- Baidu remains behind on mobile monetisation

- Baidu Connect service expected to boost mobile revenues

- Content costs an issue for online video

Chinese search giant Baidu Inc. (NASDAQ:BIDU) is set to release its fiscal fourth quarter results tonight after the close of the US markets. Along with Alibaba, Baidu is a closely followed firm because its dominant market position will likely give a good indication of what investors can expect from the rest of China’s tech firms during this earnings season. Ahead of the release, here are the four key points that investors should focus on.

Mobile traffic and revenue growth

The third quarter saw mobile traffic exceed PC traffic for the first time in the firm’s history, although this was aided by management's classification of traffic from tablet devices being classed as mobile as of the third quarter.

However, mobile only contributed 36% to total revenues, as the firm is still in the process of effectively monetising its mobile user base. The cause of this is the difference in search behaviour between PC and mobile users, and Baidu is learning that PC monetisation methods don’t necessarily work on mobile.

Along with the Baidu Connect service that I will discuss later, 2015 should be the year when mobile revenues exceed PC revenues, and it will be interesting to see how Baidu intends to do this.

As the firm’s mobile ecosystem grows, its focus on big data analysis should see mobile advertising become a lot more targeted, which will boost advertising revenues and the advertising conversion rate.

Baidu Connect

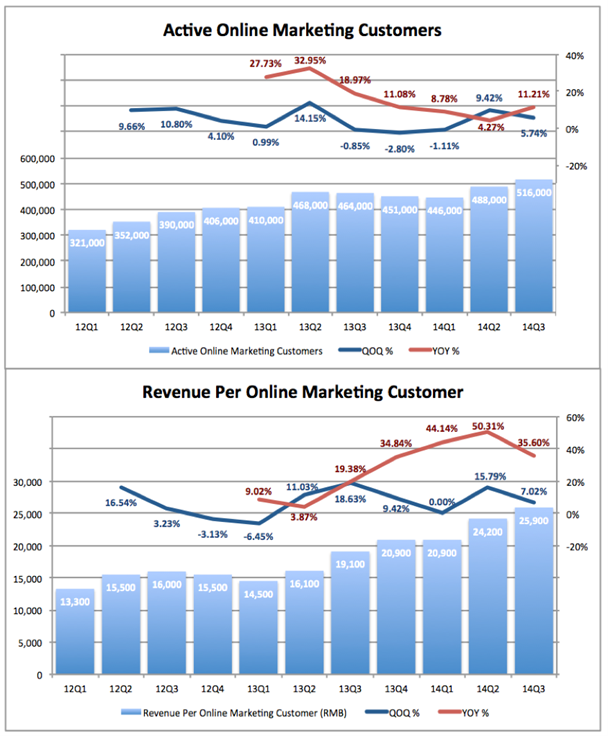

Baidu has been unable to maintain steady growth for its active online marketing customer figures and revenue per online marketing customer. One of the main reasons for this is that as Baidu focuses more of its resources towards mobile, merchants were becoming more disappointed with the conversion of online traffic into offline sales, because the traditional advertising model is more suitable for PC.

This has caused merchants to bid less for advertisements on mobile, and hence mobile search revenue growth is stunted. This is why PC search revenues were higher than mobile search revenues in the third quarter, despite mobile traffic exceeding PC search traffic for the first time in the company’s history.

Source: Baidu Investor Relations

In the third quarter, Baidu announced a new O2O advertising strategy that works in parallel to the traditional keyword and ad-bidding service. Baidu Connect is intended to boost online traffic into offline sales for mobile search, as firms can build their own mobile app-style page within Baidu.

So taking the example of the large restaurant chain Haidi Lao (海底捞) below, users who search for the @海底捞 handle in Baidu will be taken directly to the restaurant’s Baidu Connect page, where users can view the menu, make reservations and find the nearest location.

More importantly for merchants, if a user searches for a broader topic, such as "restaurant", Baidu Connect pages will appear at the top of the search results based on the merchant’s location relative to the user.

This is much more effective on mobile than on PC, because PC users are more willing to view several pages of search results, whereas mobile users tend not to. Therefore it can be expected that mobile search revenues will see a significant increase in 2015 as Baidu Connect becomes more popular among merchants.

Baidu Connect should be key to the firm maintaining strong growth in advertising revenues as the firm focuses more on mobile. It was released at the start of September, and by the end of October, it already had 400,000 merchants signed up. I expect that the fourth quarter will have seen a notable increase in advertising revenues due to Baidu Connect.

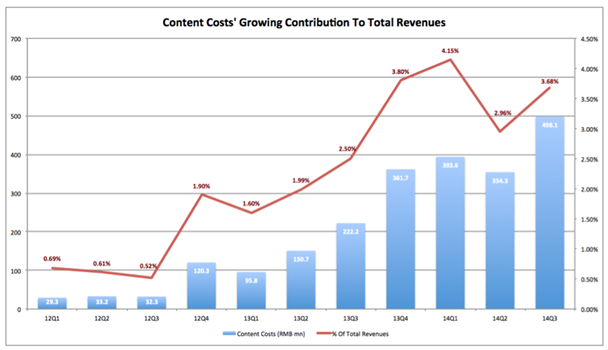

Content costs continue to rise

Content costs are a growing concern for the online video industry in China, as intense competition and government restrictions on foreign content has seen the price of TV shows and films grow exponentially.

When considered as one, Baidu’s iQiyi and PPStream platforms are the market leaders in China’s online video industry, closely followed by the Alibaba backed Youku Tudou, and in order to maintain this position Baidu has to keep investing in top quality content, which is becoming ever more expensive.In Sohu’s fourth quarter conference call, the excessive cost of content once again caused investors to be disappointed with its earnings. Management cited that 2015 is set to be just as intense as 2014 was in terms of competition, and was the cause of Sohu Video’s operating loss growing by 20% annually.Sohu differs from Baidu because it is smaller and can’t afford to compete financially with the BAT tech trio. However, with Alibaba and Tencent both having significant market share in online video, Baidu will continue to face the pressure of rising content costs. One of the main strategies that firms have pursued in order to mitigate these costs is to produce their own content. This is likely to become more common in the industry as the government places further restrictions on foreign (particularly American) content in order to promote Chinese shows and Chinese values. If management discusses that its video platforms are pursuing this strategy, then I expect that investors would be pleased.

Source: Baidu Investor Relations

Development of the mobile ecosystem

As I discussed last week, Baidu is rumoured to have partnered with Lenovo Group (HK:0992) for its new smartphone brand ShenQi, in a move that would likely see the smartphone be sold with Baidu’s services installed as default applications.Lenovo’s ShenQi smartphones are set to be launched at the start of April, and will see Lenovo build a new online platform, so that users can buy the phones direct from the firm. This would allow Lenovo to grow its internet business, and help to drive its "Internet of Things" products, services and apps in China.

It would present a very interesting opportunity for Baidu, which has had little success in entering the ecommerce business. With its BAT trio rivals Alibaba and Tencent both making a significant amount of revenues from their respective ecommerce platforms, Baidu has failed to capitalise on the tremendous growth in China’s ecommerce market.

If the rumoured investment with Lenovo is true, however, then it would mark another passive investment in ecommerce from Baidu, which has recent invested in the ecommerce project of real estate giant Wanda.

Because of the ecommerce element, this deal would add an extra dimension to the trend that we’ve seen in the industry, and contrast from two other deals that have recently been announced.

Qihoo has partnered with domestic smartphone manufacturer Coolpad, which will see Qihoo’s apps installed on the Dazen smartphone range as standard, whilst Alibaba’s investment in Meizu will see its YunOS mobile operating system being launched on the smartphones, as well as Alibaba’s apps being installed as default.

Whilst I wouldn’t expect either company to comment on a rumoured deal before it’s officially announced, I do expect Baidu management to discuss its mobile strategy for 2015. Rivals Alibaba and Tencent are expanding their mobile ecosystems towards financial services, with the launch of their respective credit rating systems.

Baidu is unlikely to have the user data to be able to compete, so it will need to find new ways to diversify its revenues away from search.

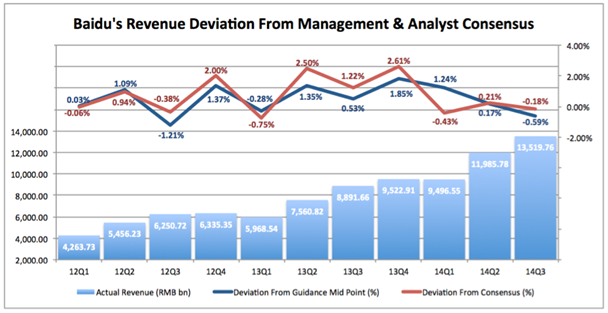

Earnings history

Baidu management’s revenue guidance for the subsequent quarter tends to be very accurate, with the reported revenue deviating slightly from the guidance midpoint. Likewise, analysts’ consensus for revenue also tends to be very accurate.

Source: Baidu Investor Relations & Yahoo Finance

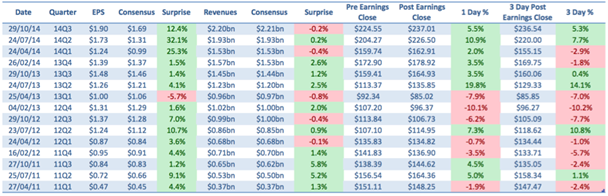

Baidu has a strong record of beating EPS consensus, with only one miss in the past 15 quarters, and has seen a positive reaction in the share price on the day after the previous six earnings releases.

The February Week Two $220 straddle, which expires on February 13, closed on Tuesday at a mid-price of $11.72 on the screen. This suggests that the market is pricing a 5.3% move from earnings, which seems in line with the share price reaction to previous earnings releases.

Source: Baidu Investor Relations & Yahoo Finance

— Edited by Michael McKenna

Neil Flynn is portfolio manager at Alcuin Asset Management. Follow Neil or post your comment below to engage with Saxo Bank's social trading platform.