Imagine that you are speeding down one of those long and lonesome stretches of highway that seem to fall off the edge of the horizon. As the painted white lines become a blur, you notice a sign that says "Warning." You look ahead for what seems to be miles of endless highway, but see nothing. You assume the sign must be old therefore you disregard it, slipping back into complacency.

A few miles down the road you see another sign that reads "Warning: Danger Ahead." Yet, you see nothing in distance. Again, a few miles later you see another sign that reads "No, Really, There IS Danger Ahead." Still, it is clear for miles ahead as the road disappears over the next hill.

You ponder whether you should slow down a bit just in case. However, you know that if you do it will make you late for your appointment. The road remains completely clear ahead, and there are no imminent sings of danger. So, you press ahead. As you crest the next hill there is a large pothole directly in your path. Given your current speed there is simply nothing that can be done to change the following course of events. With your car now totalled, you tell yourself that there was simply "no way to have seen that coming."

It is interesting that, as humans, we fail to pay attention to the warnings signs as long as we see no immediate danger. Yet, when the inevitable occurs, we refuse to accept responsibility for the consequences.

I was recently discussing the market, current sentiment and other investing related issues with a money manager friend of mine in California. (Normally, I would include a credit for the following work but since he works for a major firm he asked me not to identify him directly.) However, in one of our many email exchanges he sent me the following note detailing the 10 typical warning signs of stock market exuberance.

(1) Expected strong OR acceleration of GDP and EPS (40% of 2013's EPS increase occurred in the 4th quarter)

(2) Large number of IPOs of unprofitable AND speculative companies

(3) Parabolic move up in stock prices of hot industries (not just individual stocks)

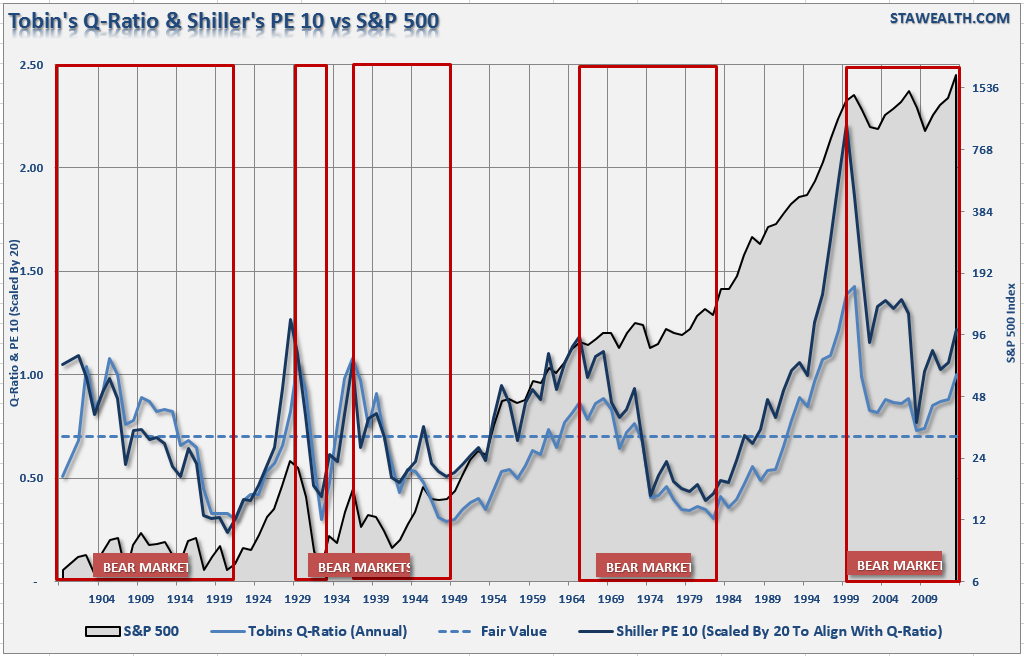

(4) High valuations (many metrics are at near-record highs, a few at record highs)

(5) Fantastic high valuation of some large mergers (e.g., Facebook & WhatsApp)

(6) High NYSE margin debt

- Margin debt/gdp (March 2000: 2.7%, July 2007: 2.6%, Jan 2014: 2.6%)

- Margin debt/market cap (March 2000: 1.8%, July 2007: 2.3%, Jan 2014: 2.0%)

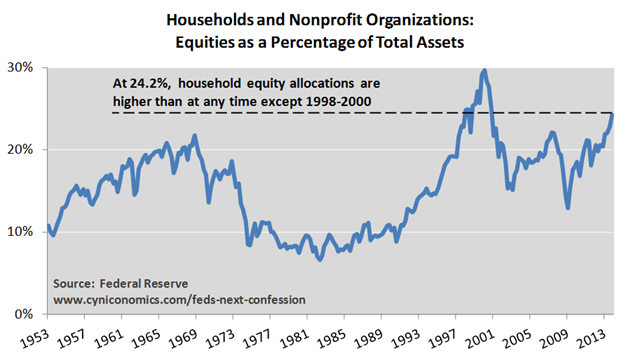

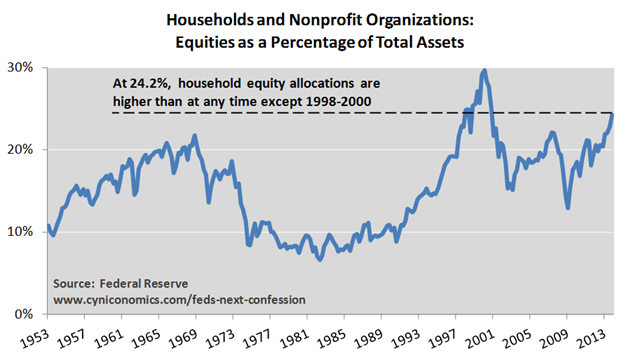

(7) Household direct holdings of equities as % of total financial assets at 24%, second-highest level (data back to 1953, highest was 1998-2000)

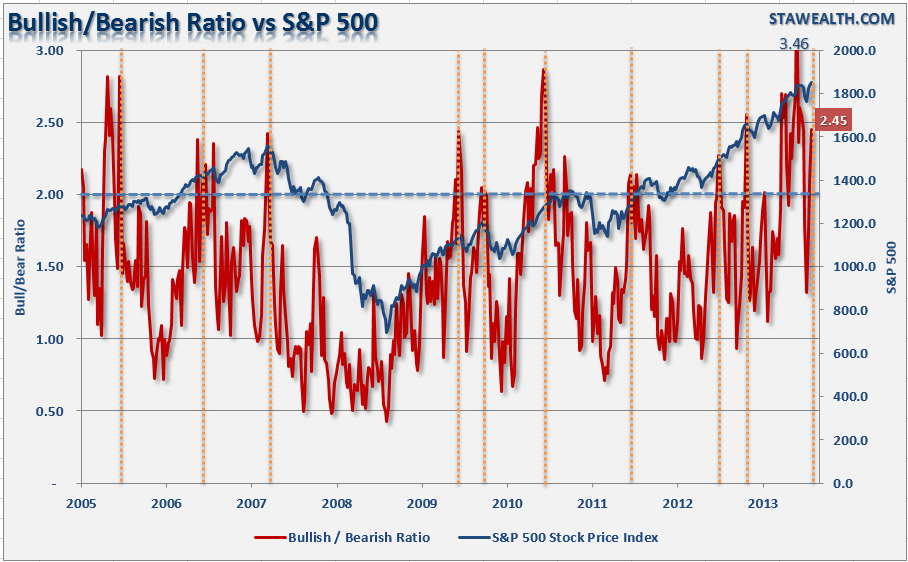

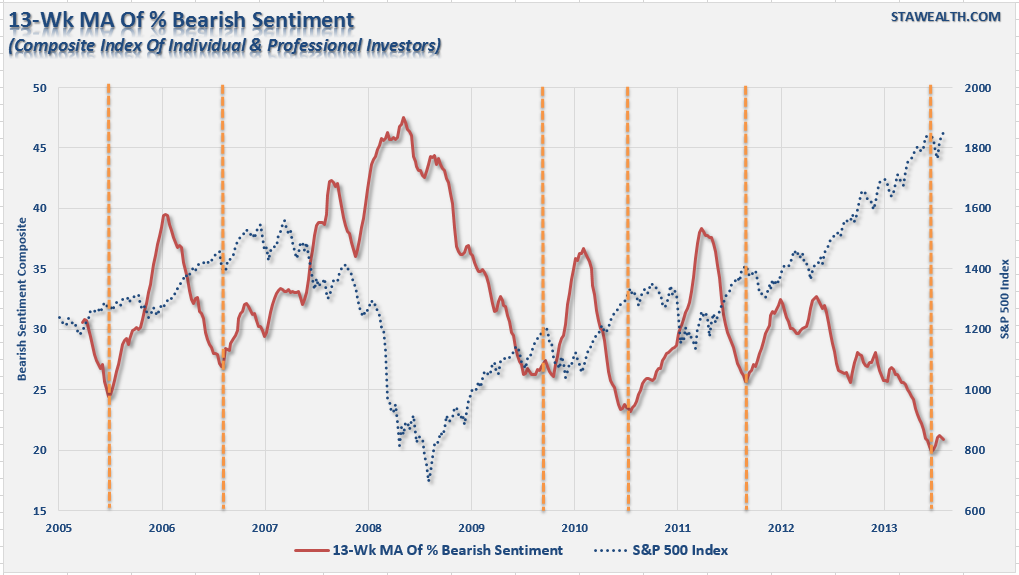

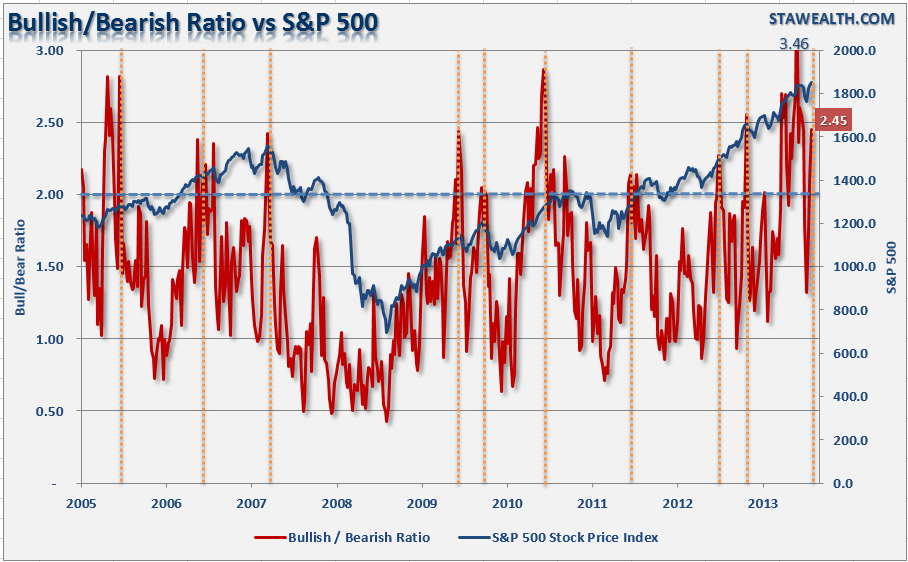

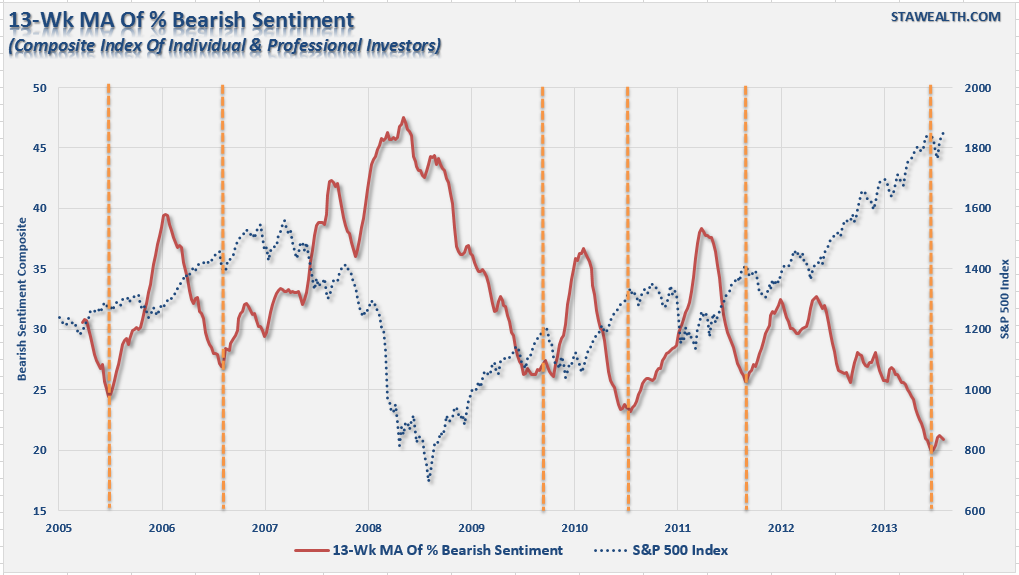

(8) Highly bullish sentiment (down slightly from year-end peaks; still high or near record high, depending on the source)

(9) Unusually high ratio of selling to buying by corporate senior managers (the buy/sell ratio of senior corporate officers is now at the record post-1990 lows seen in Summer 2007 and Spring 2011)

(10) Stock prices rise following speculative press releases (e.g., Tesla will dominate battery business after they get partner who knows how to build batteries and they build a big factory. This also assumes that NO ONE else will enter into that business such as GM, Ford or GE.)

All are true today, and it is the third time in the last 15 years these factors have occurred simultaneously which is the most remarkable aspect of the situation.

The following evidence is presented to support the above claim.

Exhibit #1: Parabolic Price Movements

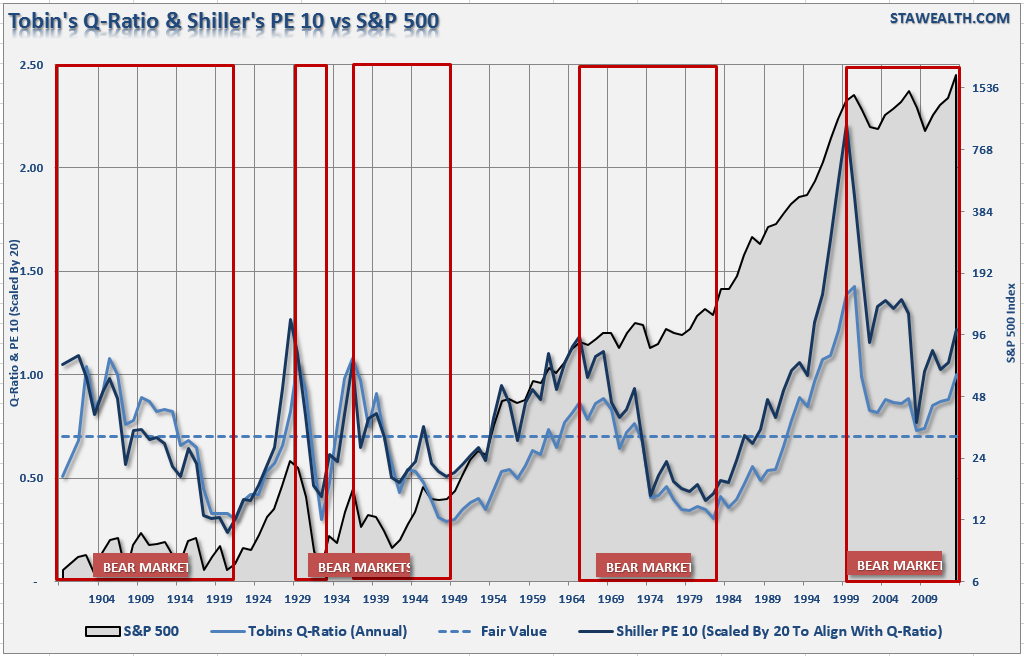

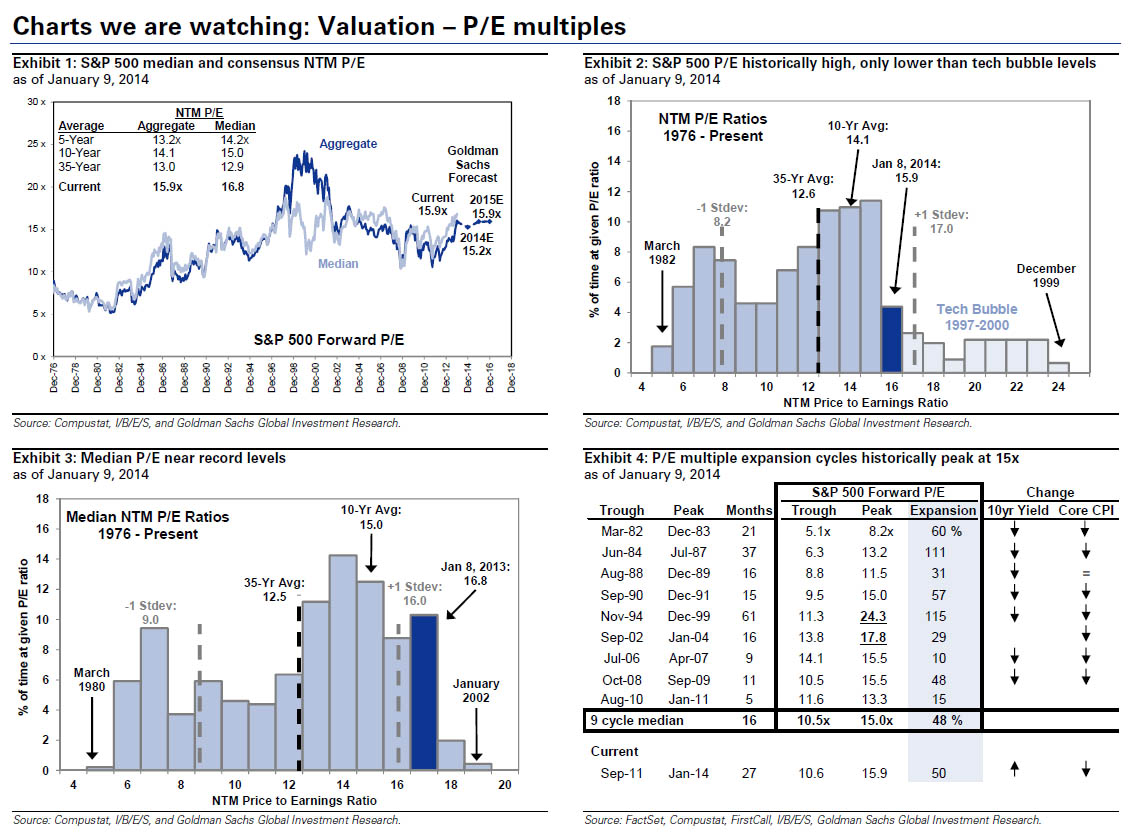

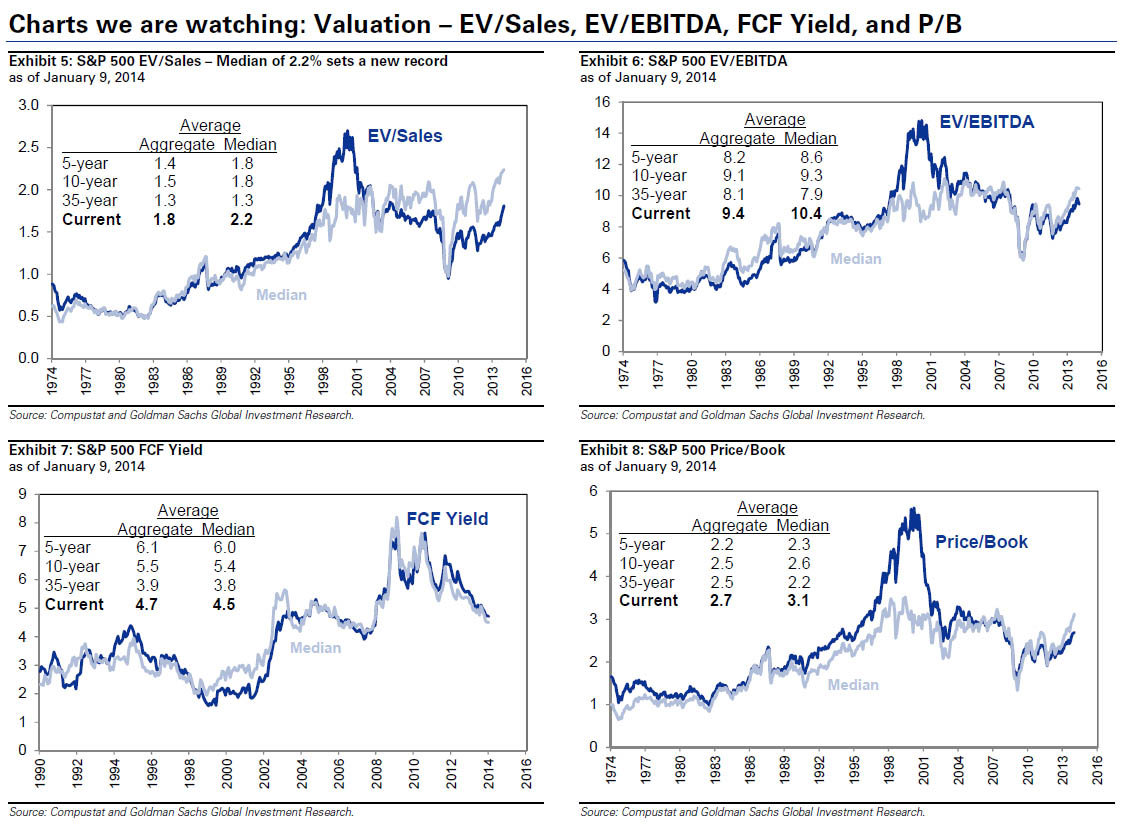

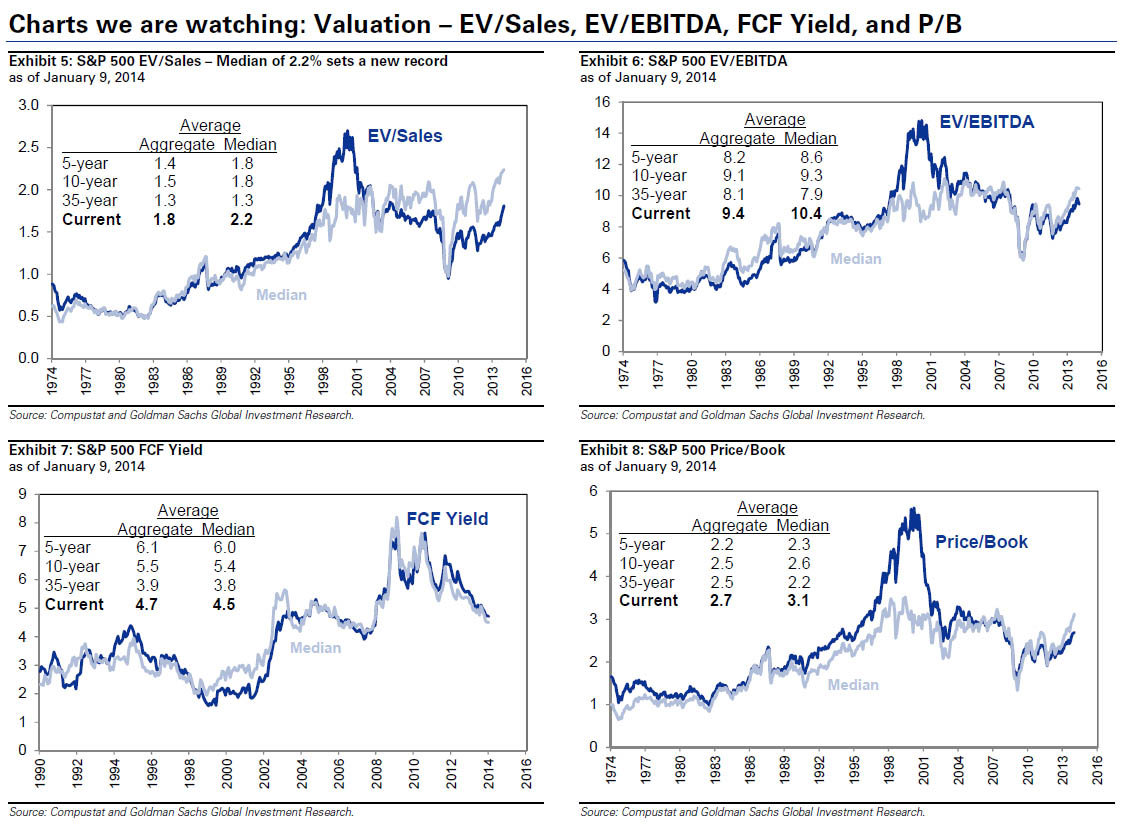

Exhibit #2: Valuation

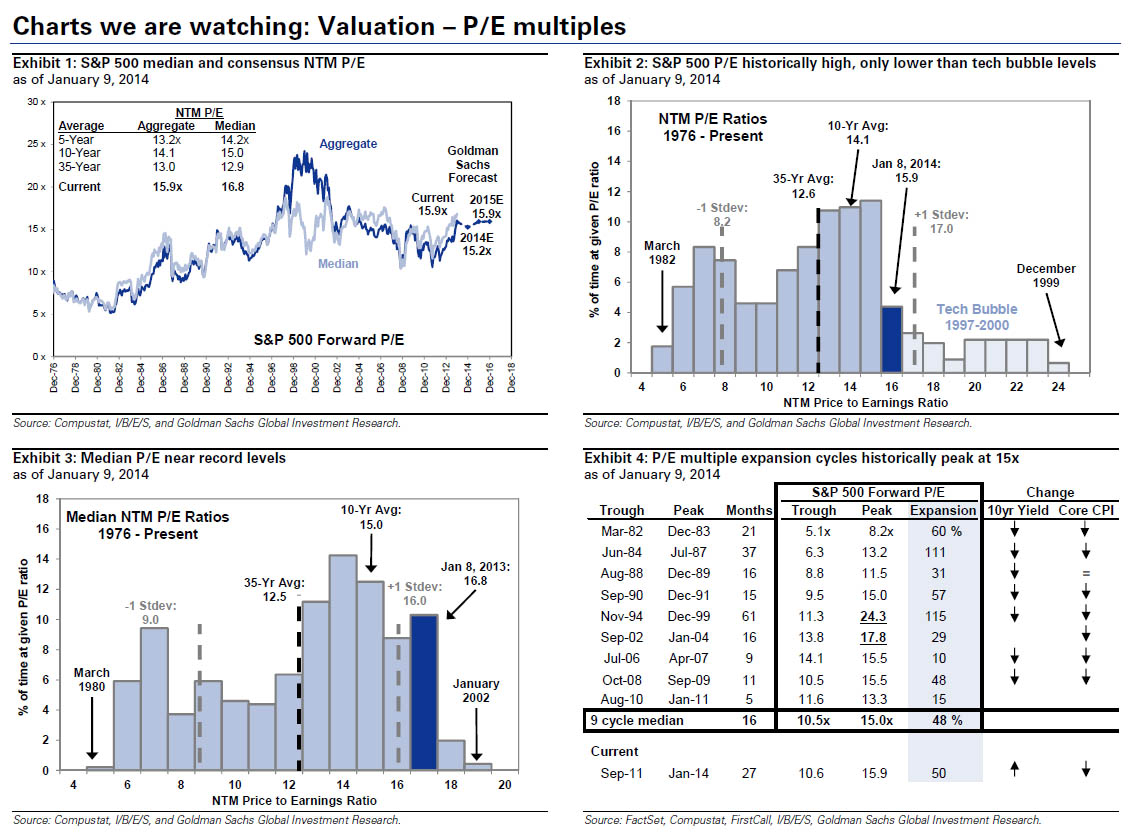

Excerpt from a recent report by David J. Kostin, Chief US Equity Strategist for Goldman Sachs, 11 January 2014:

"The current valuation of the S&P 500 is lofty by almost any measure, both for the aggregate market as well as the median stock:

(1) The P/E ratio;

(2) the current P/E expansion cycle;

(3) EV/Sales;

(4) EV/EBITDA;

(5) Free Cash Flow yield;

(6) Price/Book as well as the ROE and P/B relationship; and compared with the levels of inflation; nominal 10-year Treasury yields; and real interest rates.

Furthermore, the cyclically-adjusted P/E ratio suggests the S&P 500 is currently 30% overvalued in terms of Operating EPS and about 45% overvalued using As Reported earnings.

Reflecting on our recent client visits and conversations, the biggest surprise is how many investors expect the forward P/E multiple to expand to 17x or 18x. For some reason, many market participants believe the P/E multiple has a long-term average of 15x and therefore expansion to 17-18x seems reasonable. But the common perception is wrong. The forward P/E ratio for the S&P 500 during the past 5-year, 10-year, and 35- year periods has averaged 13.2x, 14.1x, and 13.0x, respectively. At 15.9x, the current aggregate forward P/E multiple is high by historical standards.

Most investors are surprised to learn that since 1976 the S&P 500 P/E multiple has only exceeded 17x during the 1997-2000 Tech Bubble and a brief four-month period in 2003-04. Other than those two episodes, the US stock market has never traded at a P/E of 17x or above.

A graph of the historical distribution of P/E ratios clearly highlights that outside of the Tech Bubble, the market has only rarely (5% of the time) traded at the current forward multiple of 16x.

The elevated market multiple is even more apparent when viewed on a median basis. At 16.8x, the current multiple is at the high end of its historical distribution.

The multiple expansion cycle provides another lens through which we view equity valuation. There have been nine multiple expansion cycles during the past 30 years. The P/E troughed at a median value of 10.5x and peaked at a median value of 15.0x, an increase of roughly 50%. The current expansion cycle began in September 2011 when the market traded at 10.6x forward EPS and it currently trades at 15.9x, an expansion of 50%. However, during most (7 of the 9) of the cycles the backdrop included falling bond yields and declining inflation. In contrast, bond yields are now increasing and inflation is low but expected to rise.

Incorporating inflation into our valuation analysis suggests S&P 500 is slightly overvalued. When real interest rates have been in the 1%-2% band, the P/E has averaged 15.0x. Nominal rates of 3%-4% have been associated with P/E multiples averaging 14.2x, nearly two points below today. As noted earlier, S&P 500 is overvalued on both an aggregate and median basis on many classic metrics, including EV/EBITDA, FCF, and P/B."

Exhibit #3: Selling Of Company Stock By Senior Managers

Excerpt from a recent article by Mark Hulbert

"Prof. Seyhun - who is one of the leading experts on interpreting the behavior of corporate insiders - has found that when the transactions of the largest shareholders are stripped out, insiders do have impressive forecasting abilities. In the summer of 2007, for example, his adjusted insider sell-to-buy ratio was more bearish than at any time since 1990, which is how far back his analyses extended.

Ominously, that degree of bearish sentiment is where the insider ratio stands today, Prof. Seyhun said in an interview.

Note carefully that even if the insiders turn out to be right and the bull market is coming to an end, this doesn't have to mean that the U.S. market averages are about to fall as much as they did in 2008 and early 2009. The one other time since that bear market when Prof. Seyhun's adjusted sell-buy ratio sunk as low as it was in 2007 and is today, the market subsequently fell by 'just' 20%.

That other occasion was in early 2011. Stocks' drop at that time did satisfy the unofficial definition of a bear market, and the insiders' pessimism was vindicated."

Exhibit #4: Investor's Confidence

Exhibit #5: Ownership Of Stocks As % Total Financial Assets

The point my money managing friend wishes to make is simply that the ""warning signs" are all there. However, since the road ahead seems clear, it is human nature that we keep our foot pressed on the accelerator.

As the Federal Reserve extracts liquidity from the markets, the "Bernanke Put" is being removed which leaves the markets vulnerable to a "mean reverting event" at some point in the future. The mistake that many investors are currently making is believing that since it hasn't happened yet, it won't. This time is only "different" from the perspective of the "why" and "when" the next major event occurs.

Of course, despite the repeated warning signs, the next correction will leave investors devastated, looking to point blame at everyone other than themselves. The question will simply be "why no one saw it coming?"

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure

here or

remove ads

.