After dramatically dropping 34% from its historical high of 151.85 from mid-2016 to a low of 99.98 in May of this year, the Dow Jones US Retail REITs Index has been stuck in a sideways trading range and is attempting to maintain a stable position above a long-term 40% Fib retracement level of 102.42, as shown on the following Monthly, Weekly and Daily charts.

Longer term, the Monthly momentum and rate of change technical indicators are hinting of further weakness.

In the medium term, the Weekly momentum and rate of change technical indicators are hinting of potential strength.

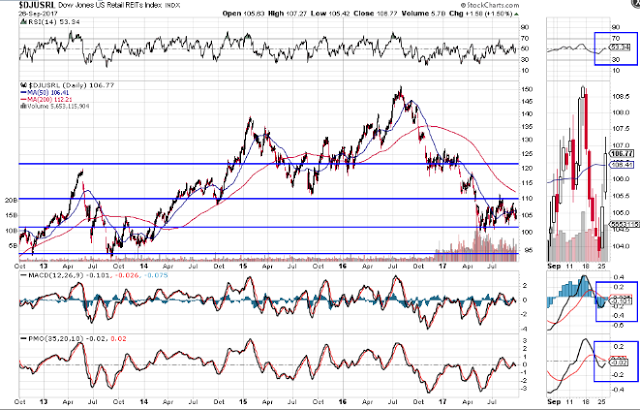

In the short term, the Daily RSI, MACD and PMO indicators are hinting of a possible new "BUY" signal forming...watch for the RSI to remain above 50, and for bullish crossovers to form on the MACD and PMO.

We'll see whether price, ultimately, breaks and holds above 110 to retest 121.31 (23% Fib retracement), or higher, or whether it breaks and holds below 102.42 to retest 94.00 (long-term major price support), or lower. Either way, watch for higher volumes on the upside or on the downside, to confirm direction in the coming days/weeks of Q4 of 2017.