CFRA Research, in conjunction with S&P Global, recently published a report on the probabilities of a market pullback. A number of interesting data points are outlined in the report, but a few interesting ones are as follows:

- "during bull markets since 1945, the S&P 500 experienced a pullback (a decline of 5.0%-9.9%) once a year, on average,"

- "a correction (a 10% to 19.9% decline) every 2.8 years, and,"

- "a bear market (-20%+) every 4.7 years."

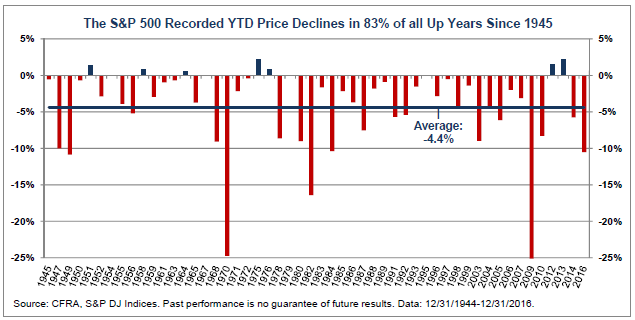

- "the S&P 500 suffered a YTD price decline in more than 80% of all years in which the S&P 500 recorded a positive annual performance since WWII."

As further proof that the market does not move higher in a straight line, the CFRA report notes the S&P 500 Index incurred a year-to-date price decline in 83% of all up years since 1945.

Also interesting in the report is the fact that 70% of all year-to-date declines occurred in the first quarter of the year and approximately a third of all the year-to-date declines occurring in January.

The entire report is a worthwhile read as it contains data on the market's performance after surpassing millennial points.