Range of the Week: 1.3000 – 1.3450

Over the past week, we have gradually returned to normal trading volumes, with many investors having taken time off for the Holidays. At the start of the week, in a context in which little economic news was released, the U.S. dollar (USD) dipped slightly against its major peers. Certain analysts have noted that this slide in the greenback may be related to a major volume of purchases in yuan, which helped bolster the Chinese currency as it made its strongest gains in several months against the U.S. dollar on Thursday. The effect apparently spread to other currencies, allowing the Canadian dollar (CAD) to gain strength against its U.S. counterpart.

According to our economists, the macroeconomic context remains favourable to a strong U.S. dollar. USD buyer clients should take advantage of weak spells in the currency, like the one we saw at the beginning of last week. We would also like to point out that placing orders on the market remains a highly valuable tool in this regard.

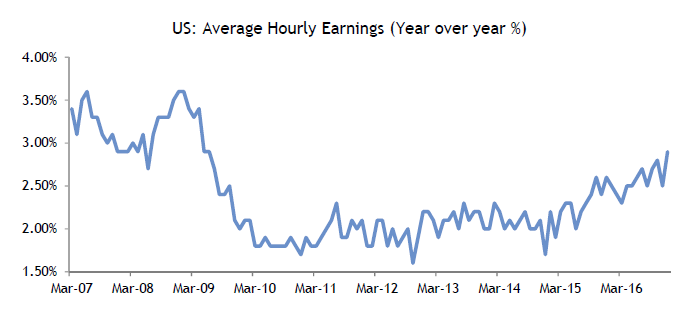

Friday was the end of the Holiday season regarding economic indicators in North America, with job data released in both the United States and Canada. South of the border, 156,000 jobs were created in December, slightly below the 175,000 that economists had forecast. Despite the slight disappointment, our economists note that the new reading is still solid and shows that the strength of the U.S. job market is not fading. It should also be pointed out that average hourly wages increased by 0.4% in December, which brought 12-month wage inflation to 2.9%, the largest increase since 2009. Our economists believe that given the job market conditions in the United States, wages could very well continue to rise in the coming months.

Meanwhile in Canada, the job report brought with it a major surprise: 53,700 jobs were created in December despite the forecast calling for a loss of 2,500 positions. The surprise was all the greater when considering full-time job creation (+81,300), which easily made up for the decline in parttime positions (-27,600). In light of these important readings on both sides of the border, the U.S. dollar and Canadian dollar posted gains against the other major currencies. Meanwhile, the USD/CAD pair remained essentially unchanged from the previous day while yields rose a few basis points on both sides of the border.

The economic indicator calendar is rather sparse in North America this week. In the United States, the most eagerly anticipated reading of the week will be retail sales for December, slated for Friday morning. In Canada, we’ll be keeping an eye on housing starts and the Teranet-National Bank Home Price Index.