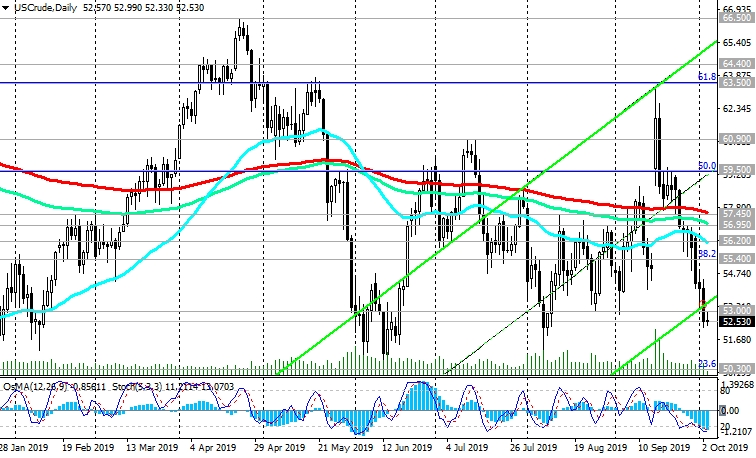

At the beginning of the European session, WTI Crude oil was trading near 52.50, below the resistance level of 55.40 (EMA200 on the 1-hour chart and the Fibonacci level 38.2%).

On Wednesday, futures for WTI crude oil on the NYMEX closed with a decrease of 1.8%, at 52.64 dollars per barrel. ICE Brent crude futures closed down 2% at 57.69 dollars a barrel.

The decline in oil prices occurs amid falling stock markets and rising oil reserves in the United States. As the Energy Information Administration (EIA) of the US Department of Energy reported on Wednesday, commercial oil reserves in the United States grew by 3.1 million barrels last week, for the third week in a row.

On Thursday, investors will pay attention to the publication (at 14:00 GMT) of the ISM index for the US non-manufacturing sector. The ISM index is expected to drop to 55.0 in September from 56.4 in August. The service sector has a smaller share of US GDP than the manufacturing and consumer sectors. However, if the data are weaker than expected, then pressure on US stock indices will intensify, which is also likely to cause a further decline in oil prices.

And on Friday (at 17:00 GMT) a weekly report on the number of active drilling rigs in the United States will be presented by the American oilfield services company Baker Hughes. Previous reports indicated a decrease in the number of active oil platforms in the United States to 713 units at the moment. If the report again indicates a decrease in the number of such installations, then this may give a short-term positive impetus to prices.

However, so far, a strong negative impulse prevails, contributing to a further decline in oil prices. Below resistance levels 56.20 (ЕМА200 on the 4-hour chart), 55.40, should be considered only short positions.

In an alternative scenario, a signal to resume purchases will be a breakdown of the local resistance level of 53.00. Further growth and the breakdown of resistance levels 55.40, 56.20, 57.45 will direct the price to resistance level 60.90 (July highs) and further towards the upper border of the ascending channel on the daily chart and marks of 63.50, 64.40.

Support Levels: 52.00, 50.30, 49.00, 42.15

Resistance Levels: 53.00, 55.40, 56.20, 56.95, 57.45, 59.50, 60.90, 63.50, 64.40, 66.50

Trading Recommendations

Sell Stop 51.90. Stop-Loss 53.10. Take-Profit 51.00, 50.30, 49.00, 42.15

Buy Stop 53.10. Stop-Loss 51.90. Take-Profit 54.00, 55.40, 56.20, 56.95, 57.45