The airline industry is howling about circumstances beyond its control.

Reuters reports Airline Industry Turmoil Deepens as Coronavirus Pain Spreads

Passenger operations have collapsed at an unprecedented rate as the virus spreads around the world, with Delta Air Lines Inc (NYSE:DAL) parking more than 600 jets, cutting corporate pay by as much as 50%, and scaling back its flying by more than 70% until demand begins to recover.

Shares in U.S. airlines fell sharply on Wednesday after Washington proposed a rescue package of $50 billion in loans, but no grants as the industry had requested, to help address the financial impact from the deepening coronavirus crisis.

The Trump administration’s lending proposal would require airlines to maintain a certain amount of service and limit increases in executive compensation until the loans are repaid.

American Airlines (NASDAQ:AAL) in a memo to staff rebuffed criticism that it had rewarded its shareholders with too many dividends and stock buybacks in better times, leaving it with less cash to manage the crisis.

“Unfortunately, this is no ordinary rainy day,” said Nate Gatten, American’s senior vice president of global government affairs. “These are extraordinary circumstances, and additional support is necessary to protect jobs and ensure that the flying public can continue to rely on our industry after the crisis ends.”

No Ordinary Rainy Day

Fair enough, this is no rainy day. But the sad fact is the industry did not save a dime, not enough for even an ordinary rainy day.

Neither did Boeing (NYSE:BA).

Nor did any company. None of them that I can find.

$4.5 Trillion Blown on Share Buybacks

Wolf Richter has an excellent report on the setup.

Please consider After Blowing $4.5 Trillion on Share Buybacks, Airlines, Boeing, Many Other Culprits Want Taxpayer & Fed Bailouts of their Shareholders

The big four US airlines – Delta Air Lines (NYSE:DAL), United Airlines Holdings (NASDAQ:UAL), American Airlines (NASDAQ:AAL), and Southwest Airlines Company (NYSE:LUV) – whose stocks are now getting crushed because they may run out of cash in a few months, would be the primary recipients of that $50 billion bailout, well, after they wasted, blew, and incinerated willfully and recklessly together $43.7 billion in cash on share buybacks since 2012 for the sole purpose of enriching the very shareholders that will now be bailed out by the taxpayer.

Share buybacks were considered a form of market manipulation and were illegal under SEC rules until 1982, when the SEC issued Rule 10b-18 which provided corporations a “safe harbor” to buy back their own shares under certain conditions. Once corporations figured out that no one cared about those conditions, and that no one was auditing anything, share buybacks exploded. And they’ve have been hyped endlessly by Wall Street.

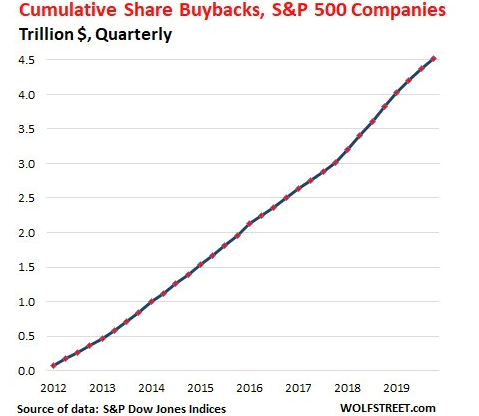

The S&P 500 companies, including those that are now asking for huge bailouts from taxpayers and from the Fed, have blown, wasted and incinerated together $4.5 trillion with a T in cash to buy back their own shares just since 2012:

And those $4.5 trillion in cash that was wasted, blown, and incinerated on share buybacks since 2012 for the sole purpose of enriching shareholders is now sorely missing from corporate balance sheets, where these share buybacks were often funded with debt.

And the record amount of corporate debt – “record” by any measure – that has piled up since 2012 has become the Fed’s number one concern as trigger of the next financial crisis. So here we are.

In 2018, even the SEC got briefly nervous about the ravenous share buybacks and what they did to corporate financial and operational health. “On too many occasions, companies doing buybacks have failed to make the long-term investments in innovation or their workforce that our economy so badly needs,” SEC Commissioner Jackson pointed out. And he fretted whether the existing rules “can protect investors, workers, and communities from the torrent of corporate trading dominating today’s markets.”

Reckless Tax Cuts, Rate Cuts, Buybacks and Bailouts

Corporations claimed they would use the Trump tax cuts for investment.

It was a lie upfront. And we knew it because President Bush told the same lie with the same result. I was against the tax cuts because it was a big handout to the wealthy, not the middle class.

Those tax cuts boosted the stock market, far more than I thought, to insane levels in fact. Trump bragged about it all the way.

The problem, now obvious, is the tax cuts were not only front-loaded but squandered as I warned about even though the cut benefitted me personally.

Supposedly 2001 was to be the last bailout. We heard that again from the Fed and Congress in 2009. And now here we go again.

And the Fed recklessly reduced rates even as the unemployment level fel to record lowes. And the Fed kept lowering and lowering rates every time the stock market sneezed.

Now the Fed Funds Rate is at 0% with the Fed totally unprepared for anything except one: Issue more bailouts and cheap money.

We had reckless tax cuts by Trump, reckless rate cuts by the Fed, reckless buybacks by corporations and reckless bailouts by Congress. And here we go again.