Although our market timing system remains in “sell” mode, and our near to intermediate-term focus remains on the short side of the market, it’s never a bad idea to keep an eye on ETFs and stocks that are exhibiting relative strength to the broad market, as these will be the first equities to move higher when the broad market eventually finds support and bounces.

One of the very few ETFs showing relative strength since the two-month selloff in the US broad market began is iShares Xinhua China 25 Index Fund ETF (FXI). Although the main stock market indexes of the USA have been in a downtrend since mid-September, FXI actually started trending higher just as the domestic markets started selling off. But despite its relative strength, FXI began correcting last week, and is now in pullback mode.

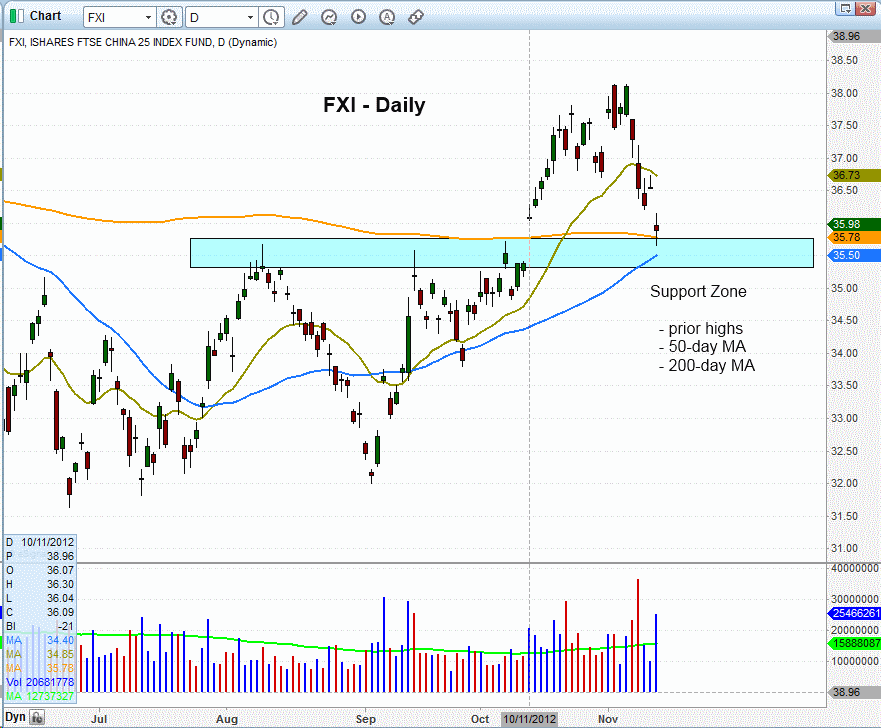

However, this is still an ETF to consider buying if the stock market suddenly surprises us with a confirmed buy signal. Looking at the daily chart of FXI below, notice that FXI pulled back yesterday to close right at support of its 200-day moving average, following an extended run up from its October breakout. Support of the 200-day MA also coincides with new horizontal price support form the prior highs:

At the present time, we are NOT looking to buy FXI because the domestic broad market has yet to put in a convincing near-term bottom. Until it does, increasing or persistent bearish momentum in the US markets is likely to hold this ETF in check. Still, FXI should be on your watchlist as one of the first ETFs to consider buying when stocks eventually find a bottom. Therefore, it has been added to our internal watchlist as a potential long candidate, just in case our rule-based market timing model happens to shift back into “neutral” or “buy” mode any time soon.

High volatility and intraday indecision, such as was exhibited in yesterday’s broad market action, can be nerve-racking and frustrating for short-term swing traders. However, there is one benefit to such price action. Since stocks formed a similar intraday pattern (morning strength followed by afternoon weakness) on November 9, we now have two failed intraday rally attempts within the past three days. The benefit of this is that it makes it easy to adjust protective stop prices on short positions because if the main stock market indexes manage to rally above their three-day highs, bullish momentum will probably move stocks substantially higher in the near-term.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

When The Stock Market Finds A Bottom, Here's The ETF To Buy

Published 11/14/2012, 06:34 AM

Updated 07/09/2023, 06:31 AM

When The Stock Market Finds A Bottom, Here's The ETF To Buy

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.