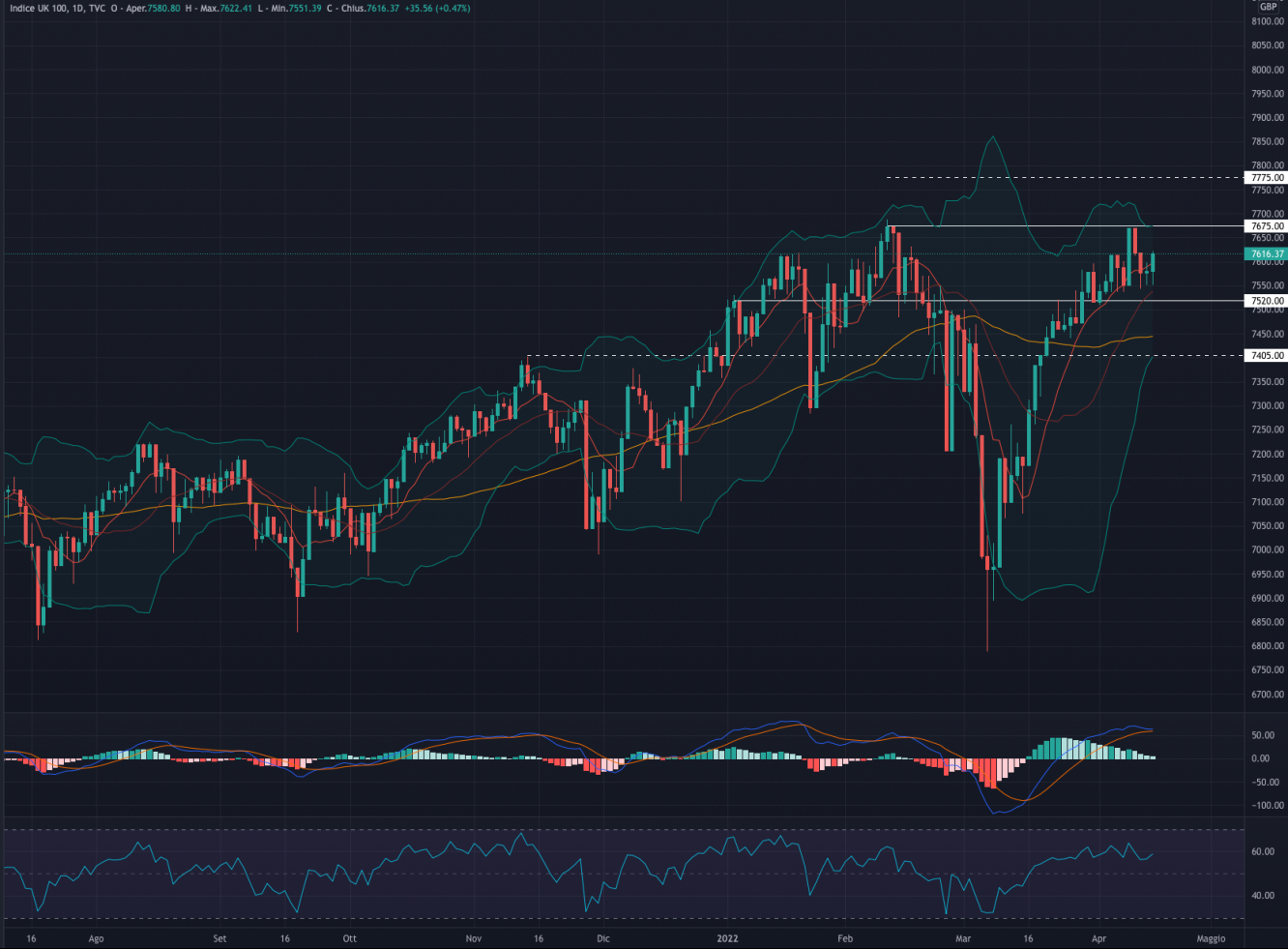

FTSE 100

The FTSE FT100 TR ended the week down by -0.02%. For the week ahead, we'll be monitoring the narrow parallel channel—7,550 - 7,620.

Indicators

The indecision on the British index continued, with another week marked by muted price action. The hypothesis of a double top with the candles of early February were still present.

Compared to the previous weeks, we saw a narrow horizontal channel between 7.550 and 7.620; the break of one of these two levels could then give rise to strong swings in both directions.

MACD and RSI reflected the current situation of indecision, where MACD, despite being above 0 (positive momentum), seemed to want to cross to the downside and the RSI continued to move at a high RSI level.

We remain positive on the index, but we await a retracement before favoring further rises. A slight reversal on the 7.450-7.500 area would avoid divergences between price and indicators and would make the move to the upside more regular.

Support at 7,520

Resistance at 7.675

FTSEMIB

The FTSE MIB Net Total Return (Lux) was up by + 0.78% last week with the an expected breakout of 24.960 this coming week.

Indicators

The past week was characterized by substantial consolidation with a move to the upside on the Friday. From a short-term view of the rises this index has experienced, we considered this price action to be positive.

MACD and RSI, despite the lack of direction, seemed supportive to bullish swings. The first, even with a weakening signaled by the histogram, saw a hinted break of the 0 line (positive momentum) and the RSI crossing the line of 50 (bullish).

We do not exclude a continued consolidation, but we are now in favor of a possible break of the current resistance level and consolidation above the 50MA (yellow line).

Support at 24,000

Resistance at 24.960

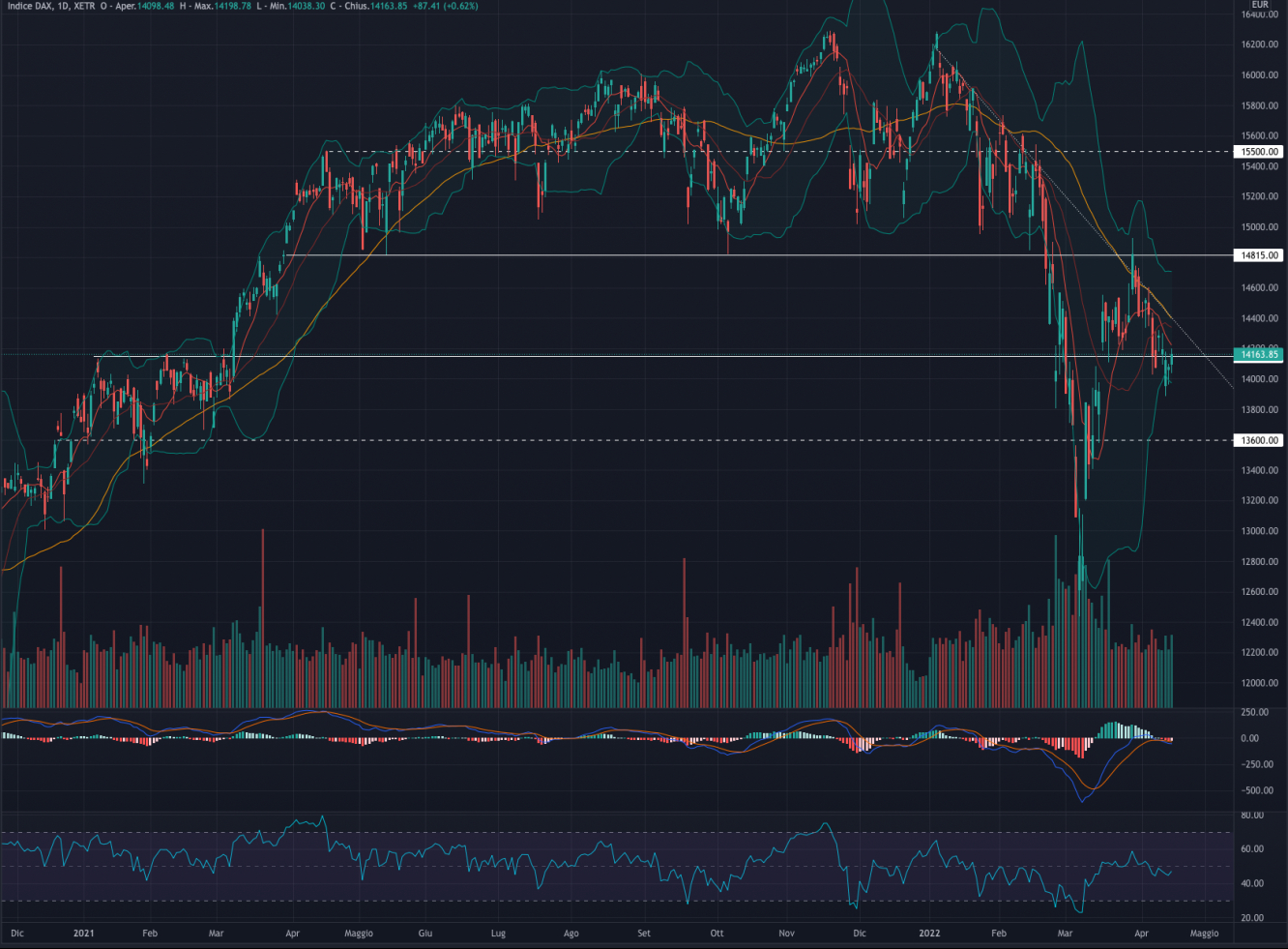

DAX 40

The DAX ended the week down by -0.72%. For the coming week, we see a move to the upside up to 14,400-14,600, at a minimum.

Indicators

We believe the consolidation of the past week was very positive from a short-medium term upside perspective. In particular, we noticed the trend reversal at 13.900 that could lead the index to regain ground during the coming week.

We believe that a break of the 9MA (red line) could be a good indicator of possible short-term upside.

MACD and RSI, thanks to the declines of the past weeks, were able to consolidate and seemed ready to support bullish swings. The first seemed close to breaking the 0 line (positive momentum) and the RSI seemed to want to cross the line of 50 (bullish).

We are positive on the DAX and see possible upside in the short-term. The break of the bearish trendline could then lead to stronger bullish price action.

Support at 14,150

Resistance at 14.815

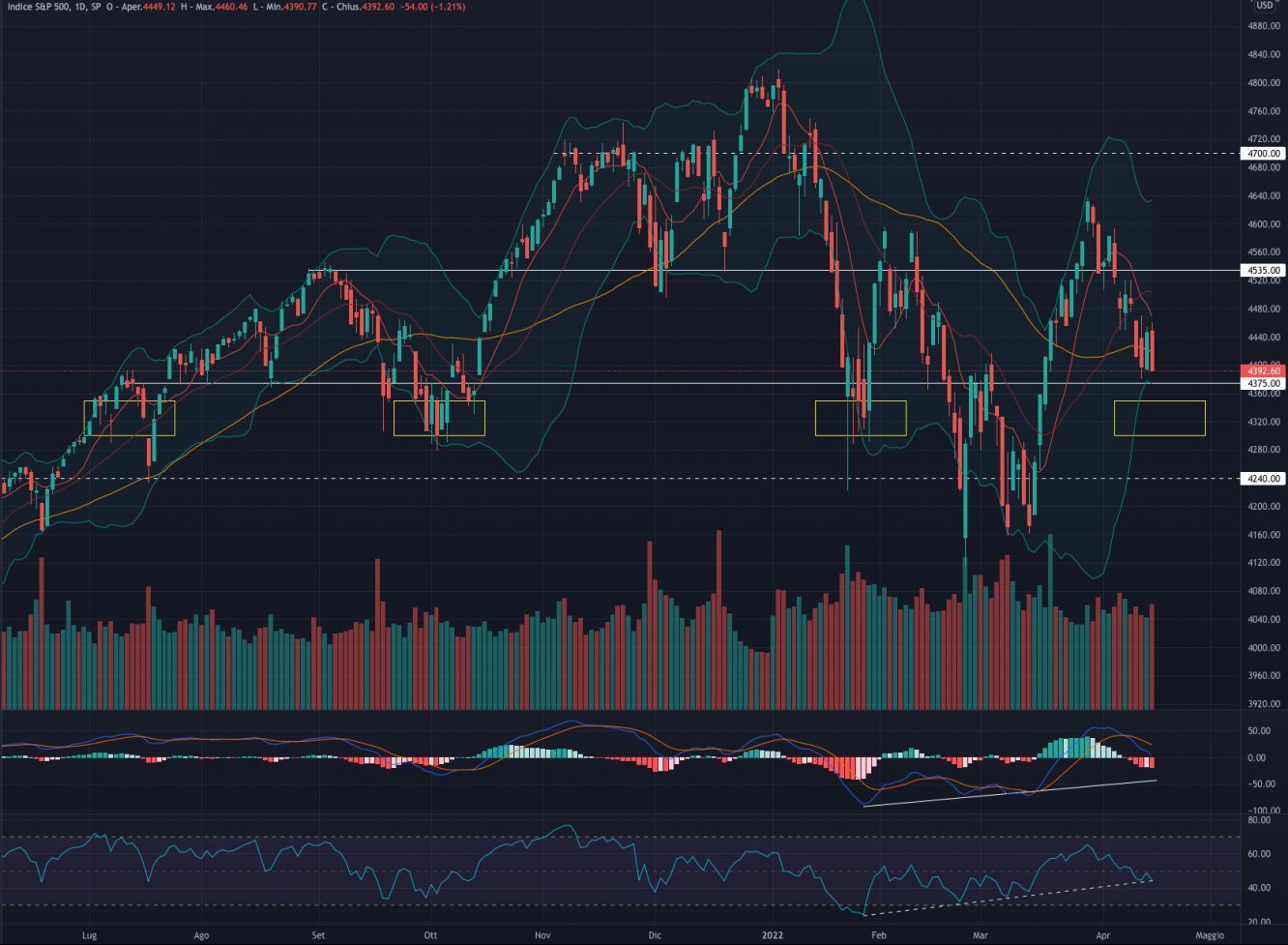

S&P 500

The S&P 500 was down by -2.17% last week. This week, we foresee consolidation between 4.420 and 4.500.

Indicators

After the sharp decline at the beginning of the week, the SPX consolidated in a tight channel between 4.390 and 4.450. The break of one of these two levels will lead to strong moves in both directions.

MACD and RSI, despite moving to the downside, were very close to their respective uptrend lines and a possible reversal could then support upsides on the index.

We remain positive on the US index also given the strong support area between 4.300-4.350, on which we could eventually expect a rapid decline and subsequent upside reversal.

Support at 4.375

Resistance at 4.535

NASDAQ 100

The NASDAQ 100 ended the week down by -3.62%. For the week ahead, we see consolidation between 13,800 and 14,200 with a possible reversal to the upside

Indicators

Despite a bearish week, we believe the overall scenario remains positive and in favor of possible short-term move to the upside. MACD, above 0 (positive momentum), was crossing to the downside and the RSI, below 50 (bearish), close to its uptrend line which could act as a reversal area.

We are positive on the NASDAQ and believe that the index may be close to a "bottoming" phase in the area of 13,600-14,000.

Support at 14.350

Resistance at 15,000

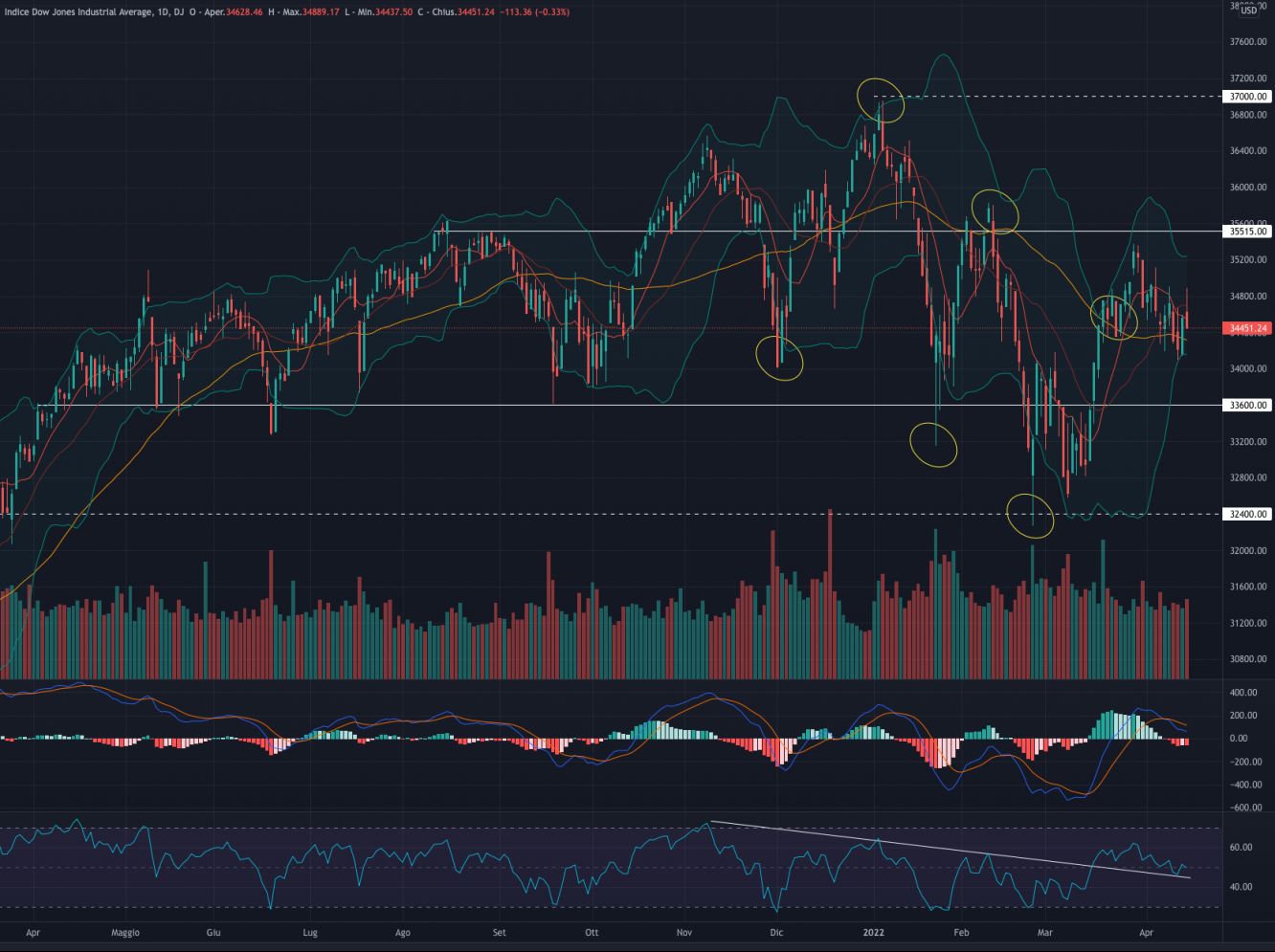

Dow Jones

Dow Jones Industrial Average ended the week down by -0.41%. For the week ahead, we expect a possible upside to 35,200.

Indicators

The index continued to fluctuate on the upper part of the broad bearish channel (yellow points on the chart) and within the wide side band 33.600 - 35.515 (support and resistance) in place since April 2021.

Consolidation above the channel keeps us very positive for a medium-term bullish scenario. MACD and RSI were both positive, but slightly slowing. The former had crossed to the downside while remaining above 0 (positive momentum), the RSI was swinging at the top of the bearish trendline, which we read as a further positive indicator in a bullish type scenario.

A break to the upside of the 35,000 range would confirm the hypothesis of further extensions in the short to medium term.

Support at 33,600

Resistance 35.515