Excessive leverage and risk in the financial system, e.g., using customer funds to speculate, never ends well. Stock market crashes, bank and investment firm failures or economic recessions are all potential consequences. Following the failure of the United States to regulate over the counter (OTC) derivatives and the repeal of the Glass-Steagall Act, U.S. banks became the largest financial business entities in history. The U.S. real estate bubble, sub-prime lending and mortgage backed securities (MBS), along with unregulated OTC derivatives, then lead to bank insolvencies, a historic stock market crash and a near collapse of the global financial system.

Central banks and governments intervened to prevent systemic collapse but governments were saddled with enormous debts due to bank bailouts, lost tax revenues and massive social welfare costs. Rather than systemic collapse, and perhaps another Great Depression, the post crisis period came to be characterized by (1) market interventions, (2) direct government control over the economy, and (3) ongoing monetization by central banks. Longer term solutions that would have allowed a return to putatively free markets failed to emerge and government debt, particularly in Europe, became a crisis in its own right.

Measures that began as emergency interventions became routine suggesting a new economic paradigm. In the new paradigm, big banks, politicians and academics would decide what market outcomes, e.g., bankruptcies, interest rates or bond yields, would be permitted, as well as when to apply accounting rules, regulations and laws. Despite increased centralization of decision making and greatly expanded powers, however, policymakers were unable to repair the financial system. Instead, mounting government debt led to de facto financial repression.

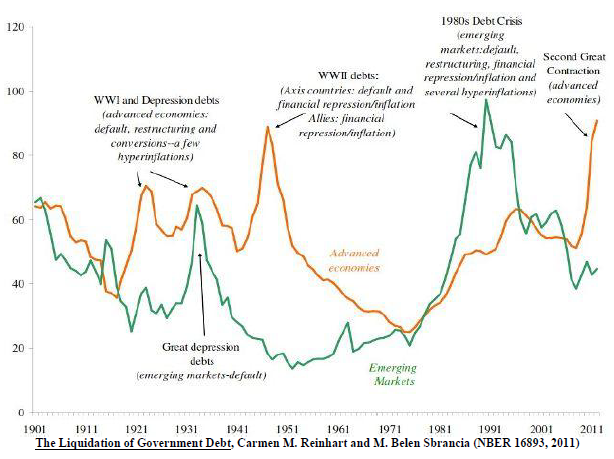

Financial repression occurs when governments channel funds into their own sovereign bonds in order to reduce debt levels through mechanisms such as directed lending, caps on interest rates, capital controls, debt monetization, or by other means. Economist Carmen M. Reinhart, et al., brought the term back into popular usage in 2011 after a long hiatus. Past examples of financial repression include several South American countries, such as Argentina. The promise of financial repression is that it will hold down government borrowing costs and reduce government debt levels, but critics argue that financial repression merely targets the producers of society, i.e., the middle class, and therefore harms the economy.

Debt monetization, which can be a tool of financial repression, destroys savings while a zero percent interest rate policy (ZIRP), which reduces government borrowing costs, deprives savers and pensioners of interest income and can lead to inflation. What is more important, however, is that financial repression prevents capital formation. Of particular concern in the U.S. is the link between capital formation and new business creation, which is primarily a middle class phenomenon. The vast majority of corporations in the U.S. are small businesses and they account for the majority of jobs. By preventing capital formation, financial repression short circuits the engine of new business creation, increases unemployment and threatens to bring down the middle class.

Governments cannot supply entrepreneurship or innovation in the marketplace, nor can they effectively replace savings (genuine capital derived from surplus production) or private investment with bank credit or with public funds, which represent debt and a transfer of wealth, respectively. The deployed capital, inventions, products and services of new businesses drive innovation, fuel competition, provide jobs and increase the wealth of society. In contrast, financial repression can only produce economic stagnation and result in a net loss of wealth to society.

Crisis and Consequence

Substantially as a consequence of the financial crisis and global recession, Europe was engulfed in a sovereign debt crisis characterized in the European periphery by austerity measures and Great Depression levels of unemployment. In the U.S., the real estate collapse and stock market crash represented a direct loss of household wealth while bank bailouts represented a transfer of wealth from proverbial Main Street to literal Wall Street. Deficit spending, debt monetization and the Federal Reserve’s purchases of MBS and U.S. Treasury bonds expressed a radically inflationary monetary policy and, although much of the money is idle in the banking system, the overall increase in the supply of U.S. dollars is concerning.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why Financial Repression Will Fail

Published 11/15/2012, 02:21 AM

Updated 07/09/2023, 06:31 AM

Why Financial Repression Will Fail

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.