WTI hits the upper bound of a medium-term downside channel

- Oil prices extended their latest gains on Wednesday, on the weekly US EIA crude inventory data. Inventories fell by 7.2 million barrels, far more than the consensus for a decline of 2.6 million barrels. The precious liquid began to recover earlier this week, following announcements by Saudi Arabia that it plans to limit its oil exports, and by Nigeria that it will cap its production. In addition, the consistent plunge in the US dollar in recent days probably boosted oil prices even further.

- Even if oil prices remain supported on the back of this sentiment over the next few days, we do not believe that the latest rally will develop into a longer-term healthy uptrend in oil. Continued gains in prices would probably invite more US shale producers back into the market, something that could increase supply even further and thereby, put a lid on prices.

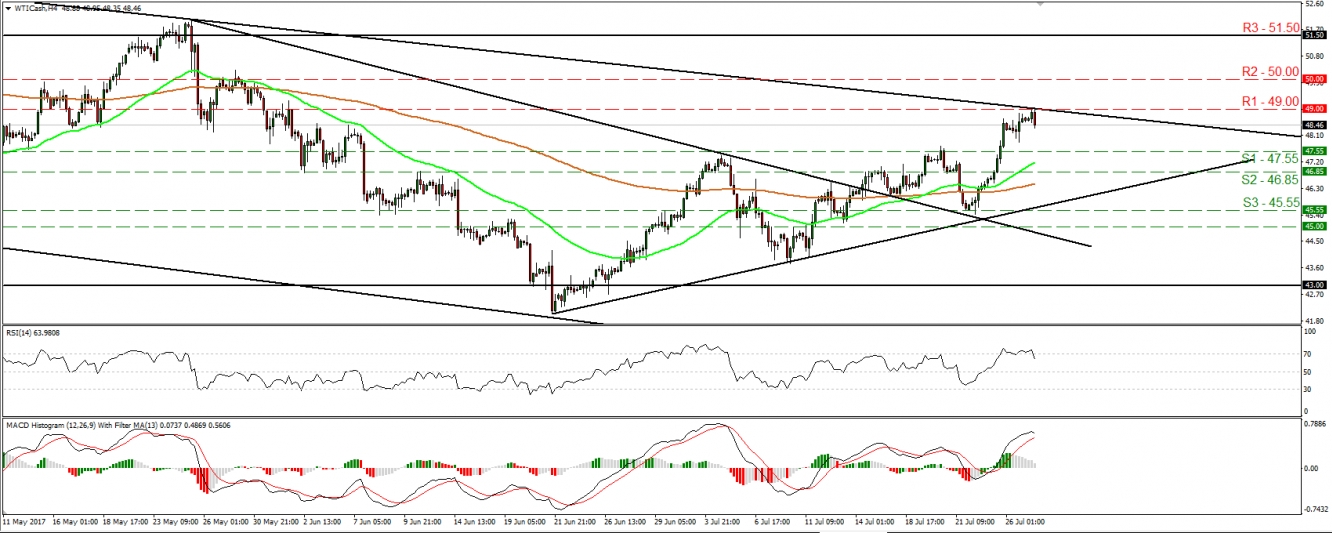

- WTI continued trading higher in the aftermath of Saudi’s and Nigeria’s announcements. Nevertheless, today the precious liquid hit resistance at the crossroads of the 49.00 (R1) level and the upper bound of the medium-term downside channel that has been containing the price action since the beginning of February. Although the price is still trading above the short-term upside support line taken from the low of the 21st of June, the fact that it hit resistance at the upper bound of the channel makes us mindful that a slide may be on the cards soon.

- The possibility for a setback is also supported by our short-term momentum indicators. The RSI just exited its above-70 territory and is pointing down, while the MACD, although above both its zero and trigger lines, shows signs of topping. A decisive close above the aforementioned crossroads is needed to make us confident oil is likely to continue higher in the next days.

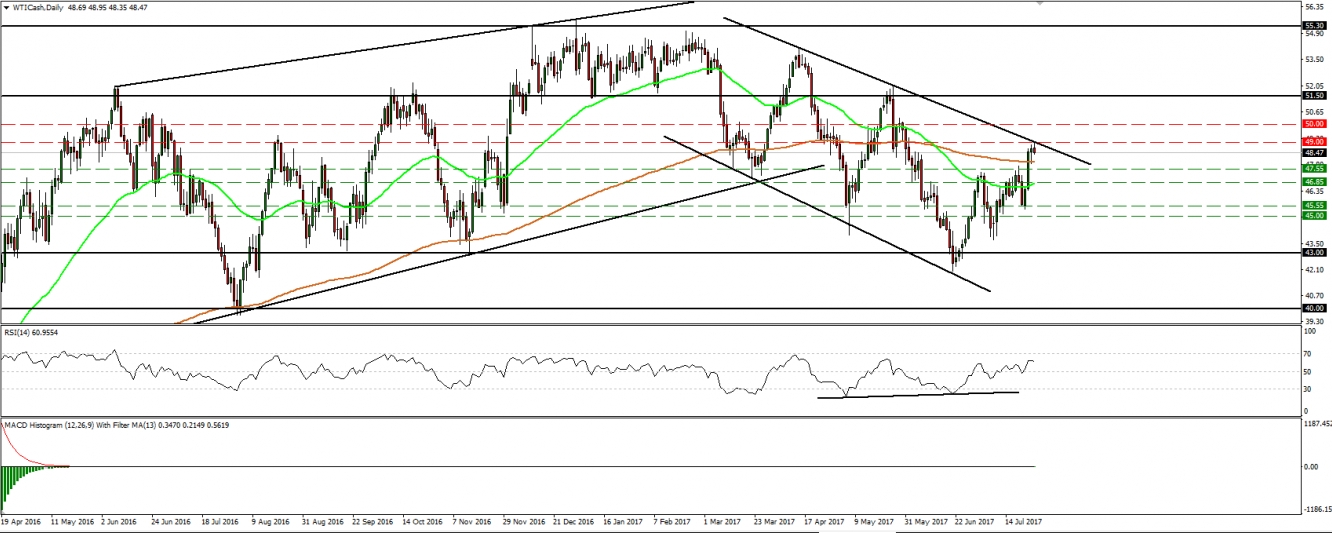

- Switching to the daily chart, given that WTI remains within the channel that has been containing the price action since February, we maintain our view that the longer-term path is cautiously negative and that the latest recovery is just a corrective phase.

- Even if the bulls manage to overcome the upper bound of the channel, we are hesitant to call for a reversal and a newborn long-term uptrend. We expect any further gains to remain capped by the 51.00-55.00 range, where we believe US shale producers may be attracted to increase production.