Selling covered calls and cash-secured puts are the main strategies highlighted in our BCI community. Much of the information disseminated on the Blue Collar site, books and DVDs is based on member feedback, inquiries and comments. In September 2017, Marc sent me an email question about selling naked (without owning the underlying security before selling the option) out-of-the-money call options against shares with poor fundamentals and technicals. The rationale behind such a strategy is that cash would be generated from the option sale and share price would most likely not appreciate due to the lack of bullish fundamentals or technicals. Options would therefore expire worthless resulting in a near risk-free profit. I decided to publish Marc’s entire email inquiry and my subsequent responses because I feel this is such an important topic for our members to fully understand before deciding on which strategies are most appropriate for our families.

Marc’s email to Alan

At last yesterday I managed to open my first covered call positions, thanks to your detailed explanations given in your books and videos and your latest weekly stock report. Now I just sit, wait and read your book about exit strategies

Some question arose from thinking over after looking into another book from (author name deleted) about writing naked calls (book title deleted).

Briefly: the writer of the named book advertises for selling uncovered deep OTM calls in their book.

My question in this context:

Wouldn’t it be ok to write a deep OTM naked call on an underlying which has very bad fundamentals and technicals and set a stop buy order (let’s say at a level where the call rises to 100% or 200%) for the underlying just in case it is climbing suddenly?

Some kind of “late covering call writing” this would mean.

If it’s really true that 80% of all options expire worthless then this should be a very easy way of making money via the statistics:

starting with setting stop buy orders on different “bad” stocks, then writing lots of different deep OTM calls on these stocks, and simply wait.

If a stop buy is be executed and then trigger buying back the call (generating a loss on this call) and track/analyze the underlying to look what happened.

The advantage would be that the needed capital would be much less because you do not need to own the stock in most cases.

I am aware that you have to forget about any dividends in this case but maybe it is worth it.

You just would have to do the opposite in a screening process as you do: selecting stocks with poor fundamentals and technicals which even might be easier I could guess.

Something I must have got wrong because this would be actually too easy and “too good to be true”…

So please tell me: where is the hook in this probably quite bad idea?

Thanks for your great help and support.

Marc

Alan’s response to Marc

Hi Marc,

I never comment on other authors or their books, but I can make some general comments which you should find useful. Let me start with this: If any strategy appears too good to be true, it generally is.

General information:

- Deeper OTM calls generate very little time value premium unless the underlying stock is highly volatile (risky)

- Why would anyone buy that option? They believe it will end up in-the-money. Who’s right?

- Stops at 100%/200% means losing double or triple our investments. It’s all about percentiles.

- It is not true that 80% of options expire worthless. About 1/3 of options expire worthless, 10% are exercised and the rest are closed prior to expiration.

- Naked options are risky. Share price can gap-up and stop losses can be by-passed. Technically, risk is unlimited.

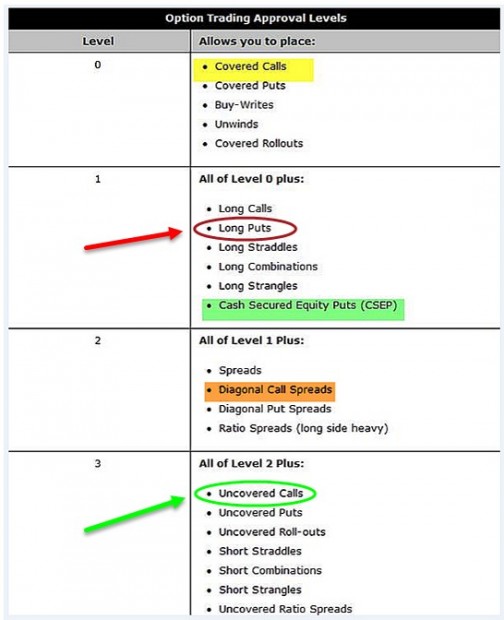

- If bearish on a stock, puts can be purchased where risk is limited to the cost of the put. Put value will rise if we are directionally correct on share value decline. The chart below shows that buying puts requires a lower level of trading approval than does selling naked calls.

- Naked options require a higher level of broker approval. This is because it is not appropriate for most retail investors (see screenshot below).

- We can use covered call writing in our self-directed IRA accounts. We cannot use naked option selling in these accounts because of the implied risk.

- Dividends should not be a major factor when selling options.

- Markets tend to move up in value. Taking bullish positions is riding our bicycle downhill. Bearish positions are like riding uphill. There are exceptions.

- There is no one strategy that is right for every investor and naked option selling is appropriate for some sophisticated investors with high risk-tolerance. For most retail investors, naked option selling is too risky and include me in that latter pool.

Levels of trading approval

I may use your question and my responses in a future blog article as I view it as a very important topic.

Best regards,

Discussion

Selling naked call options is a high-risk strategy which may be appropriate for some sophisticated investors with high-risk tolerance. It is not appropriate for most retail investors and that comment is reflected in the higher level of trading approval (compared to more conservative option strategies) required by most brokerages.

Market tone

This week’s economic news of importance:

- Producer price index March 0.3% (0.1% expected)

- Wholesale inventories February 1.0% (0.9% last)

- Consumer price index March (-) 0.1% (expected)

- Federal budget March (-)209 billion ((-)176 billion last)

- Weekly jobless claims 4/7 233,000 (230,000 expected)

- Job openings February 6.1 million (6.2 million last)

- Consumer sentiment index April 97.8 (101.0 expected)

THE WEEK AHEAD

Mon April 16th

- Retail sales March

- Homebuilders’ index April

- Business inventories Feb

Tue April 17th

- Housing starts March

- Building permits March

- Industrial production March

Wed April 18th

- Beige book

Thu April 19th

- Weekly jobless claims through 4/14

- Leading economic indicators March

Fri April 20th

- None scheduled

For the week, the S&P 500 moved up by 1.99% for a year-to-date return of (-) 0.65%%

Summary

IBD: Market in confirmed uptrend

GMI: 2/6- Sell signal since market close of March 23, 2018

BCI: Selling 2 in-the-money strikes for every 1 out-of-the-money strike for all new positions. Currently fully invested and slowly re-adjusting portfolio positions to more bullish positions. Global and US economies are a positive while political events are concerning. The Friday evening bombing in Syria was anticipated.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a bearish sentiment. In the past six months, the S&P 500 was up 2% while the VIX (17.41) moved up by 78%. The VIX has calmed a bit from the prior week..

Wishing you much success,