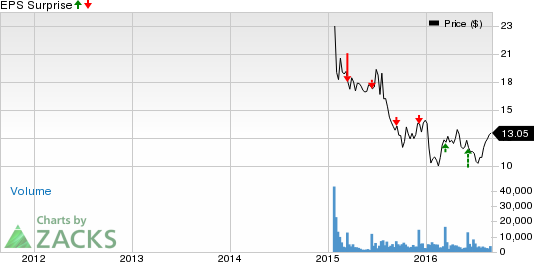

Box, Inc. (NYSE:BOX) is set to report second-quarter fiscal 2017 results on Aug 31. Last quarter, the company posted a positive earnings surprise of 20.51%.

Let’s see how things are shaping up for this announcement.

Factors at Play

Box incurred fiscal first-quarter loss of 31 cents per share. However, revenues of $90.0 million were up 37.4% year over year driven by strong growth in billings.

Also, the company reported operating loss margin of 42.8%, which narrowed from operating loss margin of 71.7% in the year-ago quarter.

The company has been continuously investing in security, compliance and administrative technology, and plans to hire more sales personnel. These investments and partnerships with leading enterprises namely Cognizant and Adobe among others will enable the company to capitalize on increasing adoption of cloud computing technologies and the need for secure collaboration.

However, continuous investments in research and development could dent margins as well as profits going ahead.

For the second quarter of fiscal 2017, the company expects to report revenues in the range of $94–$95 million and non-GAAP loss per share of 19 to 20 cents.

Earnings Whispers

Our proven model does not conclusively show that Box will beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: Both the Most Accurate estimate and the Zacks Consensus Estimate stand at a loss of 37 cents. Hence, the difference is 0.00%.

Zacks Rank: Box has a Zacks Rank #4 (Sell). We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

You could consider the following stocks with a positive Earnings ESP and a favorable Zacks Rank:

Barracuda Networks, Inc. (NYSE:CUDA) with an Earnings ESP of +66.67% and a Zacks Rank #1.

Stoneridge Inc. (NYSE:SRI) with an Earnings ESP of +5.71% and Zacks Rank #1.

Cognex Corporation (NASDAQ:CGNX) with an Earnings ESP of +2.13% and Zacks Rank #1.

BOX INC-A (BOX): Free Stock Analysis Report

STONERIDGE INC (SRI): Free Stock Analysis Report

COGNEX CORP (CGNX): Free Stock Analysis Report

BARRACUDA NTWRK (CUDA): Free Stock Analysis Report

Original post

Zacks Investment Research