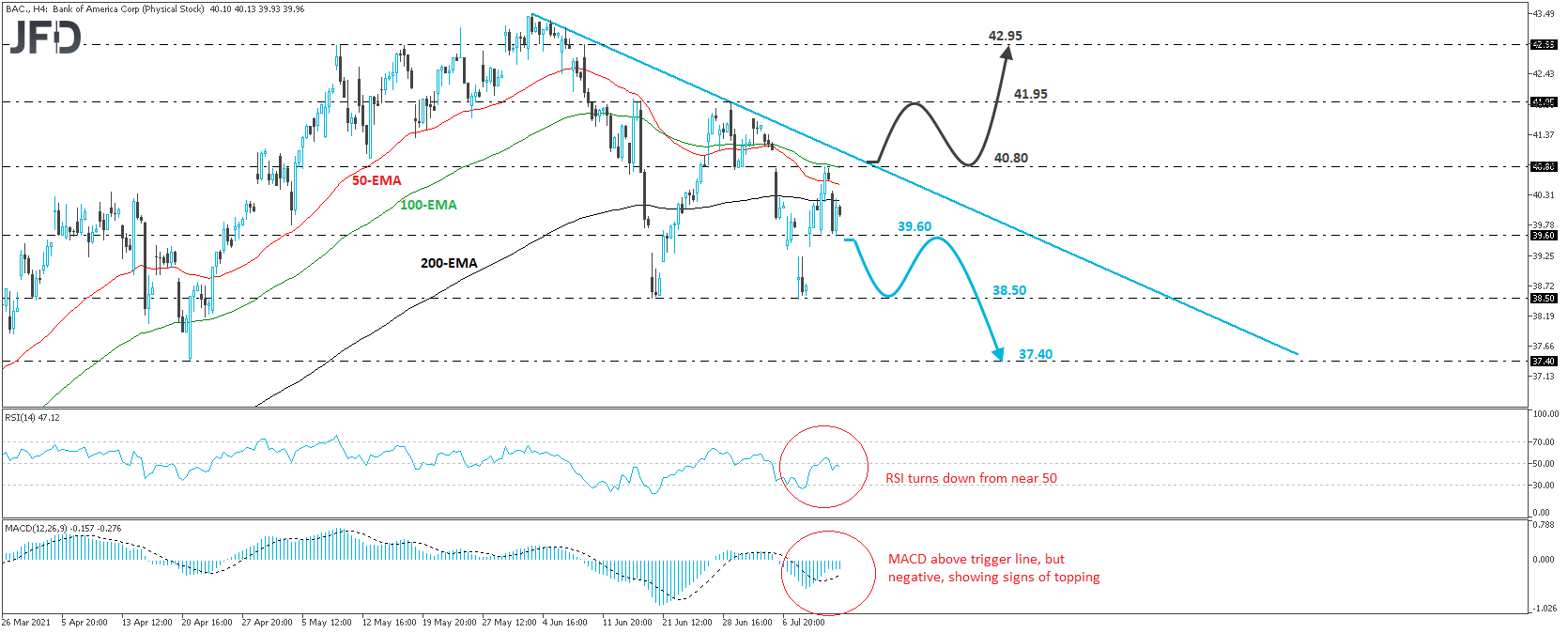

Bank of America (NYSE:BAC) traded lower on Tuesday, after hitting resistance at 40.80 on Monday. Overall, the stock continues to trade below the downside resistance line drawn from the high of June 3, but it has been struggling to fall below 38.50, a territory that attracted some buying interest on June 18 and July 8. That’s why we will adopt a cautious stance for now.

At the time of writing, the bank announced its earnings results with earnings per share (EPS) higher than the consensus, but also with revenue missing its own estimate. In our view, even it this allows some buying after the opening bell, the recovery may still stay limited near the 40.80 territory, or the aforementioned downside line. Another round of selling may be possible from there, with a break below yesterday’s low of 39.60 having the potential to open the path for another test near the key 38.50 barrier. If that barrier is not able to halt the slide this time around, its break may pave the way towards the low of Apr. 21 at 37.40.

Taking a look at our short-term oscillators, we see that the RSI ticked down from near its 50 line, while the MACD, although above its trigger line, shows signs of topping within its negative territory. Both indicators suggest that the stock may start gathering negative speed sometime soon, which supports somewhat the idea of seeing further declines in the short run.

In order to start examining whether investors have become more interested in this stock, we prefer to wait for a break above 40.80. This may also signal a break above the aforementioned downside line and perhaps allow advances towards the 41.95 zone, which provided resistance on June 16, 17 and 29. If that area is not able to halt the advance, the next level to consider as a potential resistance may be the high of June 10, at around 42.95.