As a futures and options broker, I rarely mention individual stocks, but the current environment demands it, which in itself has me raising an eyebrow. We must wonder if this type of manic euphoria over a single stock (that few can articulate what products they provide) is sustainable.

We saw something similar in the fall of 2021. Tesla (NASDAQ:TSLA) stock’s cult-like buyers generated a parabolic rally, taking the indices for a ride. Tesla has never regained those highs, and the Nasdaq 100 has just recently managed to do so.

So, what about the current situation? As is always the case, corporate earnings are released before or after the bell. I’d ask why this is the case, but I know the answer – It has always been that way, and tradition is difficult to alter even if it is logical to do so. Humans are creatures of habit, and change is generally unwelcome.

Nevertheless, announcing game-changing data for each reportable company while trading on domestic stock exchanges are, for all intents and purposes, closed is undesirable at best. At worst, the practice of hitting a thinly traded market with substantial news is a recipe for disaster.

In addition to the Nvidia (NASDAQ:NVDA) earnings news being released into a low-liquidity environment after the mainstream media, finance bloggers, and FinTwit accounts pumped it up, the earnings report came on the heels of a market sell-off that invited the bears to pile into short positions and encouraged some complacency.

Questionable liquidity and limited access to Nvidia shares in aftermarket trading triggered massive volatility and, eventually, buying in Nasdaq 100 futures. As mentioned, the Nasdaq 100 and Nvidia have become highly correlated, so it makes sense for those seeking an open and liquid marketplace to either offset or take risk to use Nasdaq 100 futures.

Although stock index futures are reasonably liquid for their entire 23-hour trading session, they are less liquid in the last hour of trading (when earnings are typically released) and in overnight trading. Thus, the influx of market activity profoundly impacted price (arguably more than would have been the case were earnings reports released during the traditional day session).

This seems to have triggered a gamma squeeze in which market makers who had sold calls to retail traders, or even those selling calls to collect what previously seemed like attractive premiums, were forced to buy futures to hedge their option risk. You might recognize this phenomenon. It was one of the primary driving forces of the meme stock rallies a few years ago.

Nvidia is not a meme stock, but it is acting like one and taking the rest of the market for a joy ride. Excessive call option buying is indicative of speculators running amok. We’ve all seen how this ends, but unfortunately, we can’t see when or where it ends until it does.

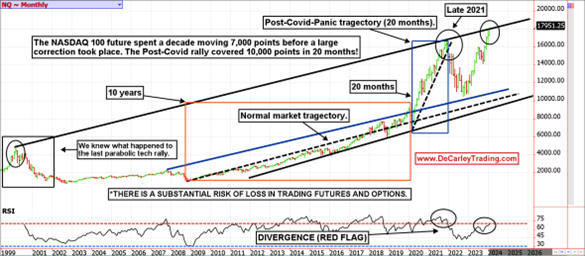

For now, the Nasdaq 100 chart suggests the rally is overheated based on standard technical oscillators regardless of the daily, monthly, or weekly time frame. Further, the RSI (Relative Strength Index) is diverging from the markets (as the Nasdaq 100 makes new highs, the RSI is not following).

This doesn’t guarantee prices experience some mean reversion selling, but the odds strongly favor such. We have shared this chart multiple times in recent weeks, but we don’t mind sharing it again.