The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Wednesday lower.

- ES pivot 2000.00. Holding below is bearish.

- Rest of week bias lower technically.

- Monthly outlook: bias higher.

- Single stock trader: N:VZ still not a swing trade buy.

Recap

Last night I mentioned that the charts were all looking tired and that fatigue came home to roost on Tuesday, as all three major averages lost ground with the Dow down 0.29%. That leaves us at an interesting juncture, so lets go straight to the charts as we figure out where Wednesday is heading.

The Technicals

The Dow: On Tuesday, the Dow snapped an impressive 7-day winning streak and 9 out of 10 with a 50 point loss. This move left it teetering on the brink of its steep rising RTC. I will add that indicators have already begun coming off of extreme overbought levels (which isn't hard since when RSI hits 100, there there's no place left to go but down). The stochastic remains threaded out at extreme overbought so there's no telling when it will form a bearish crossover. However, the overall look of this chart is now quite bearish.

The VIX: In an impressive show of strength on Tuesday, the VIX managed to escape the 200 day MA trap by refusing to sink lower, and instead actually gained 9.28% to finish with a green hanging man that started to bring the indicators off of extreme oversold level and left this chart right on the edge of its descending RTC. This all looks bullish for Wednesday.

Market index futures: Tonight, all three futures are mixed at 12:29 AM EDT, with ES dead even. I wasn't ready to commit to a move lower in ES last night considering all the momentum it had going for it. However, on Tuesday, it had a bad day, indeed with its worst performance since September 28th. That left it hanging right on the edge of its rising RTC and all of the indicators are now descending strongly off of overbought, with the stochastic in a nicely completed bearish crossover. The overnight is trading outside this RTC, so that's a bearish set up, and therefore, this chart now looks negative for Wednesday.

ES daily pivot: Tonight, the ES daily pivot falls from 2008.92 to 2000.00 on the dot. ES remains below its new pivot though, so this indicator continues bearish.

Dollar index: Last night, I noted a reversal warning in the dollar, but one which required confirmation. We got that on Tuesday, and while the dollar only gained 0.03%, it did it on wide-ranging red spinning top. However, indicators continue to remain quite oversold, so it looks like the dollar still has more room to run higher from here

Euro: However, last night, I missed the euro, which I thought would move lower on Tuesday. Instead it continued higher to close at 1.1395, marking its third day in a row where it just exactly touched its upper BB. Indicators continue to rise and are now at extreme overbought levels. The stochastic also looks like its trying to form a bearish crossover, but it's not quite there yet. So this chart is a little too difficult to call tonight.

Transportation: Last night, I noted a classic hanging man in the trend. And interestingly, on Tuesday, marketwatch.com also noted it in one of their TA pieces. That was the same day that we got the payoff in the form of a giant 2.22% decline with a red marubozu that crashed right out of a steep two week long rising RTC and sent all the indicators lower off of overbought. That leaves no bullish signs at all on this chart tonight.

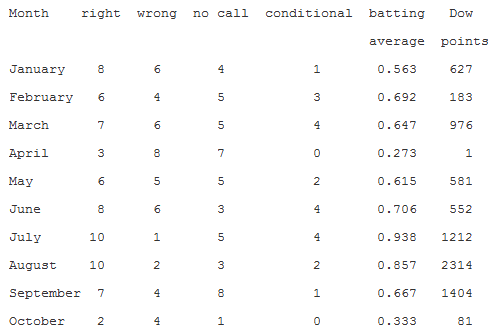

Accuracy:

Tonight the futures appear to be trying to find some support after Tuesday's big drop, but the overall tenor of the charts remains bearish. It just seems that overall, there's more downside risk than upside potential, so I'm going to go ahead and call Wednesday lower. I'll be happy to be proven wrong.

Single Stock Trader

On Tuesday, Verizon gained a bit on an upgrade from Morgan Stanley (N:MS) to finish with a small bullish engulfing pattern. However indicators continue climbing into overbought territory and the stochastic remains on the cusp of a bearish crossover. The stock continues to find resistance around 44.40 and I still don't see this as a swing trade buy right now.