Everyone take a deep breath. It isn’t quite time for a victory lap yet.

This week, we get the latest installment of the CPI report. Judging from market commentary and pricing, here is what everyone thinks we are going to see:

- Another month-on-month (mom) decline in headline CPI

- Another return-to-normalcy type core CPI number

- One more 75 basis point (bp) Fed hike, but then the foot can come off the brake at least a little bit, because inflation is clearly headed lower.

I say again, it may not yet be time for a victory lap. Last month’s CPI report had a dramatic drop in core inflation that was very exciting to some people. Core CPI was +0.3% m/m, with the market looking for 0.5%. The consensus for this month is for another 0.3% on the core. For this entire month, and really for the last several months, the market pricing for near-term inflation has become incredibly sanguine.

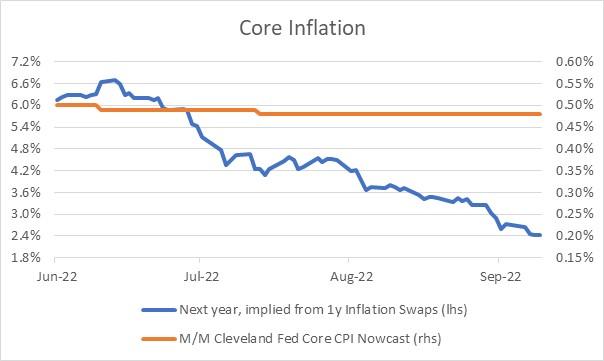

In early June, 1-year inflation swaps were pricing in about 6.6% core inflation for the ensuring one year. As of now, 1-year inflation swaps are pricing in only 2.4% core inflation as the chart shows. Essentially, pricing in the inflation market says the Fed ought to be done since core PCE will be right about at target over the next 12 months.

Source: Enduring Investments, Cleveland Fed

But hold your horses! The orange line in that chart is the current Cleveland Fed Inflation Nowcast for Core CPI, which is at 0.48% for this month (which would annualize to a 5.76% pace).

Now, it’s not quite fair to annualize one month’s nowcast, but it is worth noting that it is also drastically above the economists’ estimates. Also, last month’s 0.3% surprise on core CPI was largely due to one-off factors. Sticky categories, where all of the momentum in inflation resides, didn’t slow much. Median CPI was +0.53% m/m. (You can see my entire breakdown, which I tweeted in real time last month, summarized here.)

There are some predictable drags on core CPI this month. Used car prices have set back a little bit, and will probably be a small drag. But last month there was also a large drag from home furnishings, major appliances, furniture, linens, and Internet Services. These were all ‘left-tail’ events, and not likely to be repeated. I am not saying we can’t get another 0.3%—although I think it is unlikely—but with the big and slow-moving categories like rents remaining hot I think it is very unlikely that inflation a year from now will be right back at target. In fact, I don’t think it will be close.

Taking a Step Back…

Let’s suppose that we take market pricing at face value. And let’s imagine that this week’s CPI does in fact print with -0.1% on the headline number and +0.3% on the core figure. If we give credence to both of those things, then truly the Fed ought to be about done, and be preparing to take a pause for at least a few meetings and probably well into 2023. After all, market pricing says that expectations are fully contained, current figures are in retreat, and there are enough ancillary risks associated with continued aggressive rate hikes that it would be prudent to pause. If, that is, we believe market pricing.

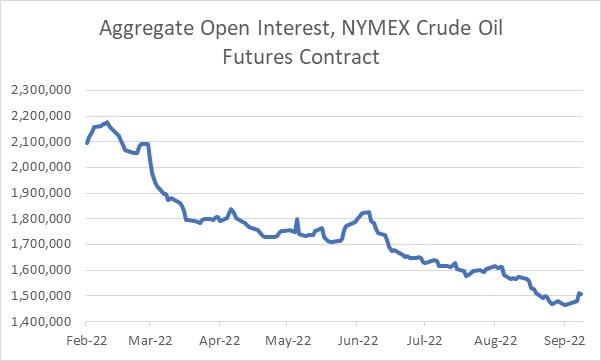

Market pricing, though, is where risk clears. I am not sure why risk is clearing where it is right now, but some of that might have nothing to do with expectations of price. For example, I suspect that the problem the energy sector is having with financing hedges might be one reason for the dramatic decline in open interest in energy futures (see chart) and that’s probably part of the cause of the decline in energy prices in the futures market as well.

Source: Bloomberg

The underlying facts here remain the same—the price level still needs to catch up with the prior growth in the money supply, and it is far from doing that. Bond and equity investors don’t seem to be ready yet to take the victory lap that clearing levels in the inflation markets seem to suggest they should, but if we get a strong rally on the back of the CPI report I think it is probably better to be using that as an opportunity to trim risk further.

Disclosure: My company and/or funds and accounts we manage have positions in inflation-indexed bonds and various commodity and financial futures products and ETFs, that may be mentioned from time to time in this column.