On analysis of the developments in different parts of the world on Apr. 24 and 25, to face the challenges of growing economic weakness globally, I find that the changing fiscal attitude could extend volatility in the currency market. Despite a collective effort to come out of the vicious circle of Covid-crisis, the pace of recovery in a particular region matters a lot for the currency used in that particular region.

European countries look promising for a fast pace of recovery than the U.S. The dollar weakened in early European trading Monday, with risk sentiment on the rise as economic data point to a global economic recovery ahead of this week’s Federal Reserve meeting. I feel that global Central Banks could adopt an easy fiscal policy to revive coronavirus-battered economies.

Despite a Reuters poll of analysts published on Apr. 13 showed an average forecast for growth of 5.0% in the UK, the world's fifth-biggest economy in 2021. The International Monetary Fund has projected a 5.3% expansion. But since those forecasts were made, there have been signs of acceleration in the pace of recovery with the country now having given a first coronavirus vaccine to more than half of its total population.

Goldman Sachs (NYSE:GS) said gross domestic product to grow by a "striking" 7.8% this year, "above our expectations for the U.S." on Sunday that Britain looks set to see faster economic growth than the United States this year as the country races ahead with its vaccination program after its slump in 2020, The bank said in a note to clients that it now expects British

Italy has reached a deal with the European Commission over its recovery plan, Prime Minister Mario Draghi told cabinet late on Saturday, after days of intense talks, paving the way for it to be submitted to Brussels by the end of April.

On the other hand, China is supposed to launch a series of activities next month to boost domestic consumption, including an expo on consumer goods in the southern province of Hainan, the commerce ministry said on Sunday. Expanding domestic consumption is a priority in China's "dual circulation" economic strategy presented last May, which also called for reduced dependence on foreign markets.

What Could Boost Precious Metals

I find the growing strength of the Euro exerting bearish pressure over U.S. Dollar. Weak Dollar could be supportive of both gold and silver. Secondly, the global central banks could prefer to adopt an easy fiscal policy to revive economic growth. The main focus could be centered around expanding domestic consumption as China plans to do once again what it did last year to reduce dependence on foreign markets.

Silver could lead the race

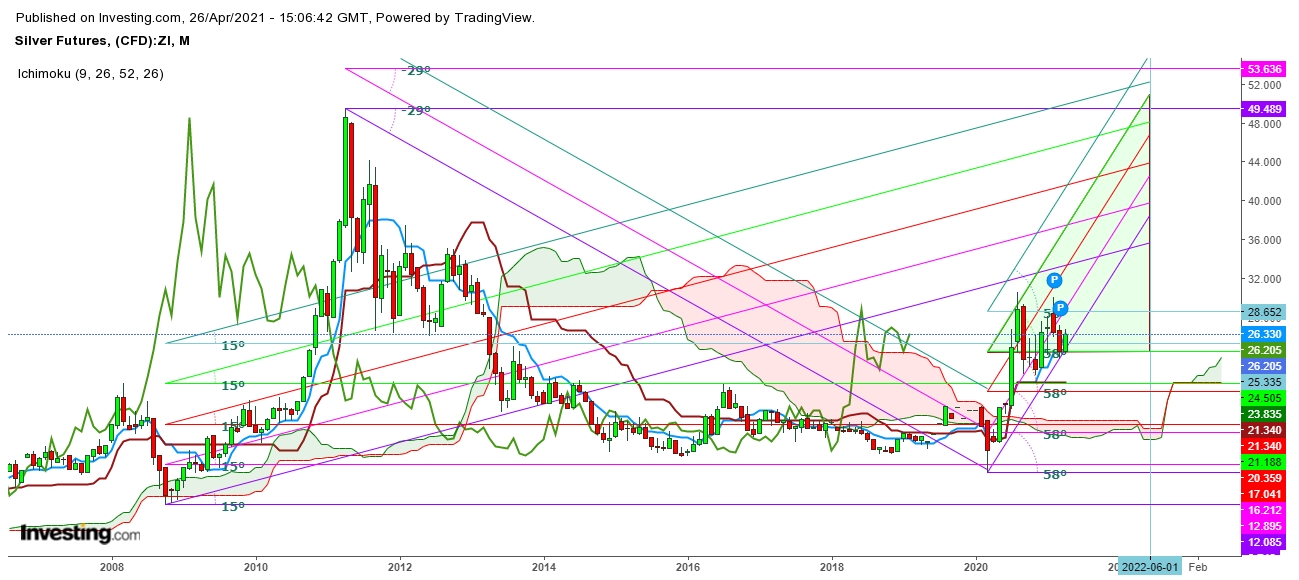

On analysis of the movements of silver futures, I find that silver could be the next gold in case of steep move in precious metals due to its industrial use. Undoubtedly, demand for gold could remain high in China and India due to its domestic use in ornaments. But, silver looks promising in a steep uptrend to sustain for a longer duration than other precious metals.

Gold could find buying support from central banks.

Central banks could start buying gold to strengthen currency to set off a growing fiscal deficit globally. This needs an easy fiscal policy to boost economic recovery while the resurgence of the second wave of Covid-19 has resulted in steep growth of the fiscal deficit, and the need for a quick accumulation of public debt.

Technical speaks a lot

On analysis of the moves by gold and silver futures, I find that the gold could consolidate between the range of $1731 to 1818 before a breakout move. While the silver could take a breakout if sustains above $26 during the upcoming week; above $30.

Disclaimer

1. This content is for information and educational purposes only and should not be considered as investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.