasing Managers Index, which hit an 11-month low of 47.7 in July.

China is the world’s largest copper consumer, accounting for almost 40% of world consumption last year.

Moves in the gold price this year have largely tracked shifting expectations as to whether the Fed would end its quantitative easing program sooner-than-expected.

On the Comex division of the New York Mercantile Exchange, gold futures for December delivery traded at USD1,319.55 a troy ounce during European morning hours, up 0.5%.

Gold futures were likely to find support at USD1,306.05 a troy ounce, Tuesday’s low and resistance at USD1,346.15, the high from July 24.

At the end of its two-day policy meeting on Wednesday, the Fed said it would keep buying USD85 billion a month in mortgage and Treasury securities and added that the pace of economic growth is "modest".

Market players now looked ahead to highly-anticipated data on U.S. nonfarm payrolls due on Friday for indications of how the recovery in the U.S. labor market is progressing.

Investors have closely been looking out for data reports recently to gauge if they will strengthen or weaken the case for the Fed to reduce its bond purchases.

Gold traders also looked ahead to the European Central Bank's upcoming policy statement due later in the day, as well as ECB President Mario Draghi's traditional press conference.

The December contract settled down 0.9% at USD1,313.0 a troy ounce on Wednesday after official data showed that the U.S. economy grew more-than-expected in the second quarter of 2012.

The Commerce Department said that gross domestic product grew at a seasonally adjusted annual rate of 1.7% in the three months to June, beating expectations for growth of 1%.

The robust GDP data came after payroll processing firm ADP said non-farm private employment rose by a seasonally adjusted 200,000 in July, above expectations for an increase of 180,000.

Any improvement in the U.S. economy was likely to reinforce the view that the Federal Reserve will begin to taper its bond purchase program in the coming months.

The precious metal is on track to post a loss of 21% on the year amid concerns the Fed will start to unwind its stimulus program by the year's end.

An exit from the stimulus would deal a heavy blow to gold, which has thrived on demand from investors who buy gold to hedge against the inflationary risks of loose monetary policies.

Elsewhere on the Comex, silver for September delivery rose 0.1% to trade at USD19.65 a troy ounce, while copper for September delivery added 0.5% to trade at USD3.135 a pound.

Earlier in the day, a government report showed that China’s manufacturing purchasing managers' index rose unexpectedly to 50.3 in July from 50.1 in June.

Above 50.0 indicates industry expansion, below indicates contraction.

However, the official data differed from the final reading of the HSBC China Purchasing Managers Index, which hit an 11-month low of 47.7 in July.

China is the world’s largest copper consumer, accounting for almost 40% of world consumption last year.