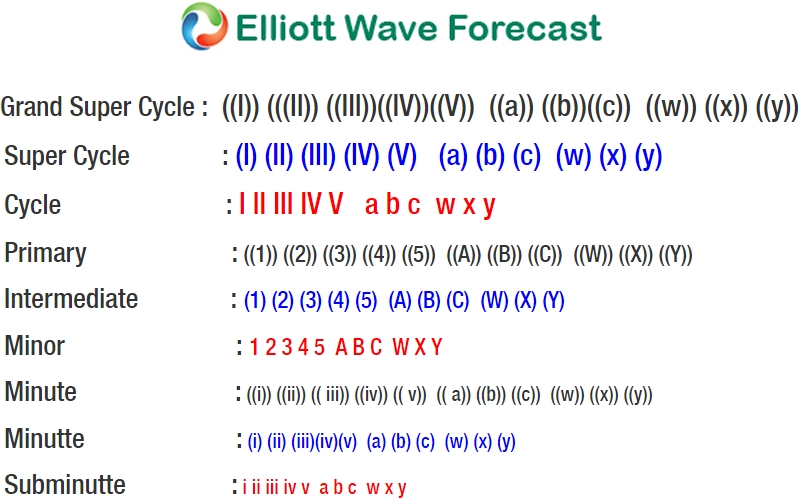

Vanguard communication services ETF ticker symbol: Vanguard Telecommunication Services (NYSE:VOX) short-term Elliott Wave view suggests that the bounce to 88.35 on 4/24/2018 high ended cycle degree wave “b”. Below from there, the cycle degree wave “c” remain in progress as an Impulse Elliott Wave structure looking for more downside extensions.

Down from 88.35 high, Primary wave ((1)) is in progress as Impulsive structure where the internal distribution of each leg down is unfolding in 5 waves structure. Intermediate wave (1) ended in 5 waves structure at 86.93. Above from there, Intermediate wave (2) bounce ended at 88.21 as a Flat structure. Then down from there Intermediate wave (3) ended at 82.51 low. Subdivision of wave (3) unfolded as impulse structure of lesser degree where Minor wave 1 of (3) ended at 85.99, Minor wave 2 of (3) ended at 87.89, Minor wave 3 of (3) ended at 82.91, Minor wave 4 of (3) ended at 84.27, and Minor wave 5 of (3) ended at 82.51 low.

Above from there, the bounce to 84.23 high ended Intermediate wave (4) bounce as a zigzag correction. Intermediate wave (5) of ((1)) remains in progress in another 5 waves structure looking to extend 1 more push lower towards 81.45 – 82.11, which is inverse 123.6%-161.8% Fibonacci extension area of Intermediate wave (4). Afterwards, the instrument is expected to see a bounce in Primary wave ((2)) in 3, 7 or 11 swings to correct cycle from 4/24 high ($88.35) before further downside extension is seen. We don’t like buying it into a proposed bounce.

VOX 1 Hour Elliott Wave Chart