AUD/USD" title="AUD/USD" height="242" width="474">

AUD/USD" title="AUD/USD" height="242" width="474">

Summary:

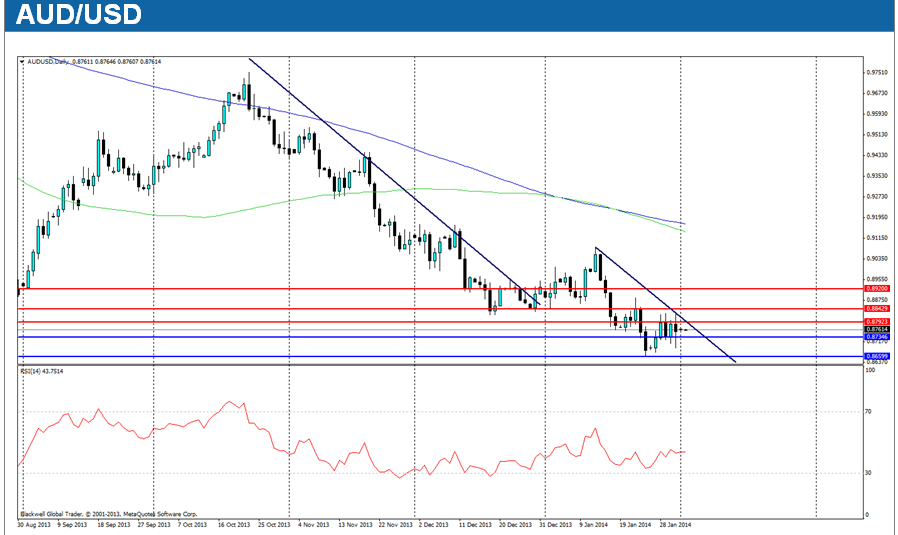

The Aussie dollar has consolidated over the past week, as markets look for further signs to help push it lower. The Reserve Bank of Australia is still trying to push the dollar lower, but for the time being, the AUD’s fall has stopped, as markets look to consolidate before the next move.

The week ahead is unlikely to see any massive movements for the AUD overall, as Thursday brings Retail Sales data and the Trade Balance for last month. However, both are forecast to be relatively downbeat, so any positive data could lead to large jumps for the pair. Despite this, current market fundamentals are still negative as a whole.

Current market technicals show the market as strongly bearish, with resistance levels found at 0.8792, 0.8842 and 0.8920. Strong resistance can be found at 0.8842, and any rise in the AUD will certainly look to bounce off this level. Support levels can be found at 0.8734 and 0.8659, with 0.8659 likely to be the most tested level as the pair looks to move lower. Overall market sentiment is bearish and it’s unlikely that we will see strong upward movement in the coming week.

EUR/USD" title="EUR/USD" height="242" width="474">

EUR/USD" title="EUR/USD" height="242" width="474">

Summary:

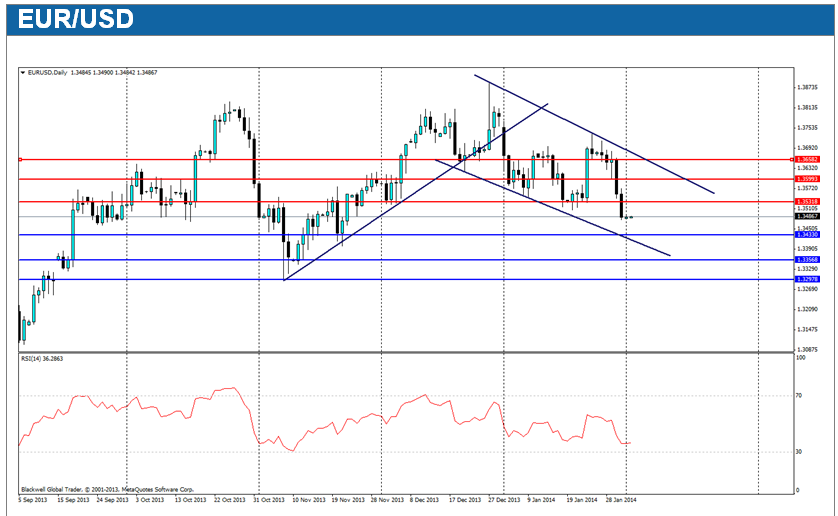

The Euro has been in a decline over the last week, as US data showed a booming economy coupled with tapering, which helped push the Euro lower. Additionally, CPI showed a slight decrease, causing some concern, as the Euro is seen as a deflation threat as of late.

Data in the Euro-zone is moderate for the week coming, as PMI data is due out on Wednesday, with German Manufacturing Orders and the ECB rate interest rate due out on Thursday. The interest rate will also give the ECB a chance to talk about monetary policy, and it’s expected they will speak on the deflation issue at hand in the Euro-zone.

Current resistance levels can be found at 1.3531, 1.3599 and 1.3658, with major resistance found at 1.3531. Support levels can be found at 1.3433, 1.3356 and 1.3297, with 1.3433 likely to be the most tested level in the coming days. Overall, with the strong USD, the Euro has been pushed into a bearish channel, and it's likely that both channel lines will act as dynamic support and resistance as the currency pair moves.

GBP/USD" title="GBP/USD" height="242" width="474">

GBP/USD" title="GBP/USD" height="242" width="474">

Summary:

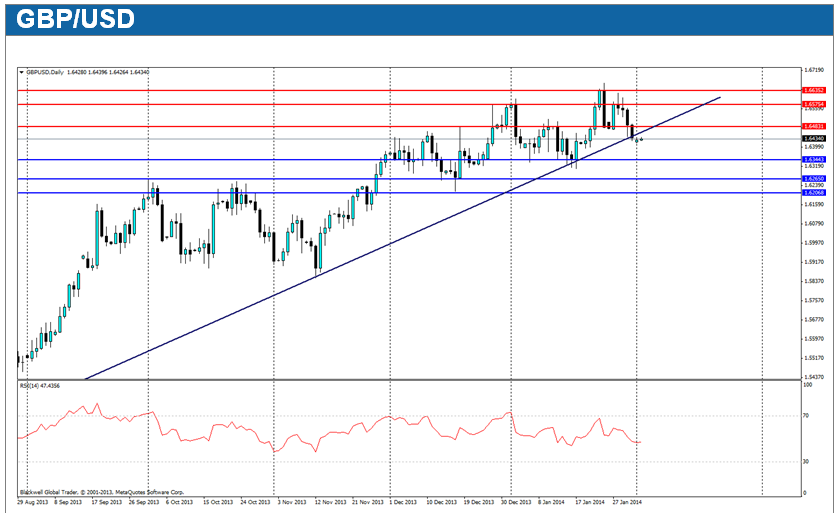

Trading in the Pound was bullish for the start of the week, before it pulled back, touching on trend lines as the US markets remained strong, after the FED announced that tapering would commence for the month of Feburary.

The markets are looking forward to Thursday and Friday, as the Interest rate decision is made, along with data on Manufacturing Production; which is expected to show expansion for the most part. Interest rates are not expected to change soas not to cause a shock for the Pound against the USD, as the governor has warned against such an event in case of Pound action during this period.

Current market technicals show that the Pound has been bouncing off its trend line over the past two weeks, and it's likely that during this coming week, we will either see new highs or a complete breakdown of the pair southwards. Current market resistance can be found at 1.6483, 1.6575 and 1.6635, with major resistance found at 1.6575. Current support levels can be found at 1.6344, 1.6265 and 1.6206, with major support at 1.6344. Sentiment remains bullish, however, in the long run there could be weakness due to the current macroeconomic climate.

NZD/USD" title="NZD/USD" height="242" width="474">

NZD/USD" title="NZD/USD" height="242" width="474">

Summary:

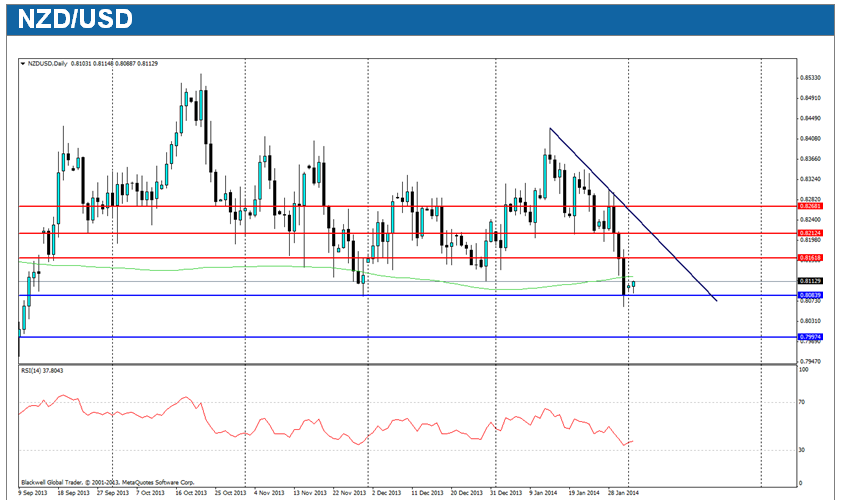

The New Zealand Dollar has been in a steep decline over the past week as pressure from the USD flows onto the currency, and as the Reserve Bank of New Zealand governor talked down the possibility of an interest rate rise until March.

Traders in the coming week willlikely look to consolidate the pair before Wednesday, when Unemployment data is due out. This is expected to show a decrease overall on the unemployment rate, but most importantly, traderswill be looking for signs that the RBNZ will be forced to act if the data is positive.

Market technicals show that resistance can be found at 0.8161, 0.8212 and 0.8268, with 0.8161 acting as the first major level of resistance. Current support levels can be found at 0.8083 and 0.7997, expect any push below 80 cents though to require significant downside pressure or bad economic data. Overall, the current trend is certainly bearish in the long run for the Kiwi, given the recent market dive.

USD/JPY" title="USD/JPY" height="242" width="474">

USD/JPY" title="USD/JPY" height="242" width="474">

Summary:

The Yen continued to claw back against the USD last week, as markets reveled in the fact that Abenomics for the most part looks to be working, as inflation lifted. Additionally the Bank of Japan has so far turned away from increasing stimulus, adding a more positive sentiment to a bullish Yen.

The week looks to be very light for the Japanese economy, with most news likely to come from the US. Nonfarm payroll and the Unemployment rate look likely to influence major movements as always for the USD/JPY pair when they are due out on Friday.

Looking at market technicals, it’s clear that there is a bearish channel formed for the pair. Current resistance levels can be found at 102.774, 103.514 and 104.274, with 103.514 acting as hard resistance. Support levels can be found at 101.804, 101.253 and 100.027, with major support found at 101.253. However, the bearish channel will act as dynamic support and resistance.

DISCLAIMER

The report provided by Blackwell Global Investments Limited ("Blackwell Global") is meant for informative reading and should not be relied upon as a substitute for extensive independent research . The information and opinions presented do not take into account any particular individual's investment objectives, financial situation, or needs, and hence does not constitute as an advice or a recommendation with respect to any investment product. All investors should seek advice from certified financial advisors based on their unique situation before making any investment decisions and should tailor the trade size and leverage of their trading to their personal risk appetite.

Blackwell Global and all of its subsidiaries and affiliates endeavour to ensure that the information provided in this communication is complete and correct but make no representation as to the accuracy or completeness of the information. Information, data and opinions may change without notice and Blackwell Global is not obliged to update on the changes. The opinions and views expressed in the report are solely those of the authors and analysts and do not necessarily represent that of Blackwell Global. It should not be construed as financial advice for a purchase or sale of any foreign currency, contracts-for-differences, precious metals or any other products offered by Blackwell Global mentioned herein. Any projections or views of the market provided by Blackwell Global may not prove to be accurate. Past performance is not necessarily an indicative of future performance. Blackwell Global will not accept liability for any losses incurred directly or indirectly made by readers and clients as a result of any person or group of persons acting on the information contained herein.

The Blackwell Global's Research team does not render investment, legal, accounting, tax, or other professional advice. If investment, legal, tax, or other expert assistance is required, the services of a competent professional should be sought. This report is prepared for the use of Blackwell Global's clients and may not be reproduced, distributed or published by any person for any purpose without the prior consent of Blackwell Global.

Summary:

The Aussie dollar has consolidated over the past week, as markets look for further signs to help push it lower. The Reserve Bank of Australia is still trying to push the dollar lower, but for the time being, the AUD’s fall has stopped, as markets look to consolidate before the next move.

The week ahead is unlikely to see any massive movements for the AUD overall, as Thursday brings Retail Sales data and the Trade Balance for last month. However, both are forecast to be relatively downbeat, so any positive data could lead to large jumps for the pair. Despite this, current market fundamentals are still negative as a whole.

Current market technicals show the market as strongly bearish, with resistance levels found at 0.8792, 0.8842 and 0.8920. Strong resistance can be found at 0.8842, and any rise in the AUD will certainly look to bounce off this level. Support levels can be found at 0.8734 and 0.8659, with 0.8659 likely to be the most tested level as the pair looks to move lower. Overall market sentiment is bearish and it’s unlikely that we will see strong upward movement in the coming week.