Dollar continues to drift lower ahead of Fed minutes tomorrow

Japanese yen recovers amid growing bets of foreign rate cuts

Oil prices bounce back on potential supply cuts, gold steadies

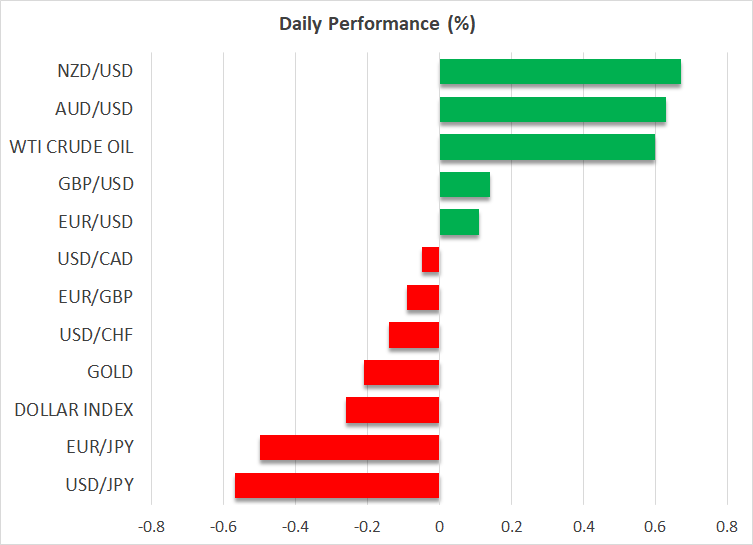

Dollar feels the blues

A paradigm shift has taken place in global markets this month, after a string of disappointing data releases from the major economies eliminated any surviving bets of further rate increases and instead fueled speculation about a series of rate cuts next year.

Market pricing currently suggests the US and Europe will launch a coordinated easing cycle in the spring or early summer of 2024, as their central banks switch away from fighting inflation and towards safeguarding economic growth. This repricing has helped push bond yields down, which has been a blessing for assets such as gold and equities that benefit from lower rates.

In the FX arena, falling yields have translated into a weaker US dollar. That’s partly because the Fed has more space to cut interest rates than most other economies, and partly because the sanguine mood in riskier assets has dampened safe-haven demand for the world’s reserve currency.

All told, the key question for EUR/USD traders is whether current market pricing that sees the Fed and ECB cutting rates almost simultaneously and by equal amounts next year is realistic, considering that the US economy appears much healthier than the Eurozone’s at this stage. The latest edition of business surveys on Thursday will be crucial in shaping this narrative.

Yen recovers, sterling eyes tax cuts

With the dollar losing ground and mounting speculation that lower interest rates are on the horizon in most economies, the Japanese yen has come back to life. The Japanese currency is trading higher for a third straight session on Monday, after almost touching a three-decade low last week.

Whether this is the beginning of a trend reversal or just another false dawn is questionable, but it does appear that the macroeconomic landscape next year favors the yen, in an environment where foreign economies slash rates while the Bank of Japan raises them. With domestic inflation heating up and Tokyo preparing a spending package to boost growth, investors expect the BoJ to tighten policy next year, flying against the global winds.

Over in the UK, politics is back in the spotlight ahead of the Autumn Statement on Wednesday, where the government has entertained the idea of cutting income taxes as a means to boost stagnant economic growth. With the Conservatives trailing miles behind Labor in opinion polls and an election approaching in 2024, this appears like a last-ditch attempt by Prime Minister Sunak to turn the political tide.

But for the pound, there is a silver lining. Lower income taxes would help shield the economy from a dreaded recession and also pour gasoline on the inflationary fire, which in turn could force the Bank of England to keep rates elevated for longer. Hence, any announcement of tax cuts might prove beneficial for sterling, both from a growth perspective and the interest rate channel.

Oil bounces back, gold consolidates gains

In the commodity complex, oil prices staged a turnaround last week after OPEC+ officials floated the idea of extending their production cuts into next year. The supply cuts were meant to expire at the end of this year, but it seems Saudi Arabia is concerned about demand weakness in 2024 and is trying to establish a floor under oil prices by keeping supply constrained.

Gold prices enjoyed a sharp rebound last week, drawing fuel from bets that central banks will cut rates faster and deeper next year. The softness in the US dollar also helped the dollar-denominated precious metal to shine, with gold currently trading less than 5% from its record highs.

The next event for gold traders will be the minutes of the latest Fed meeting, due out tomorrow.