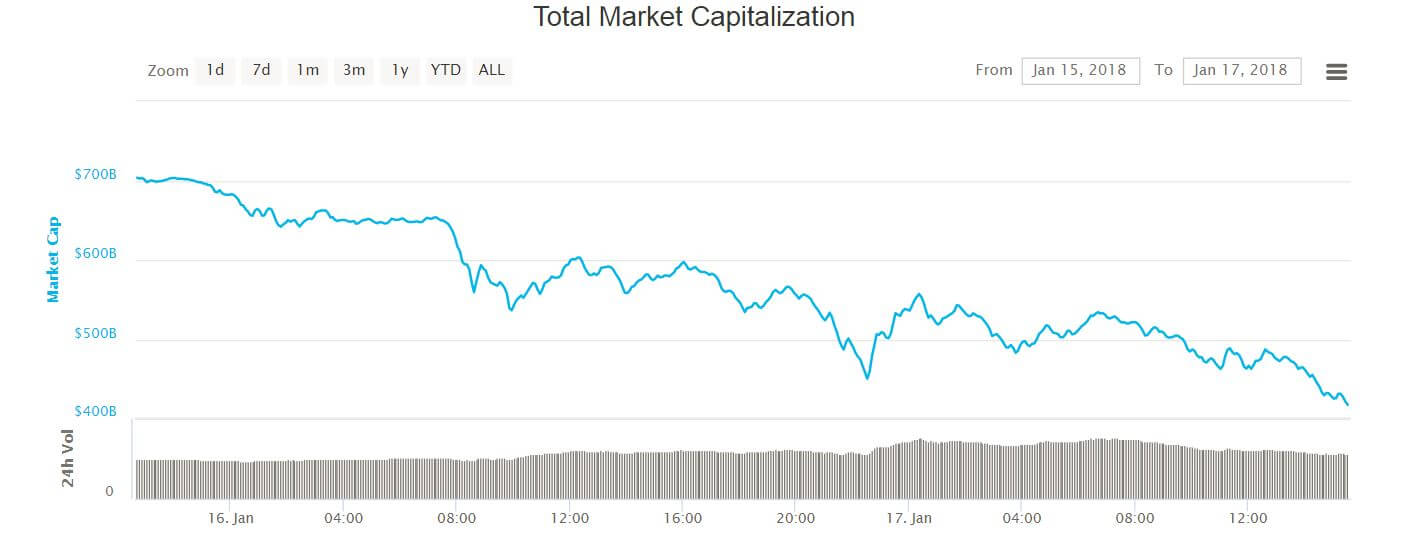

It’s been a very busy week for the likes of Bitcoin and Dash, as well as the stock market. Cryptocurrencies saw a roughly 40% drop and over $200 billion of value wiped out in 48 hours. At the same time Dow Jones continued climbing and reached 26,000, with optimism partially fueled by the tax cut for corporations.

The largest number of headlines was reserved for Bitcoin and the popular altcoins. At the beginning of the week we saw one of the biggest drops in the sector, with the most popular digital coin falling 50% from its all-time high before recovering to about 12,000. News was playing catch-up – China cracked down on exchanges on Monday, but Elliott Wave analysis helped us identify the first signs of the drop over ten days ago!

Our Dash analysis from January 3rd also panned out with its movements coming right on schedule. It’s one of the more interesting cryptos out there and we’ve followed up with a fresh Elliott Wave analysis.

Apple (NASDAQ:AAPL) made a huge announcement on Wednesday that they will bring back over $350 billion back to the U.S. to take advantage of the new tax rates that favor corporations. Its stock tracked the overall bullish mood and closed the week at 178.46.