Priceline.com Incorporated (NASDAQ:PCLN) Consumer Discretionary - Internet & Catalog Retail | Reports August 4, Before Market Opens

Key Takeaways

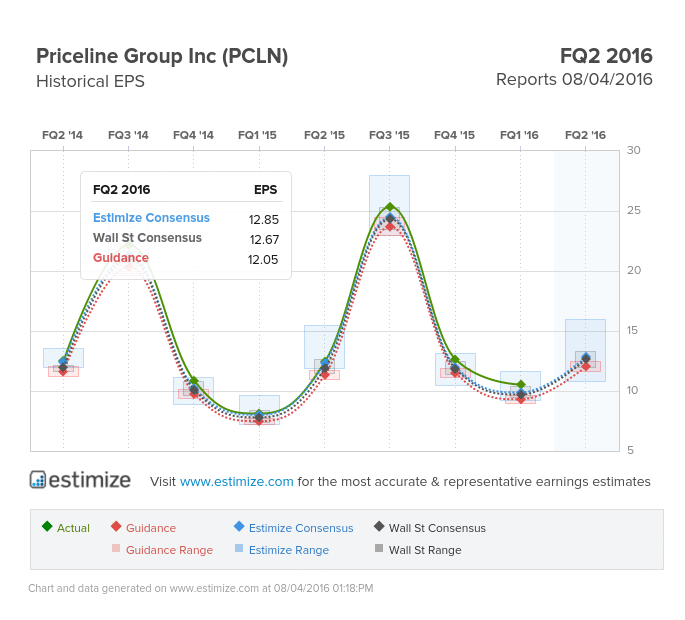

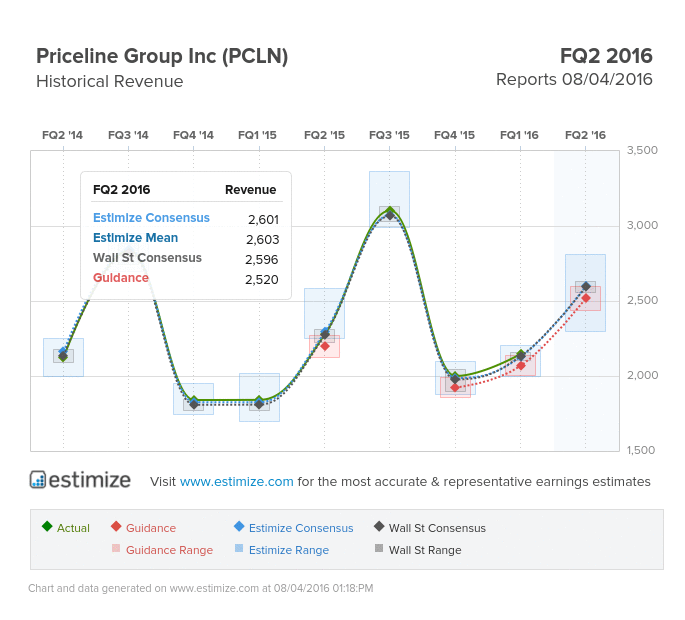

- The Estimize consensus is looking for earnings per share of $12.85 on $2.60 billion in revenue, 18 cents higher than Wall Street on the bottom line and right in line on the top

- Priceline has the largest exposure to Europe amongst its peers. Any indications of Brexit or currency headwinds could send the stock plummeting

- Long term, Priceline’s investment in Ctrip provides it access to the hot travel market in China

Priceline is scheduled to report second quarter earnings tomorrow, after the market closes. The online travel operator isn’t a name that frequently beats or misses its expectations. This quarter might be different though, given its exposure to Europe.

Between Brexit and the recent terror attacks, travel to Europe has started to slip. Expedia cited waning demand in the region as a key factor of its undesirable results. These sentiments will likely be echoed in Priceline’s conference call tomorrow.

The Estimize consensus is looking for earnings per share of $12.85 on $2.60 billion in revenue, 18 cents higher than Wall Street on the bottom line and right in line on the top. Compared to a year earlier, this represents a 4% increase in earnings coupled with 14% sales growth. That said, profit estimates have been cut by 6% in the last 3 months in light of Brexit and currency concerns.

In recent months, Priceline has been in the hot seat. The initial sign came during the company’s first quarter earnings call when management issued weak guidance, cautioning investors of difficulties ahead. However, the bigger concern came in late June when the UK voted to leave the European Union, which sent major currencies plunging. Priceline currently generates more than two thirds of its revenue from Europe, so this could be a major blow for earnings in the near future.

Another emerging trend is the alternative accommodations segment, popularly referred to as the sharing economy. Both Priceline and Expedia (NASDAQ:EXPE) have been bolstering their presence in this sector to compete with Airbnb. There is still room to grow here, but if Airbnb gets any bigger it could spell trouble.

Long term, Priceline still has considerable upside. The company’s investment in Chinese travel company Ctrip and the handful of acquisitions made in recent years will be an important source of revenue moving forward. Investors will likely need to withstand a few down quarters before reaching potentially better results in the future.

Do you think PCLN can beat estimates?