- US stocks erase early gains to close negative, falling yields don’t help

- Yen advances as risk aversion intensifies, oil succumbs to gloomy mood

- Dollar choppy, Netflix (NASDAQ:NFLX) disappoints, US-Russia meeting in focus

Selling snowballs

The stock market just can’t shake off the blues. Wall Street took another sharp hit yesterday as investors continued to unload riskier assets and rotate into safe havens to insulate their portfolios from any further downside.

All this mayhem started with worries around the Fed raising interest rates at a faster clip, but that’s no longer the driving force. Treasury yields have been falling for most of the week as traders hedge risk and yet, equities keep bleeding. Hence, there is no clear catalyst behind the selloff anymore aside from the fear of further selling itself.

This is the type of move you would expect to see when market participants are worried about something huge, like a Russian invasion of Ukraine, not the Fed trying to raise rates into a solid economy. But if that was the case, oil and gold prices would be going berserk, which hasn’t really happened.

Ultimately this is good news. As long as yields are stable or retreating, that will help cushion the stock market from any brutal losses. It can always get uglier, but without a clear narrative behind the shellacking anymore, bargain hunters could soon emerge to take advantage of the deepening discounts in many quality names.

Yen shines as yields retreat

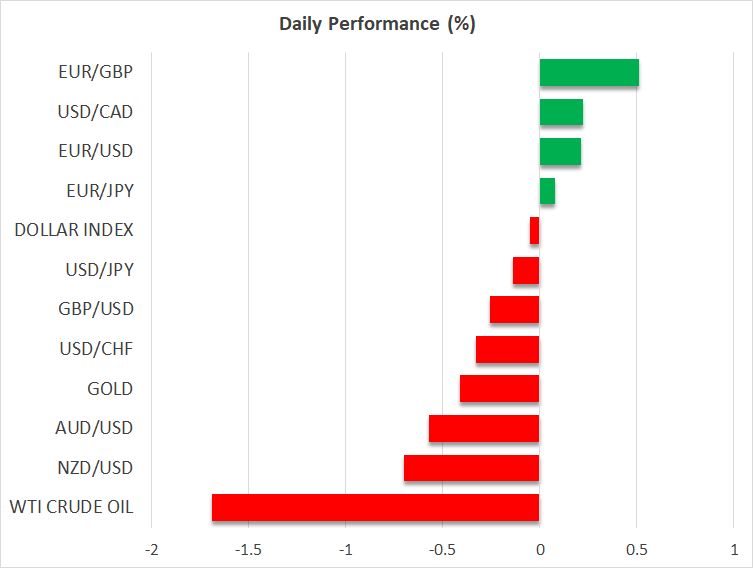

In the FX spectrum, the defensive Japanese yen has been the clear winner this week, capitalizing on all the risk aversion and the pullback in global yields. The US dollar has been choppy in recent sessions but is still headed for solid weekly gains against the euro and sterling, both of which tend to underperform in periods of market stress.

The sour mood has also left its marks on the New Zealand dollar, which is currently testing multi-month lows despite money markets pricing in a rate increase by the Reserve Bank in every single meeting this year and fresh stimulus measures in China.

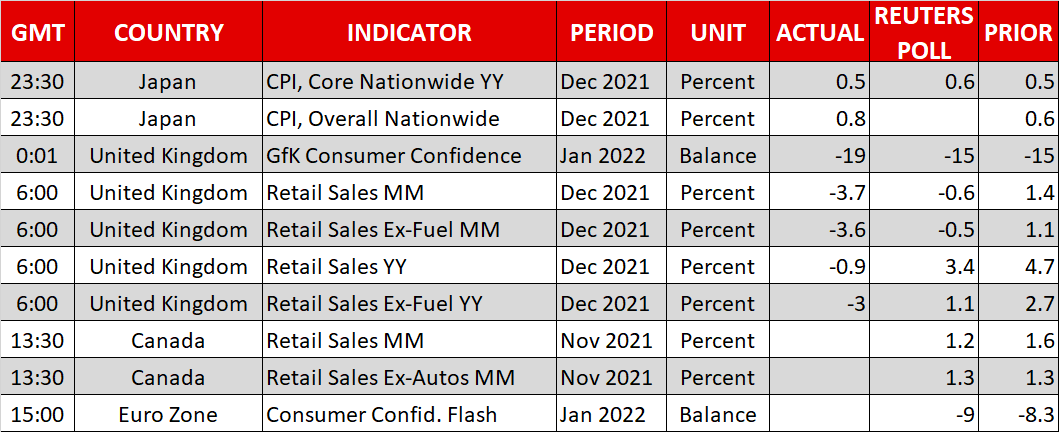

The Canadian dollar has performed much better than its commodity cousins, helped by speculation that the Bank of Canada will expedite its normalization plans and raise interest rates next week. The final piece of this puzzle will be the retail sales numbers that will be released today.

Oil pulls back, geopolitics in focus

Meanwhile in energy markets, oil prices have rediscovered the gravitational pull of risk sentiment, erasing all their gains for the week to trade lower instead. It seems that crude cannot ignore the havoc in stocks for too long, although geopolitical factors could also be at play.

The top diplomats of the United States and Russia will meet today for the second round of negotiations to de-escalate the crisis around Ukraine. Whether these talks bear fruit could be crucial for traders trying to price geopolitical risk into assets such as crude oil and gold, as the rhetoric has become more heated lately with President Biden warning of a ‘heavy price’ if Russia invades.

There isn’t much else on the economic calendar today. Instead, markets will turn their gaze to next week’s events, which feature central bank meetings in America and Canada.

Finally, it is worth noting that Netflix shares are lower by a stunning 20% in premarket trade after the streaming giant warned of a slowdown in subscriber growth during its quarterly earnings call.