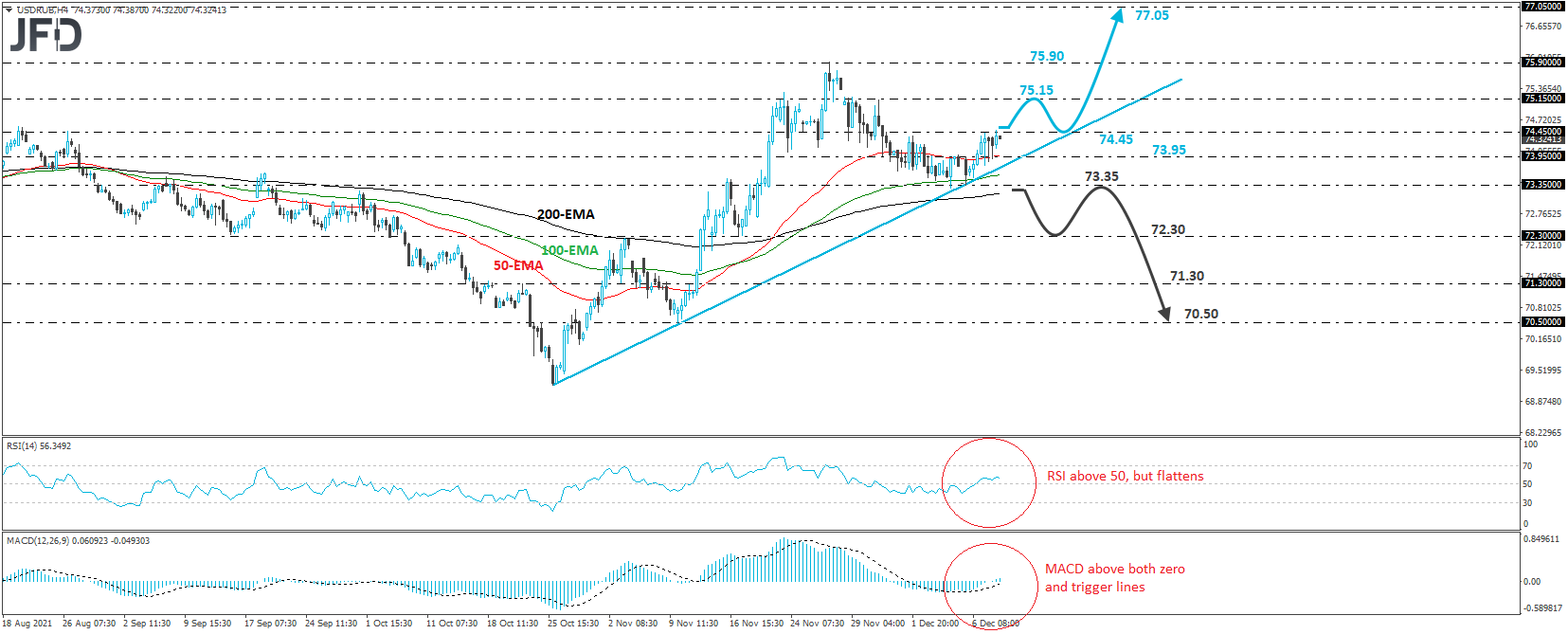

USD/RUB traded higher yesterday and today, after it hit support at the crossroads of the 73.35 level and the upside support line drawn from the low of Oct. 26. However, the recovery was stopped today, near the 74.45 area. Given that the rate remains above the aforementioned upside line, we would consider the short-term picture to be positive.

However, we would like to see a break above the 74.45 zone to get confident on more significant advances. This could encourage advances towards the high of Nov. 30, at 75.15, the break of which could extend the advance towards the peak of Nov. 26, at 75.90. If the bulls are not willing to stop there either, we could see them climbing towards the 77.05 zone, which is defined as resistance by the highs of Apr. 20 and 21.

Shifting attention to our short-term oscillators, we see that the RSI emerged above its 50 line, but flattened after that, while the MACD lies above its zero and trigger lines. Both indicators detect upside speed, which is in line with the view on further advances. However, the flattening of the RS is another reason we prefer to wait for a move above 74.45 before we get more confident on that.

The outlook could turn bearish upon a break below 73.35. Such a dip will confirm the break below the pre-mentioned upside line and a forthcoming lower low. The bears could then get encouraged to push towards the low of Nov. 17, at 72.30, the break of which may see scope for extensions towards an intraday inside swing high formed on Nov. 11, at 71.30. If that barrier cannot halt the slide either, we could see the bears diving towards the low of the day before, at 70.50.