Another set of statistics from China has added to the wave of disappointment over the momentum of the world's second-largest economy, prompting a dichotomic response from regulators.

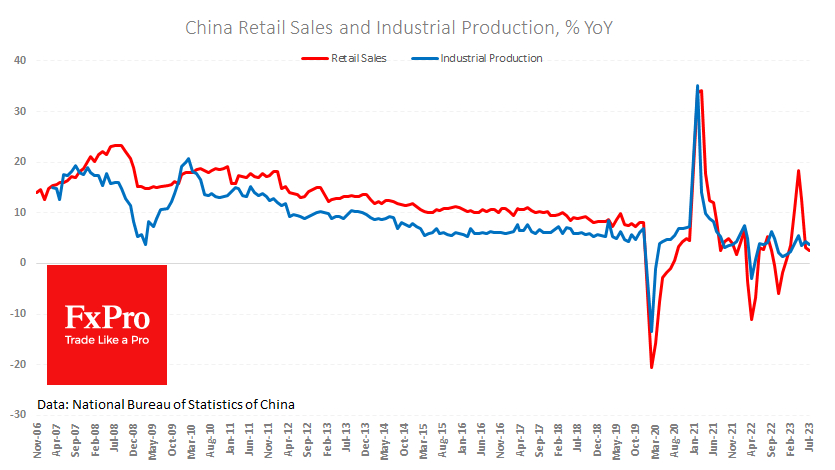

Retail sales in July were only 2.5% y/y, down from 3.1% y/y in the previous month and in stark contrast to the expected acceleration to 4.2% y/y. Until now, there has been a lack of visible results from the measures taken to stimulate final demand. China continues to struggle to rely on domestic demand as a source of growth.

Industrial production failed to impress either, rising 3.7% y/y after 4.4% in the previous month and worse than expected at 4.3%.

The unemployment rate unexpectedly rose to 5.3%, and urban youth unemployment figures were "suspended" after the numbers exceeded 21.3% in June.

Shortly after the statistics release, the People's Bank of China cut its medium-term lending rate by 0.15 percentage points to 2.5%. The weak economic data and the rate cut put pressure on the Yuan.

The USD/CNH exchange rate was above 7.32 on Tuesday and was only higher for a few days in October-November last year. Consistently higher, it was traded until 2008. This is an explainable market reaction to the dramatic shift in expectations and the divergence in US and Chinese monetary policy.

What is more difficult to explain are reports that state banks have become active in the foreign exchange market to protect the national currency from depreciation. The dichotomy of such moves is that the weakening of the exchange rate can boost exports and stimulate domestic purchases. In contrast, attempts to stop the exchange rate deterioration against macro data only lead to the burning of reserves.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Yuan Nears Multi-year Lows After Economy Weakens

Published 08/15/2023, 09:34 AM

Updated 03/21/2024, 07:45 AM

Yuan Nears Multi-year Lows After Economy Weakens

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.