Yum! Brands (NYSE:YUM) posted decent fourth-quarter 2017 results, beating the Zacks Consensus Estimate on earnings but missing the same on revenues.

Adjusted earnings of 96 cents per share surpassed the Zacks Consensus Estimate of 80 cents. Further, earnings increased 21.5% year over year. The shift to refranchising substantially boosted the company’s operating margin and earnings per share and the trend is expected to continue.

Total revenues of $1.58 billion were down 16.4% year over year and missed the Zacks Consensus Estimate of 1.61 billion. The decline in total revenues was mainly due to decrease in company sales as an impact of its continued strategic refranchising initiative. The reduction in ownership through refranchising is an overhang on near-term revenues.

Yum! Brands, Inc. Revenue (TTM)

Just before the earnings announcement, Yum! Brands announced a partnership with online food delivery platform Grubhub to enhance online sales and delivery from its restaurants. As part of the deal, Yum! Brands will acquire $200 million of Grubhub stock. The proceeds will be used by Grubhub to speed up expansion of its delivery capacity.

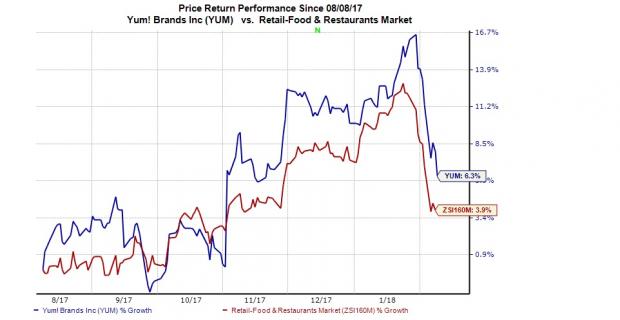

Shares of Yum! Brands have gained 6.3% over the past year, outperforming the industry’s 3.9% rally.

Segmental Performance

Yum! Brands now reports under three segments – KFC, Pizza Hut and Taco Bell.

KFC revenues were $814 million, down 11.8% on a year-over-year basis. Comps at the KFC division increased 3% compared with the year-ago quarter’s rise of 2% and the previous quarter’s increase of 4%.

Segment operating margin was up 6% year over year owing to refranchising and same-store sales growth.

At Pizza Hut, revenues were $234 million, down 24.3% on a year-over-year basis. Comps were up 1% against the year-ago quarter’s decline of 3% and preceding quarter’s increase of 1%.

Segment operating margin was up 2.9% year over year, attributable to refranchising, offset by higher franchise and license costs.

Taco Bell revenues were $531 million, down 18.8% from the year-ago quarter. Comps were up 2%, which compared unfavorably with the year-ago quarter and prior-quarter growth of 3%.

Segment operating margin was up 3.8% year over year, attributable to refranchising and same-store sales growth.

Yum! Brands carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

McDonald's (NYSE:MCD) reported fourth-quarter 2017 adjusted earnings per share (EPS) of $1.71, beating the consensus mark of $1.59 by 7.5%. Earnings improved 19% from the year-ago quarter (16% in constant currencies). The upside reflects strong operating performance and G&A savings.

Dunkin' Brands (NASDAQ:DNKN) fourth-quarter 2017 adjusted earnings of 64 cents per share beat the Zacks Consensus Estimate of 63 cents. Earnings, however, stayed flat year over year, as a decline in adjusted net income was offset by decline in shares outstanding.

Chipotle Mexican Grill’s (NYSE:CMG) adjusted earnings per share in the fourth quarter were $1.34, surpassing the consensus estimate of $1.32. Earnings also grew 143.6% year over year on lower costs and higher revenues.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN): Free Stock Analysis Report

Original post

Zacks Investment Research