Utilities ran away with first place yesterday rising over 1% despite the S&P being slightly lower. Is the recent bout of strong demand for longer-term Treasury auctions and flight to utilities a message from Mr. Market? The dynamic bears watching closely, given the poor breadth, extreme valuations, and the degree to which markets are extended from moving averages,

Markets are opening weak this morning despite Fed member Raphael Bostic’s dovish comments about tapering. While he thinks taper is in the works, like Powell, he wants the Fed to delay taking action to ensure the recovery remains robust. Dallas Fed President, on the other hand, is not as patient and ready to taper ASAP.

What To Watch Today

Economy

- 8:30 a.m. ET: Initial jobless claims, week ended Sept. 4 (335,000 expected, 340,000 during prior week)

- 8:30 a.m. ET: Continuing claims, week ended Aug. 28 (2.730 million during prior week)

Earnings

Post-market

- Zscaler (NASDAQ:ZS) is expected to report adjusted earnings of 9 cents on revenue of $186.885 million

Market Internals Continue To Weaken

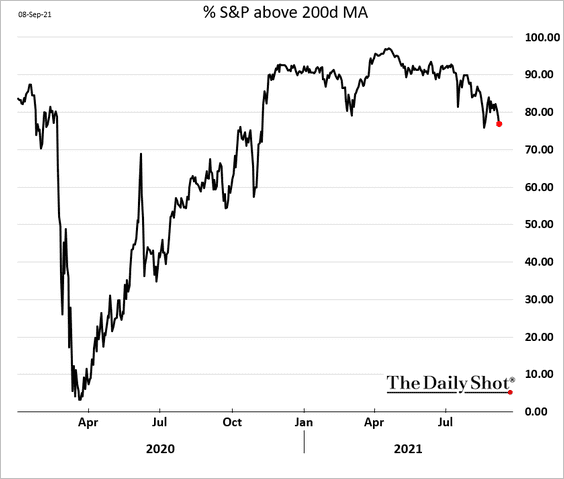

While the market remains near all-time highs, market internals continue to weaken. The chart shows the number of stocks above their respective 200-dma.

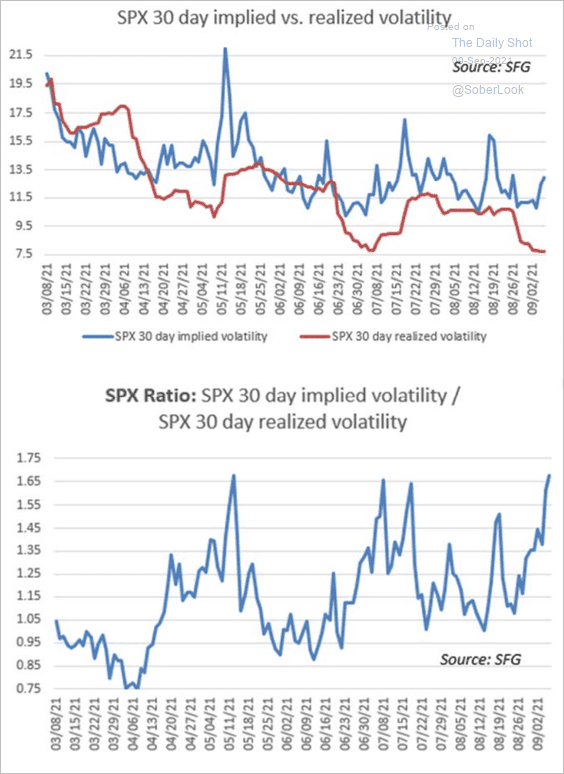

Currently, the extremely low volatility, and outsized year-to-date returns, continue to mask the narrowing breadth of the market. The S&P 500 realized and implied volatility measures continue to diverge suggesting not all is as well as it seems.

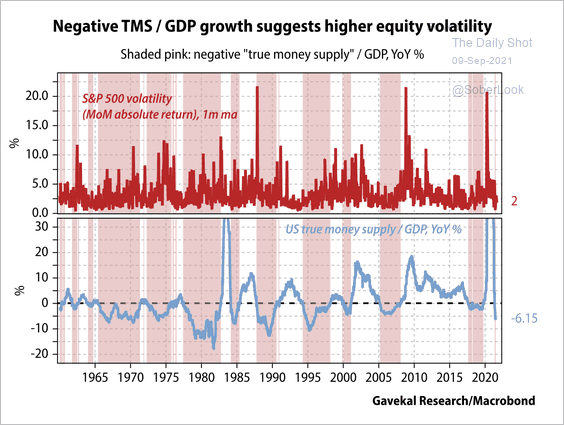

With the amount of liquidity in the system declining, there is a rising probability of a pickup in volatility. As discussed previously in “low volatility begets higher volatility.”

Strong Auction

The Treasury Department’s 10-year auction was met with strong demand for the second month in a row. The recent backup in yields seems to be motivating bond buyers. Today’s auction has a bid to cover ratio of 2.59, meaning there are 2.59 bids for every bond offered. That is the second-highest bid to cover in over a year. The highest was last month’s auction. 30-year bonds will be auctioned on Thursday.

Jobs Jobs Jobs!

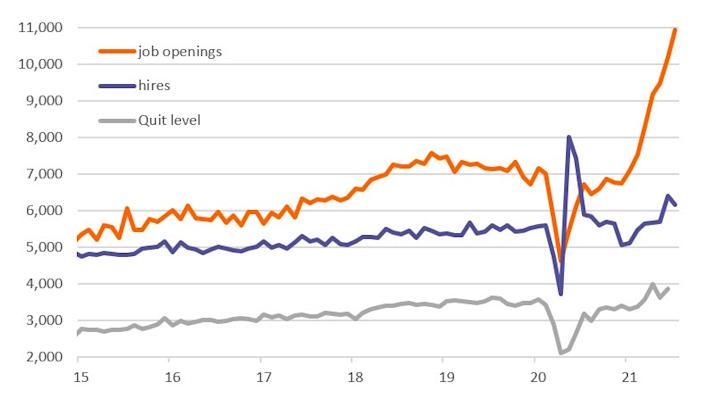

The BLS JOLTs report shows the number of job openings surged from 10.2 million to 10.9 million, blowing away estimates of 10 million. There are over 2 million more job openings than the 8+ million the BLS says are unemployed. The data is for July when over 7 million were still receiving unemployment claims. It is widely expected the number of openings will fall in the coming months as the pandemic-related jobless benefits expired last week.

“The JOLTS data also has implications for soaring prices — expect things to get worse before they get better, because employers feel compelled to continue hiking pay. Pointing to a “quit rate” that shows employees leaving their old jobs in favor of new ones at an all-time high, ING said companies “no longer think purely about having to raise pay to attract staff but also need to consider raising pay for staff retention purposes.”

Such suggests that a tapering of the Fed’s balance sheet by the end of the remains probable.

Rule #5

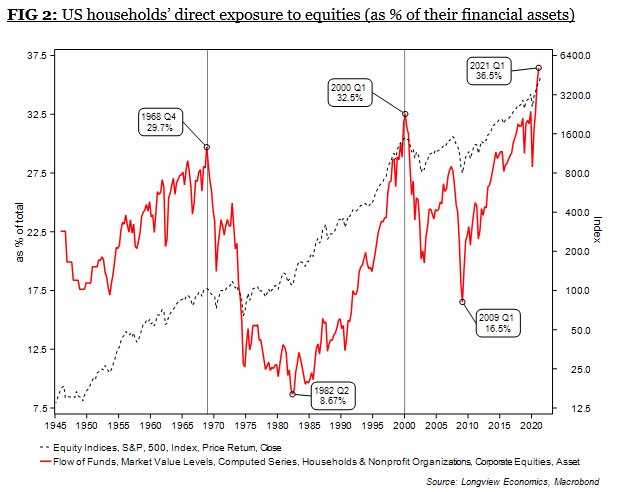

Bob Farrell’s rule #5 states: “The public buys the most at the top and least at the bottom.” The graph below from Longview Economics speaks volumes for where the equity markets are in the investment cycle based on Bob’s logic.

The Problem With El Salvador’s Bitcoin

Goldman Joins Morgan Stanley and the Atlanta Fed

Last week we noted that Morgan Stanley and the Atlanta Fed sharply reduced their estimates for Q3 GDP. Goldman Sachs is now joining them. Per Goldman: “.. we have long highlighted that the fiscal impulse will fade sharply .. it might take a while for spending to recover in still-depressed categories .. we have lowered our forecast for 2021Q4 consumption growth by 2.5pp to 3.5% … We now expect GDP growth of 3.5% in Q3″

In mid-August Goldman Sachs (NYSE:GS) was expecting Q3 GDP growth of over 8%! The effects of 7+million losing unemployment benefits and the removal of the moratorium on evictions have yet to be felt. Both actions will likely further complicate forecasting going forward and weigh on economic growth.

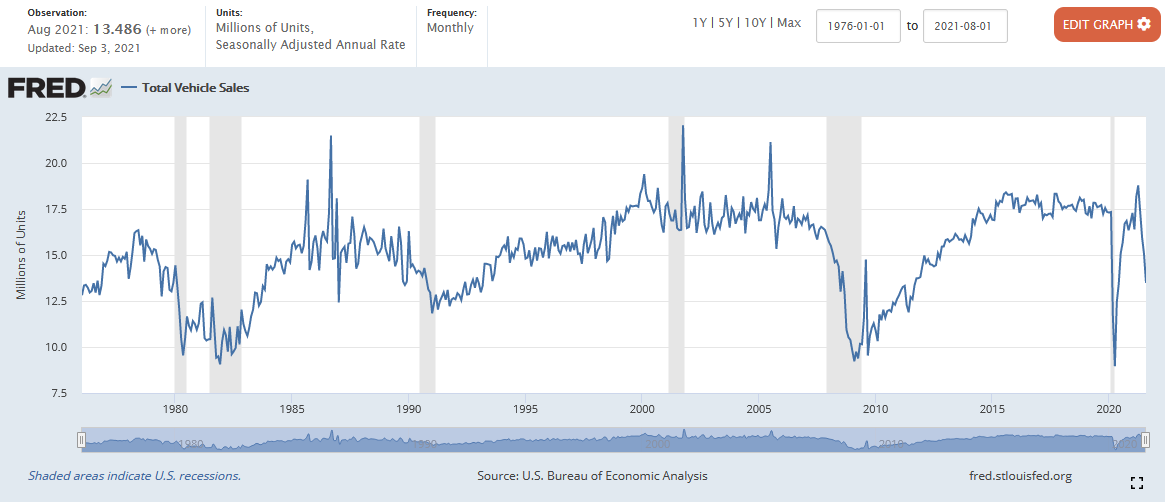

Volatile Auto Sales

The graph below shows the recent volatility in auto sales over the past year and a half. After plummeting to 40-year lows at the onset of the pandemic, auto sales roared back to 15-year highs. Since then they have fallen nearly 30%, sitting at levels consistent with previous recessions. There are a few factors wreaking havoc on this data including pent-up demand, massive fiscal stimulus, and car/truck shortages. It is being said chip shortages for auto could last well into 2022 and possibly 2023. Given the shocks to demand and supply of autos, we caution not to read too much into this chart. That said, the industry is important as it accounts for about 3-3.5% of GDP and about 4.5% of jobs.