The immediate answer involves the ECB which steers market rates by setting policy rates or by buying assets on financial markets. But the determination of interest rates is not arbitrary: it depends on inflation dynamics and the equilibrium interest rate, which is consistent with stable inflation.

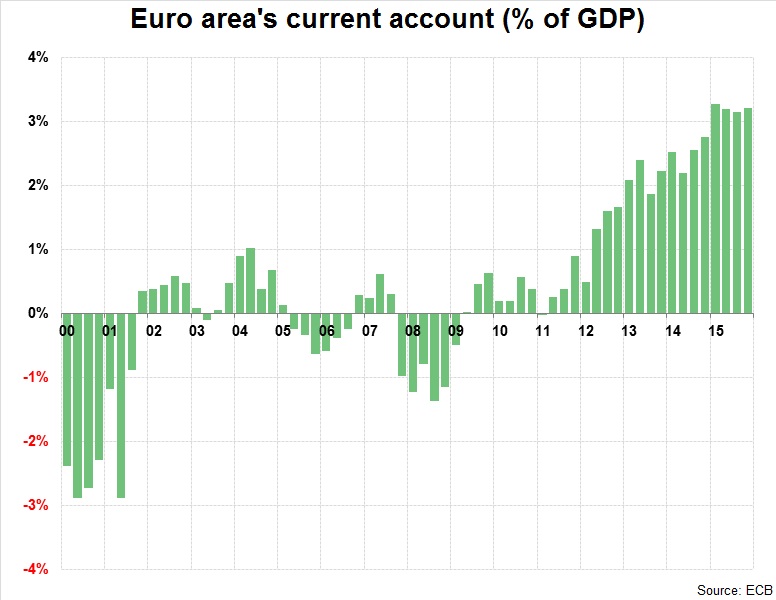

When inflation is too low (high), the central bank steers market rates below (above) the equilibrium level which is ultimately the main determinant of the level of interest rates. The latter is defined by the real return generated by the balance of saving and investment in the economy. The Eurozone is currently characterised by excess savings, as illustrated by its current account surplus of more than 3% of GDP. This situation results from structural factors such as ageing populations, cuts in public investments or poor productivity gains that are out of a central bank’s reach.

by Thibault MERCIER