Florham Park, NJ-based Zoetis Inc. (NYSE:ZTS) is one of the leading global animal health companies focused on the discovery, development, manufacture and commercialization of animal health medicines and vaccines, with a focus on both livestock and companion animals. The company came into existence following Pfizer’s decision to spin off its animal health business in 2013.

Zoetis’ diversified portfolio of products for livestock and companion animals should continue to drive top-line growth at the company. The company’s top line should benefit from the addition of products acquired from Abbott Laboratories (NYSE:ABT) (Feb 2015), Pharmaq (Nov 2015) as well as from the performance of Apoquel and other key brands. In this scenario, investor focus remains on top-and bottom-line numbers.

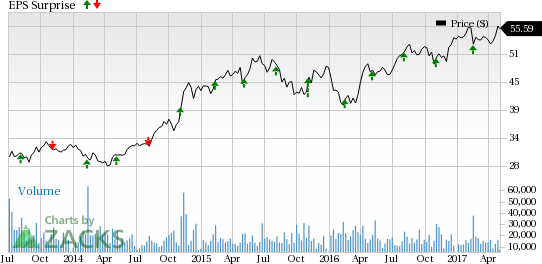

Zoetis’ track record has been impressive with the company beating earnings estimates consistently. In fact, Zoetis’ earnings surpassed expectations in each of the last four quarters, with an average positive surprise of 11.48%.

Currently, Zoetis has a Zacks Rank #3 (Hold), but that could definitely change following the company’s earnings report which was just released. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings Beat: Once again, Zoetis has surpassed earnings estimates. Zoetis beat on first-quarter 2017 earnings. The company reported EPS of 53 cents while our consensus called for EPS of 48 cents.

Revenues Beat: Zoetis posted revenues of $1.23 billion surpassing the Zacks consensus estimate of $1.19 billion.

Key Stats: The company strengthened its canine dermatology portfolio with the approval of Cytopoint in the European Union in April 2017 and in Canada inMarch 2017. Cytopoint is the first monoclonal antibody (mAb) therapy approved to help provide a reduction in the clinical signs associated with atopic dermatitis such as itching in dogs.

2017 Outlook Re-affirmed: Zoetis reiterated its outlook for 2017. In 2017, the company expects earnings in the range of $2.26 to $2.36 per share on revenues of $5.10 billion and $5.23 billion. The Zacks Consensus Estimate for earnings is $2.32 per share on revenues of $5.17 billion.

Share Price Impact: Shares of the company were up 0.4% in-pre-market trading.

Check back later for our full write up on this ZTS earnings report later!

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge. With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research. It's not the one you think. See This Ticker Free >>

Zoetis Inc. (ZTS): Free Stock Analysis Report

Original post

Zacks Investment Research